Italmobiliare Deep Dive - 50% Discount for Multiple High-Quality Companies?

Content

Introduction

Company Overview

Investment Thesis

History

Discussing NAV and Discounts

Calculating NAV

Italmobiliare’s Business

Business Model & Businesses

Portfolio Companies

Caffè Borbone

Officina Profumo-Farmaceutica di Santa Maria Novella

Tecnica

AGN Energia

Italgen

Iseo Serrature

SIDI Sport

Casa della Salute

Bene Assicurazioni

Capitelli

Callmewine

Clessidra

Overview of Other Assets Classes

Other Investments

PE Investments

Real Estate

Financial Assets

Investment Return Expectations

First of all, if you see value in these deep dives, I publish one every month. Subscribe to never miss one again:

Introduction

Today, we will look at an Italian company valued at 50% of its Net Asset Value while holding multiple high-quality businesses that grow rapidly both financially (revenues, margins, cash flows) as well as quality-wise (moat, structural).

Company Overview

What does Italmobiliare do?

Italmobiliare (ITM) is an Italian Investment Holding company that invests in mid-sized Italian companies. But Italmobiliare is not only buying companies and letting them run. They also actively participate in the business by appointing new management teams and/or working on the company’s long-term strategy. In most of their businesses, they aim to expand internationally sooner or later.

Italmobiliare does not invest in companies that are in turnaround situations. They want to own high-quality companies with strong brands, unique selling points, and the potential for internationalization.

However, Italmobiliare isn’t your typical buy-and-hold company. They are interested and open to selling businesses when they can make a good profit and have set free the value that they have seen.

There are five assets Italmobiliare invests in:

Portfolio Companies

Other Investments

Private Equity Funds

Financial Assets, Trading, and Cash

Properties and Related Assets

Investment Thesis

Key points:

Valuation: 50% Discount to NAV

What got me interested in this company is its undervaluation compared to NAV. According to Italmobiliare, it is 50% to NAV, and as you’ll see, I think that’s realistic.

Quality: High-Quality Companies

Italmobiliare’s portfolio, with very few exceptions, consists of market-leading companies with very strong brands, strong financials, and rapid growth.

Two of them are exceptionally strong and have the potential to become internationally known superbrands.

Generally, with the exception of two to three companies out of twelve, I’d own any of these companies if they were listed on the market at these prices.

Business Model: The Best of All Worlds

Italmobiliare reminds me of a mix between Berkshire and LVMH. I know this comparison lacks in size, and the strategies also differ here and there, but there are similarities that I very much like to see.

It seems as if the management has a very good eye for quality companies at the right price and has a strong enough network and knowledge of their expertise to invest in them when they find them. They know their circle of competence and stick to it.

I’m usually not a big fan of holding companies. They tend to be intransparent in their NAV calculations, cost structures, and own companies that don’t paint a coherent picture for me.

However, Italmobiliare seems to be the opposite. The information you can get on its website are very transparent. Great presentations, overviews, and transparency in numbers and costs. And the businesses they own are very high-quality and exactly what I would look for in such a company.

The comparison to LVMH or Berkshire lacks due to its smaller size, smaller portfolio, less-known brands, etc., yet, when I came across ITM, I was reminded of both of them in some aspects.

Italmobiliare’s History

Italmobiliare goes way back. As a holding company, it has existed since 1946. Before that, the company was known as Italcementi, founded in 1864, and, well, a cement company. Initially, Italmobiliare was founded to allocate capital outside of the building materials sector.

The year 1979 marked the next milestone for the company and initiated the next phase. Italcementi was integrated into Italmobiliare, and the company was listed on the Milan stock exchange.

What followed were almost five decades of portfolio diversification. Although the cement business remained the main operation of the company.

The company that we’re discussing today came to light in 2016. When Italcementi was sold for a mix of assets and cash. Some of the assets/company shares that Italmobiliare received are still part of the portfolio. The cash from that sale went into acquisitions and laid the foundation of the holding company that Italmobiliare is today.

Because of its “unique” history and the many changes within the business, the stock movements of the past are not representative of today’s company. The first time I looked at the stock, I thought of a very cyclical business. Which some of the companies still are. But way less than the cement business in the past.

The company that we’re talking about today started in 2015-2016, so that is the timeframe we should focus on.

Discussing Net Asset Value and Discounts

The reason I got interested in Italmobiliare is the 50% discount to NAV that they claim to have. First, it’s not uncommon for holding companies to claim to trade at a discount to their NAV—one of the many reasons I have a healthy general skepticism regarding holding companies.

Secondly, even if such discount exists, there are often reasons for that. Holding companies can have disadvantages that, in my opinion, should be priced into the stock. The most common disadvantages are value destruction, holding costs, lack of transparency, complex structures, and acting against shareholder interests.

If I see any signs of that, I stay away from a company since I can’t know what discount is fair to account for these negatives. I generally trust the market that it has it right, then.

In the case of Italmobiliare, I don’t see any of these signs. They’re transparent in their numbers and clear in communicating with shareholders; their track record shows that they’re a value-adding holding company rather than a value-destroying one, and the structure is quite simple without other holdings or companies that are connected to them in some weird way or being loaded with debt.

Holding costs are about 1.3% of NAV (€26m), which is in a respectable range.

In the chart above, you can see the evolution of NAV per share and the NAV discount. The current discount is 49% without counting the distributed dividends of 5.70€ per share.

Starting from 2017, the compounded annual growth rate of NAV was 7.5%. However, I expect this number to be higher in the future since Italmobiliare only started buying many of the companies they now own in recent years.

As mentioned in the company's history, Italmobiliare doesn’t exist very long in the form it is now. Because of that, the cash ratio in 2017 was also quite high, with 36%. It declined with the acquisitions that Italmobiliare made over time and is now at 8%.

Many acquired companies have shown significantly more growth since ITM stepped in. Besides that, some companies are still young and in the growth phase and thus have most of their value coming in the next few years anyway.

The success of these companies will only be seen in the next years in this NAV evolution chart.

So, if we assume there is nothing that would justify a huge holding company discount, let’s try to calculate the NAV and see if Italmobiliare’s stated NAV of ~2 billion is realistic.

Calculating NAV

Now, let’s check if the alleged discount of 50% that ITM claims to have is even realistic. I’ve come up with some assumptions on ITM’s 2023 numbers that I think are realistic. However, these are estimates, so keep that in mind.

I’ve tried my best to adjust for seasonality, one-time events, the aftermath of the pandemic for all the businesses that were affected by it, and, of course, inflation and a possible recession or at least a slowdown in the European/global economy.

These are the numbers that I came up with:

ITM calculates an NAV of €2065 million, and I come to an NAV of €1969 million, which is pretty close. However, this model is highly sensitive to your inputs and assumptions. Increase the discounts and you come up with very different values for the segments. More important than the discounts on the other segments are the multiples adjusted to the portfolio companies. I’ve been realistic with these, not extra conservative. If you want, play around with these numbers and look at what value you get.

I think they are realistic, but you might come to a different conclusion. I don’t care too much about the exact number resulting from this model anyway. My focus is on the underlying companies that ITM owns, and this calculation only proves to me that ITM’s calculations of NAV do not seem to be completely off.

With an idea of NAV in mind, let’s discuss why this discount exists. In my discussion at the beginning of the analysis, I already elaborated on some points that can cause discounts for holding companies. I also said that I didn’t see any of those signs in ITM.

So where does the discount come from, and will it revert to fair value?

Young Company

In its current form, ITM only exists since 2016-2017. That’s not a lot of time, and as we’ve seen in the evolution of NAV, at first glance, an 8% growth rate of NAV does not seem outstanding either.

There’s a good chance that there are just too few investors aware of this company right now.

Dislike of Holding Companies

Speaking from experience, there are also a lot of investors who dislike holding companies in general. An alleged discount to NAV is also a common claim among holding companies and, thus, nothing that would immediately spark an interest in ITM for many.

Italian Company

European economies, and Italy in general, have had some rough years and likely even rougher years ahead. There’s a recession on the horizon and Italy’s GDP has been declining ever since the global financial crisis in 2008.

However, many people lose sight of the other side of the facts. Italy is still Europe’s fourth-largest economy, and the stock market outperformed all major European indexes (Germany, United Kingdom, and France) over the past five years.

Italmobiliare’s Business

Italmobiliares Business Model and Businesses

As mentioned in the company overview, ITM is an Italian holding company investing in high-quality, mid-sized, Italian-based companies with strong brands, unique selling points, and the potential for growth and internationalization.

ITM is also taking an active approach within the companies, often restructuring the management and taking part in planning the future.

In contrast to the best-known holding company in the world, Berkshire Hathaway, Italmobiliare didn’t prescribe to the buy-and-hold philosophy. But despite exiting the positions sooner or later, this does not seem to create short-term thinking.

ITM has a clear plan for the companies they buy and many of them have a long runway where I think it would make sense to hold them for many years. For ITM, not being a buy-and-hold investor seems to be more about having the freedom to sell companies when attractive offers come up instead of holding on at any price because that fits the philosophy.

As you have seen in the NAV calculation, Italmobiliare invests in five asset classes.

1. Portfolio Companies

Portfolio companies make up 67% of Italmobiliare’s NAV. Currently, ITM has positions in 12 companies, with ITM’s interest (share) ranging from as little as 20% to as much as 100%.

Let’s briefly discuss each company that ITM holds in its Portfolio. Where it makes sense, I also include a short industry analysis and discuss the importance for Italmobiliare.

If you do not want to read about every one of them, focus on the first four or five and quickly fly over the others. I write these deep dives knowing that they contain a lot of information. Not all of it is highly relevant, but I want to create write-ups where you can find as much as possible if you’re looking at it.

Often, you can just come back to these at a later point in time when you already know the company better and just look for the details that you maybe didn’t notice the first time you read it.

1.1 Caffè Borbone

The Company and Business Model

Caffè Borbone was founded in 1997 in Naples and is thus part of the age-old Italian and Neapolitan coffee tradition. This is a big advantage for the company’s goal of expanding internationally (in Q1 of 2023, Caffè Borbone also established an American subsidiary). Italy is known and respected for its quality brands in fashion and food and, of course, also in coffee.

In addition to this aspect, another important brand feature of Borbone is its focus on sustainability. It was the first Italian company to offer compostable pods and is now the first to offer recyclable wrapping as waste paper.

The fastest-growing segment of Borbone’s business is the coffee capsules and pods segment, in which it became one of Italy’s market leaders with a share of 25%.

On the revenue side, Caffè Borbone was able to grow at high double-digits from 2017 to 2020 and only a small setback of only 4% growth in 2022. In 2023, they’re back with 15% growth, which is a rate that I think is sustainable for many years to come. Especially when expanding in the US works out well.

The margins went up to well over 30% in the years prior to the Ukraine war and I expect them to come back to that level once prices for raw materials go down (which they are already doing) and inflation slows down (also the case).

Capsules and pods generally offer a higher margin than other segments of the coffee market, which should result in a sustainably high margin.

Industry Analysis

In 2023, the global Coffee Market size is valued at USD 127 billion and estimated to grow at a CAGR of ~4.5% for the next 10 years. The coffee capsule market, one of Caffè Borbone’s main focuses, is estimated to grow even faster at about 5% CAGR.

The chart below shows the global coffee market share by region. Europe and North America take the lead here and are also the most important markets for Caffè Borbone.

The two main market trends, organic and fair trade coffee, as well as convenience, also benefit Borbone since those are topics they prioritize and build their brand on.

The fact that they were able to gain such a significant market share in a very competitive Italian coffee market shows that they did a good job marketing to their audience and following up on those promises by offering high-quality coffee.

Valuation

I’ve assigned a fair P/E of 22 to Caffè Borbone since they are growing revenues in the high double digits, achieving high margins, and continuously growing their brand strength and international business.

Importance for Italmobiliare

ITM bought its 60% share in Caffè Borbone in 2018 (the remaining 40% are held by the founder). This deal was the second-largest acquisition since 2017. In my calculation, you see that I believe Caffè Borbone should be worth about €14, which would result in more than half the current stock price of ITM.

Thus, the success of a company like Caffè Borbone is not only important on an operational level but can also serve as a possible catalyst for the stock price to close the gap to fair value.

1.2 Officina Profumo-Farmaceutica di Santa Maria Novella

The Company and Business Model

Santa Maria (the whole name is a little too long for me ;)) is a Florence luxury brand selling perfume/fragrances, skin and body care, and other cosmetic and health products. The company was founded over 800(!) years ago in the 13th century. That tradition offers invaluable marketing and brand potential. And that’s exactly what ITM wants to build upon.

ITM bought its 95% stake in 2020 and has since had a tremendous impact on Santa Maria’s business. Before ITM, Santa Maria didn’t do any marketing. Because of that, the company was little known and couldn’t benefit from its heritage and high-quality products.

This changed with ITM and if we look at revenues, we can clearly see when ITM comes in. ITM also put a new CEO, Gian Luca Perris, into place and Davide de Giglio as support, who has experience building luxury brands and bought himself into the company with a 5% stake which I always like to see.

In 2022, Santa Maria also got a new CCO, Fabio Cantù, who also had prior experience in the luxury space working for Gucci and Montblanc Maison.

Up until now, the measures taken by ITM have worked out great and Santa Maria is growing rapidly, with growth rates ranging from 30% to over 50% annually.

The margins have been lower in recent years since they expanded their operations; they sell products in Europe (60% share), the USA (20%), and Asia (20%), and I would assume that they can achieve margins of 35% to 40% in the long-term.

Industry Analysis

The luxury industry is generally a great industry for companies to be in. Less cyclical than the “average” fashion brands, high margins and large moats. However, getting into that segment can be tough. Fortunately, Santa Maria is already established in that market and its unique and uncopyable history is the best possible starting point, The Italian image, of course, also helps, as is the case with Caffè Borbone.

The fragrance market is even stronger than the luxury market overall. In the following five to ten years, the market is expected to grow at a CAGR of over 6%.

The fastest-growing market is Asia, although North America and Europe also remain growing and important markets.

The main trend in luxury fragrance is sustainable and organic production, especially among younger buyers. This fits Santa Maria and ITM’s overall strategy. Santa Maria produces all of their perfumes with naturally grown herbs from Florence and without any testing on animals.

Valuation

Caffè Borbone’s growth is impressive, and Santa Maria is even stronger. Looking at their growth prior to ITM’s intervention makes this even more impressive. This is the perfect example of ITM seeing the potential before everyone else in the industry and then setting that potential free and adding value to the company.

Although 800 years old, the runway for Santa Maria is huge since they did not market their incredible story and products before. The history is a competitive advantage that is impossible to copy and will be a huge asset to them to keep on growing and demand premium prices for their products.

Because of the quality of the business and the runway, both nationally and internationally, I assigned them a fair P/E of 25 (I think you could even argue for higher here).

Importance for Italmobiliare

With my estimates, they should already contribute about €4.20 to ITM’s stock price. If we consider the current growth, I wouldn’t be surprised if that number doubles or triples in a few years.

That would result in Caffè Borbone and Santa Maria worth more than the whole company currently is.

Since ITM aims at selling their positions sooner or later, I also think there is a chance that Santa Maria will be sold to one of the luxury industry giants at some point in time. However, I hope this won’t be the case until the company has grown significantly and can generate a good price for ITM.

Looking at the plans of ITM for Santa Maria, I do believe that they plan to hold this position for longer and materialize Santa Maria’s value before they consider selling. They know about the gem they found in that company.

1.3 Tecnica Group

The Company and Business Model

Tecnica is a leading sports equipment manufacturer in the market of footwear and winter sports equipment known for its strong brands such as Tecnica, Nordica, Moon Boot, LOWA, Blizzard, and Rollerblade.

With Moon Boots probably being the most famous of these brands. And Tecnica is not only producing a form of this shoe. They are actually producing the original Moon Boot since it was invented by the founder of Tecnica Giancarlo Zanatti.

Despite fashion inventions, Tecnica is also responsible for the invention of the first double-injection plastic ski boot that revolutionized the ski boot sector. I wouldn’t be surprised if we also see future trends in the winter boot sector invented by Tecnica.

Once again, the phenomenal Italian reputation for fashion will be a long-term advantage. You might get an idea now why I initially compared Italmobiliare to LVMH. In my opinion, ITM benefits greatly from their expertise in the Italian luxury market and they will likely find more gems like the last three companies I presented in the years to come. One shouldn’t forget that they have only been doing this since 2017.

Like many winter equipment brands, Tecnica had a tough 2020. However, they showed a significant comeback after COVID growing rapidly in 2021 and 2022.

Quality is at the core of Tecnica’s products and it seems that they succeed at that promise judging from the feedback their products receive. Another part of their strategy, in line with ITM’s philosophy, is sustainability and environmentally friendly products and production.

Industry Analysis

The most important market for Tecnica is the winter and ski boot market since the majority of its revenues are made through Moon Boot and LOWA.

That market is expected to grow at a CAGR of about 3% in the years to come. Because of Tecnica’s unique position as a high-quality brand and the customer’s willingness to pay higher prices in this segment, low-quality shoes are nothing you want to experience going hiking or skiing, and the current expansion of its business, I think that Tecnica should be able to outgrow the industry average and reach growth rates of 5% to 6%.

Importance for Italmobiliare

In contrast to Caffè Borbone and Santa Maria, Tecnica’s future growth prospects are not as big anymore, and a lot of the value creation has already happened.

I wouldn’t be too surprised if ITM considers their job in Tecnica as “done” and we see an exit on this position. Although I still think there is great potential in the Moon Boot brand, and if the company proves as inventive as they have in the past, holding onto it can also be the right move.

I guess it would all depend on the opportunities. I haven’t heard of any offers yet.

1.4 AGN Energia

The Company and Business Model

AGN’s business is split between two services: LPG (Liquified Petroleum Gas) distribution, which makes up 75% of the business, and cross-selling of electricity and natural gas, as well as consultancy services to improve energy efficiency.

It’s a domestic market leader in LPG distribution and mainly supplies industrial, agricultural, and automotive use. Prior to 2022, the company was known as Autogas Nord. It renamed itself as part of a rebranding that aims to increase its activity in other energy sources, primarily renewable energy, such as solar photovoltaic.

ITM invested back in 2018 and AGN managed to double its EBITDA since then, which underlines the value-adding initiatives of ITM once more. However, the significant growth in revenues of 2021 and 2022 was mainly due to higher gas and energy prices caused by the Ukraine war rather than by operational improvements from AGN.

1.5 Italgen

The Company and Business Model

Italgen was part of the initial deal to sell Italcementi and transition into Italmobiliare. Therefore, it is not necessarily in the same group of investments as the ones we’ve discussed prior and remains, at least in part, connected to Italcementi.

It is based in Bergamo and also operates in the energy business but focuses solely on renewable energy (Waterfall, Sun, and Wind).

Waterfall:

Italgen’s primary focus is the use of hydroelectric power plants. They currently run 28 such operations. The concept works as follows: the potential energy accumulated in the water, moving downstream from higher altitudes such as running water of small rivers, canals, and streams, is converted into electrical energy through special turbines. The primary source is rainwater.

Sun:

Photovoltaic is one of the most efficient energy sources. Italgen has invested in photovoltaics in recent years and currently operates four photovoltaic systems.

Wind:

Italgen is also a minority partner of an Italian group in the management of wind farms installed in Bulgaria, in the region of Kavarnia.

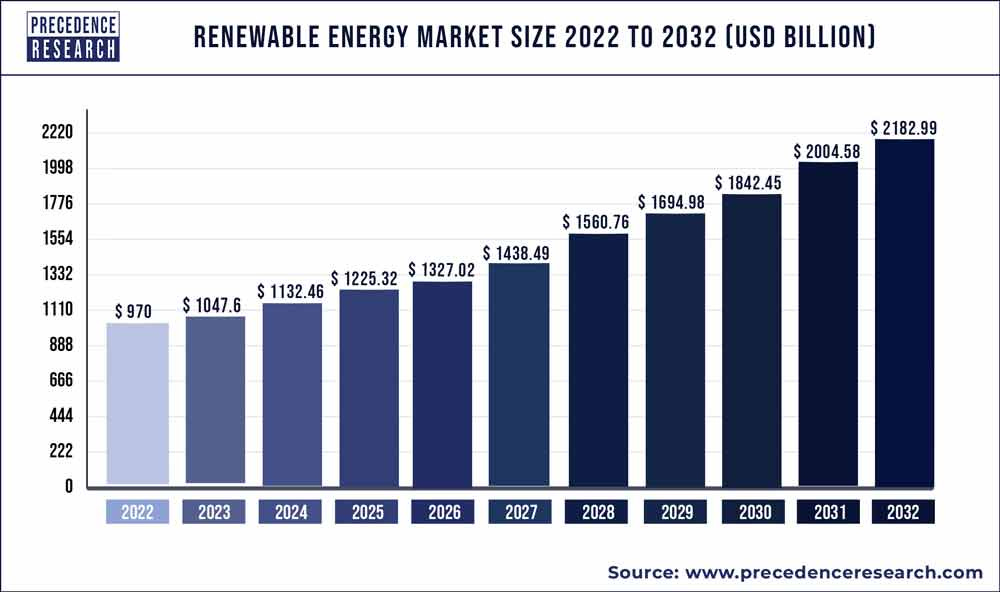

Industry Analysis

The market for renewable energy is unsurprisingly one of the fastest-growing markets. It’s not a question of if but rather when energy will have to do a radical shift and turn 100% renewable.

The overall market for renewable energy is estimated to grow at a CAGR of 8.5% over the next decade.

The hydroelectric power segment, currently Italgen’s main business, is estimated to grow at a CAGR of 6.6% from 2023 to 2032.

Solar energy will grow at more than double that pace (13.5% CAGR) and is, therefore, an important market for Italgen in the future. Since they are already operating and investing in that space, I’m confident they will be profiting from that growth.

The wind energy sector is expected to grow at similar rates.

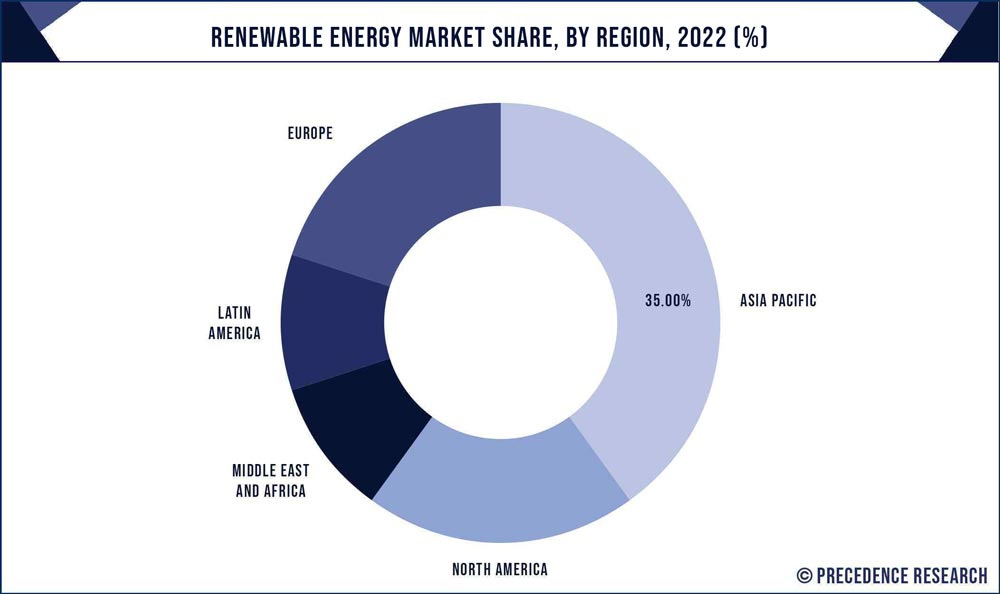

If we take a look at the market share, we can see that the demand for renewable energy is large in all parts of the world.

The current penetration of renewable energy in the global energy demand is estimated at only about 7% which ensures that this market will not only grow very fast for the next 10 years but for decades to come.

There are few countries that do not see the urgency of climate change and its consequences. Take this excerpt of the International Energy Agency’s latest reports on government spending globally:

The June 2023 update of the IEA Government Energy Spending Tracker finds USD 1.34 trillion allocated by governments for clean energy investment support since 2020.

Government spending has played a central role in the rapid growth of clean energy investment since 2020, which rose nearly 25% from 2021 to 2023, outpacing growth in fossil fuels in the same period. Around USD 130 billion of new government spending to support clean energy investments were announced in the last six months – among the slowest periods for new allocations since the pandemic.

This slowdown may be short-lived, however, as a number of additional policy packages are being considered in the European Union, Australia, Brazil, Canada and Japan. The newest outlays identified are predominately aimed at boosting mass and alternative transit modes, low-carbon electricity generation projects and low-carbon vehicle sales. Among all measures tracked since 2020, direct incentives for manufacturers aimed at bolstering domestic manufacturing of clean energy now total to around USD 90 billion.

1.6 Iseo Serrature

The Company and Business Model

Iseo is an Access technology company. It is the second largest player in Italy, with a market share of 13%, but also active in other parts of Europe. It offers its services to private buildings, apartments, companies, and public places such as railway stations, airports, and subways.

Iseo became a part of ITM’s portfolio in 2018 and since then has shown steady, yet not stellar growth. ITM’s vision for this company seems to be the expansion of the electronic business, such as smart home safety solutions.

Industry Analysis

Electronic solutions are what drive market growth for access technology companies. The access control market is expected to grow at a CAGR of 8.5% in the coming five years.

Besides a growing awareness of home security, the main driver is a rising number of smart city and smart infrastructure projects. If Iseo wants to achieve similar growth rates, however, it needs more market share in electronic and digital solutions instead of mechanical ones. Currently, the share is 84% mechanical solutions and only 16% electronic ones.

1.7 Sidi Sport

The Company and Business Model

SIDI Sport was founded in 1960 and specializes in the production and sale of cycling and motorcycling footwear. Its products are used by world-class professional and amateur athletes and stand for excellence, quality, tradition, craftsmanship, and design.

In October 2022, it became part of the Italmobiliare Group as a controlled company with a 100% stake.

Industry Valuation

The cycling and motorcycling market is currently valued at ~$72 billion and expected to reach a value of $100 billion in 2027, resulting in a CAGR of roughly 7.5% per year.

However, SIDI is focusing on customers who use bicycles or motorcycles for sports, not for everyday life. Thus, the relevant market is the sports bicycle/motorcycle market, which was valued at almost $19 billion in 2022 and is estimated to grow at an annual rate of 6%.

The largest market is Europe, although North America is currently growing the fastest. While the overall bicycle market is not relevant for the customer base of SIDI, it still affects the overall growth of bicycle adoption and, thus, ultimately also the way you can execute the sport.

In recent years, cycling infrastructure construction has been growing and it will continue to do so with more and more cities aiming for fewer cars.

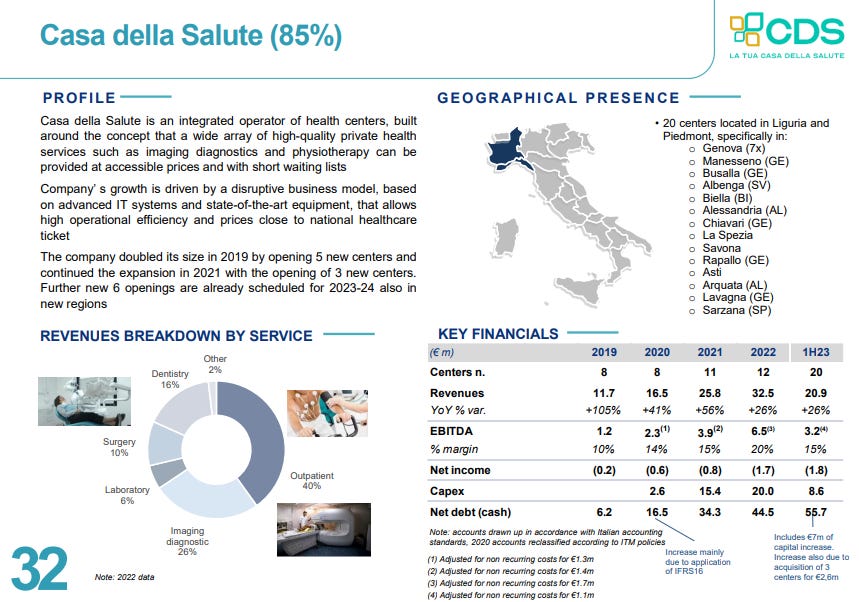

1.8 Casa della Salute

The Company and Business Model

Casa della Salute is a network of specialist diagnostic, dental, and physiotherapy clinics. They currently offer eight services: Diagnostic imaging, laboratory analyses, specialist visits, sports medicine, aesthetic medicine, dentistry, physiotherapy, and functional rehabilitation.

The first clinic was built in 2014 and since then, the company has grown fast and built a total of 23 centers all across Italy. For 2024, new clinics are planned already.

Outpatient services are the biggest part of revenues, although they’re generally quite diversified over their services. The business is not yet profitable because of the fast expansion and building of new clinics. In the long term, however, I believe that this business will prove to be very profitable and become a larger part of Italmobiliare’s business.

Industry Analysis

Unsurprisingly, the global healthcare market is huge, sitting at over $12 trillion in 2023, and expected growth of 8.7% annually over the next decade.

In Europe, North America, and parts of Asia, the main drivers are the demographic development of aging societies and the general increase in life expectancy.

Private hospitals and health centers like Casa della Salute are the fastest-growing hospital types, while currently placing behind in market share compared to public and state-owned hospitals.

1.9 Bene Assicurazioni

The Company and Business Model

Bene Assicurazioni is another young and fast-growing company. It’s an insurance company specialized on the motor segment. Since 2017, the company has grown its gross premiums from 9.4 million Euro to ~200 million Euro.

Besides this impressive growth, the company already reached profitability in 2019 and has since grown margins from year to year. 2022 was a generally rough year for insurance companies due to financial market volatility and an increase in the cost of claims. Thus, margins were a little lower.

The year was still profitable and revenues were growing by 25% due to the successful development of an omnichannel distribution network in which Bene combines an agency network with direct online sales and B2B partnerships.

Another positive of Bene is that Italmboliare invested alongside the founder, who is still leading the company.

Valuation

The company is very young and yet already very successful in growing revenues, but it also shows that it can be profitable and cash-generating in the future.

I consider it one of the best companies in ITM’s portfolio and therefore gave it a fair P/E of 20. It could also be higher in the future, but let’s wait and see if they can keep delivering these results.

Importance for Italmobiliare

Bene Assicurazioni is a great business and could become a substantial part of ITM in the future. Unfortunately, ITM’s stake in the company is the lowest out of all portfolio companies.

Maybe they can increase it over time when the development of Bene keeps improving the way it did in recent years.

1.10 Capitelli

The Company and Business Model

Capitelli operates in the production and sale of cooked and smoked cured meat characterized by a careful choice of meats of selected origin and an original craft manufacturing process, which makes them refined and niche products positioned among the Italian food excellencies.

The company’s flagship product is the San Giovanni cooked ham, created by Capitelli in 1994 and awarded many times as the “best Cooked Ham in Italy.”.

The main sales channels are supermarkets and traditional retailers.

Industry Analysis

While the perception in Europe and North America might be that meat is less and less in demand, the numbers do not yet match that narrative. The global meat industry is currently worth almost $1.3 trillion and is expected to reach more than $2.45 trillion in 2032.

Still, meat consumption will change, especially in Europe and North America, in the coming years and decades. There will be a shift to meat alternatives and high-quality meat produced under more human circumstances.

The growth rates of meat alternatives are more than double the growth of the meat market (of course, there’s also a significant size difference).

The growth of Capitelli in recent years has been reinforced by consumer trends towards high-quality craft food products and I think their high quality will give them an advantage in a market with changing consumer preferences.

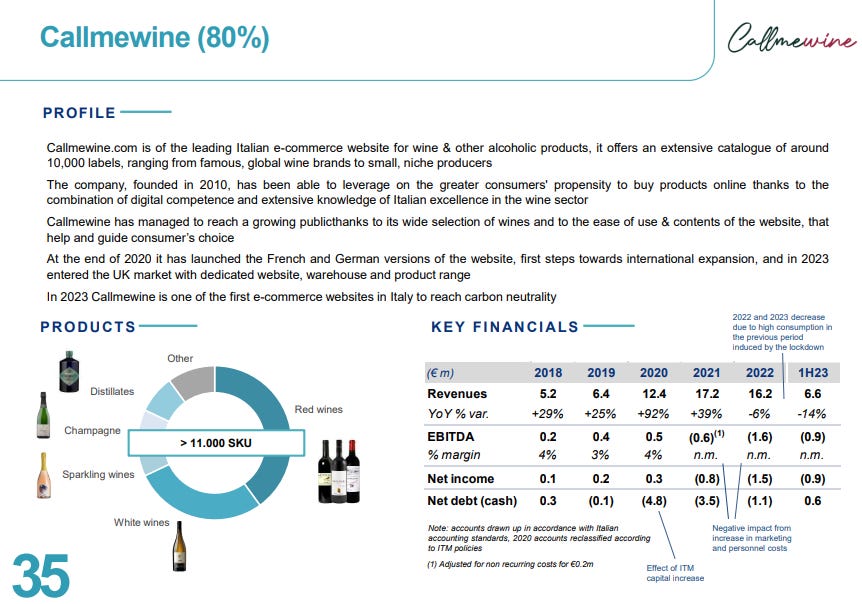

1.11 Callmewine

The Company and Business Model

Callmewine is an online wine retailer. It was founded in 2010 and ITM acquired an 80% share in 2020, right when online wine retailers like Callmewine had exceptional results following the pandemic and stay-at-home policies throughout Europe and many countries worldwide.

In 2021, I looked at a similar business located in the UK, NakedWines. While the general idea is good, long-term success in this business is challenging since there are few sustainable competitive advantages companies can have.

One thing they can do is aim at exclusive partnerships with wine producers, but apart from that, there is little a company like Callmewine can do. Many high-quality wine enjoyers also prefer buying wine in physical stores, while the people who just occasionally drink wine are less likely to order it online since there are no significant price advantages to that yet, quite on the contrary.

Overall, this investment doesn’t really fit the rest of the portfolio. I haven’t found anything specific on why ITM thought this would be a great investment for their portfolio. I guess we have to wait and see how Callmewine performs in the future.

1.11 Clessidra

The Company and Business Model

Clessidra is ITM’s Private Equity arm. Italmobiliare invested in 2016 and bought 100% of the asset manager.

Clessidra is now one of Italy’s biggest asset managers in the PE space and carries out the majority of Italmobiliare’s PE investments, which is a cost-effective way for ITM to invest in this sector.

2. Other Investments

Other investments make up a little less than 11% of ITM’s NAV and are investments in which ITM does not participate in any executive action. These are financial investments offering ITM additional diversification and steady investment returns.

3. Private Equity Investments

Private Equity Funds make up another 11% of ITM’s overall portfolio and NAV. They are a lot harder to value than the other parts of ITM’s business since you don’t have the public information about the companies, and PE-Funds often charge high fees that are also not disclosed and can vary a lot.

The good news in ITM’s case is that the majority of their PE investments are made through Clessidra, which is one of the companies ITM owns 100%. Therefore, high fees wouldn’t be a problem since they do not leave ITM in the end.

In my valuation, I applied a 30% discount to the PE investments because of the difficulty of valuing them. As before, you can play around with that number and apply a higher discount to see what it does to ITM’s overall value.

Since it is “only” 11%, the difference shouldn’t be that significant, however.

4. Real Estate

Real Estate is not really a part of ITM’s business model but since they own some, it is also listed here. It accounts for 3% of NAV or 59€ million.

Most of the objects are in Milan and Rome. The head office of ITM also belongs to their Real Estate category since it is fully owned by the company.

The reported value of the real estate has not changed through the years, which would make me assume that it is booked at cost, which would, in turn, mean that it is likely booked at historical cost and, therefore, valued far below today’s prices. Because of that, I didn’t declare any discount on the real estate investments in my NAV calculation.

Once again, at 3% of the NAV, a discount of, let’s say, 10-20% wouldn’t have made a significant difference in the end result.

5. Cash and Other Activities

In order to seize opportunities when they arise, ITM carries a cash position (short-term financial assets) of approximately 190€ million or ~9% of NAV.

Additionally, Properties and Related Assets contribute another ~50€ million to this category.

I didn’t apply any discount to this section because it is mostly cash and there is no reason that I can see to discount it. Discounting cash should only be the case when the holding company, or company in general, is burning it on capex, bad investments, or other ways that hurt the shareholder in the long term.

Both are not the case with ITM.

Share Buybacks

My first thought, seeing the cash position, was that buybacks could make sense. ITM considers their shares undervalued, and they have enough cash to buy back shares that could have an impact on the share price.

To my surprise, I couldn’t find anything on them thinking about or planning buybacks.

I then found something on the topic of buybacks in the Italmobiliare analysis by Jonathan Neuscheller (@JonNeuscheler).

He spoke to the management and they said that buybacks aren’t an option because of the stock’s low liquidity. The purchase and following cancellation of the shares would result in fewer and fewer shares being traded and thus exclusion from some indices that have minimum liquidity requirements for their investments. The same goes for institutional holders of ITM shares.

This makes sense and explains why this is not a path that ITM would follow.

Summary and Investment Return Expectations

Italmobiliare owns great businesses with lots of potential for further growth and profitability. The discount to NAV is legit and offers both, a margin of safety, as well as additional exponential growth.

The main problem I see with ITM is the absence of a hard catalyst. There’s nothing that would make me feel like there will be a narrowing discount in the near term. I think the discount will narrow over time with the underlying assets of ITM performing the way they did in the past.

With more exposure to their brands, ITM will also become more visible to investors. And when that happens, investors will see the value of ITM and that the discount is not reasonable.

Future exits could also act as catalysts for ITM but there is nothing currently planned that would have such an effect.

Besides the narrowing discount, faster growth in NAV will be another driver for returns in the future. In recent years, the average NAV growth rate was 8%. Now, with more capital deployed and fast-growing companies in the portfolio, I expect growth to accelerate.

If things turn out well, the discount will narrow and the underlying businesses keep improving. If this is the case, I think investors can expect returns up to 20% annually for the next 3-5 years. Maybe longer.

If the discount remains and growth does not accelerate but stays the same, which I deem rather unlikely, returns would equal the growth rate, so about 8%. As a margin of safety, this doesn’t sound bad.

Investors need to have patience with this. Especially if the economic state of Europe turns out as bad as currently expected. I think a 3-5 year horizon should be the minimum.

I’ll keep you posted with updates when something worth mentioning happens. I’ll specifically look at the development of Caffè Borbone and Santa Maria.

Deep Dives like these take a lot of time to research and write. But I love it, and I believe it is very valuable content that helps anyone who wants to learn about businesses and investing.

If you want access to these monthly deep dives and more research content, consider becoming a Paid Subscriber:

If you liked this Deep Dive, please like and share it so more people can see it!

Thanks a lot for taking the time!

My Current Portfolio:

My Latest Deep Dives:

Here are the tools that I use for researching Companies/Stocks:

Here’s my Investing Checklist System:

https://danielmnkeproducts.com/

Disclaimer:

I’m not a financial advisor, and this is not financial advice. This article is for research purposes only. You have to make your own investment decisions based on your research and individual situation.

Thanks for reading, and have a great day!