Visa Deep Dive & Valuation – Can this Giant continue its Outperformance?

Visa has beaten the market in an impressive way over the last decades. Now, it's a payment giant at ~$500 billion market cap. Can Visa still outperform or is the run over?

Content:

Visa’s Past Performance

Snapshot of Visa’s Performance in the last decade

A Background on Visa

Short Founding Story of Visa

Visa’s Business Model

The Core Business

What is Visa’s Business Model?

How do these processes work?

How does Visa make money?

Consumer Payments

Credit, Debit, Prepaid

New Flows

B2B, P2P, G2C, B2b, B2C

Value Added Services

Services

Acquisitions

Foundations and the Network of Networks

Visa’s Competitive Advantages

Brand

Network Effects and Infrastructure

Barriers to Entry

Scale

Innovation and Acquisitions

Growth Outlook

Financials

Balance Sheet

Income Statement

Cash Flow Statement

Competition

Mastercard

American Express

PayPal

Apple Pay / Google Pay

Risks

Competition

Regulatory

Management & Ownership

Valuation

Reversed Discounted Cash Flow

Discounted Cash Flow

Delta of the Delta

Investment Decision

Voting for the Community Portfolio

Visa’s Past Performance

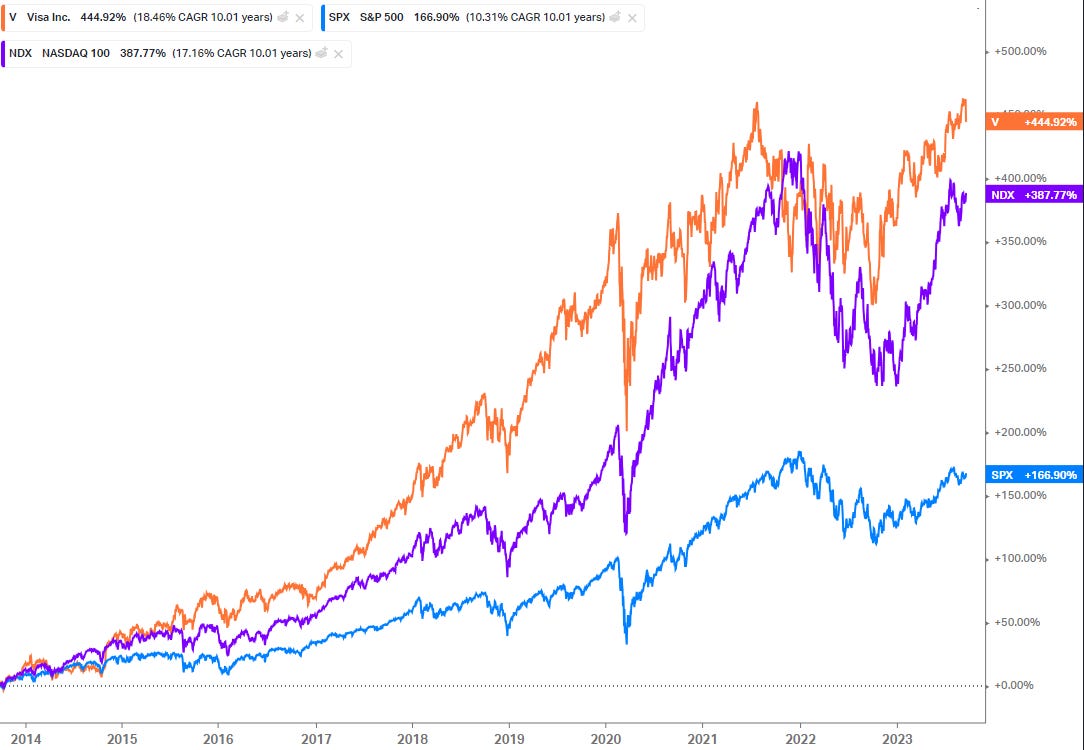

Visa has outperformed the market by a wide margin over the last decade. While Visa had a CAGR of 19%, the NASDAQ 100 achieved 17%, and the S&P 500 finished last, “only” returning a CAGR of 10%. That resulted in a 5.7x for a Visa investment, while an investment in the S&P 500 would’ve delivered a 2.5x.

This outstanding performance was fueled by double-digit growth in revenues, earnings, and cash flows. We’ll take a closer look at the financials later in the valuation.

The question is, can Visa continue this outperformance, or is there not enough runway left for the $500B payment giant?

We’ll answer that question in this Visa Deep Dive!

Background on Visa

The most common misconception is that Visa is a bank offering credit or debit cards. That’s not part of Visa’s business model. Visa is a technology company offering services to businesses, banks, and consumers.

Let’s understand Visa a little better by taking a short look into its history.

Visa’s former name was “Bankamericard,” and it was the first multi-purpose consumer card introduced by the Bank of America in 1958. It was the first card that could be used nationwide.

Until that point, small, local stores offered cards that could only be used in their store. This was a way for store owners to retain customers.

Over time, Banks introduced so-called “charge cards”. These cards could be used at multiple stores but were still limited to the geographical influence of the issuing bank. Also, as the name suggests, those cards did not offer credit lines. The balance had to be paid each month, and there were no interest payments.

All of this changed with the introduction of the Bankamericard in 1958. The card quickly grew nationwide, with local banks paying Bank of America for the right to set up their own Bankamericard systems and offer it to their customers.

Besides being the first card that could be used all over the U.S., it was also the first card that included all the features that we know from modern credit cards. It offered revolving credit and minimum payments, and it included interest, making this a profitable business for banks.

In the 1970s, the Bank of America decided to expand this business model internationally and grow its product selection by introducing debit cards.

For the purpose of expansion, the management decided to rename the Bankamericard to Visa. For one, it was easier to pronounce for foreigners, and second, the management thought it would be best if the name didn’t include “America” when the goal is to expand globally.

In 1979, Visa made the next step to become the company we know today. It introduced an electronic transaction authorization system.

This system is still a vital part of Visa’s business model today.

After this brief look into the rearview mirror, let’s focus on Visa’s presence.

Visa’s Business Model

The Core business:

Visa connects consumers, merchants, and financial institutions like banks. It securely routes payment information, data, and transaction authorizations.

A typical transaction works like this:

You’re a Visa cardholder doing your daily grocery shopping at the supermarket. You pay with your Visa card, and the process begins.

The Point of Sales, the card reader, sends your payment information to the merchant’s bank (acquirer). From there, the authorization message will be sent to VisaNet for processing. VisaNet then sends the information to the issuer of your card. Once they approve your funds, the data flow reverses.

The issuer sends the authorization request back to VisaNet. VisaNet routes it to the acquirer, which transmits the approval to the merchant, which finally ends the process, and you can make your way back home with your groceries.

What sounds like an endless process takes only a fraction of a second in real-time.

Now, there are two questions popping up in my head.

Why do we need this complex process, and why do we need Visa for this?

How is Visa making money in this process?

Why do we need this complex process and Visa?

There are two main reasons.

First, Visa is the institution doing the due diligence and approving the credibility of the credit card company. That way, the merchant doesn’t need to worry about the credibility of the credit card or the issuing bank.

Secondly, companies like Visa are the reason we can use our credit cards at different Points of Sale. It doesn’t matter what bank offers the card swiping machine for the merchant; your credit card will work because all those machines accept Visa cards.

So customers, as well as merchants, never need to worry that a card won’t be accepted and a transaction can’t happen because you’re at the wrong bank.

In short, Visa enables using credit cards regardless of the bank, geography, or currency. If you visit a country with a different currency, you can still pay with your credit card regardless of the currency in your bank account.

Now we know how the core business is set up and what it does.

But how does Visa make money from this?

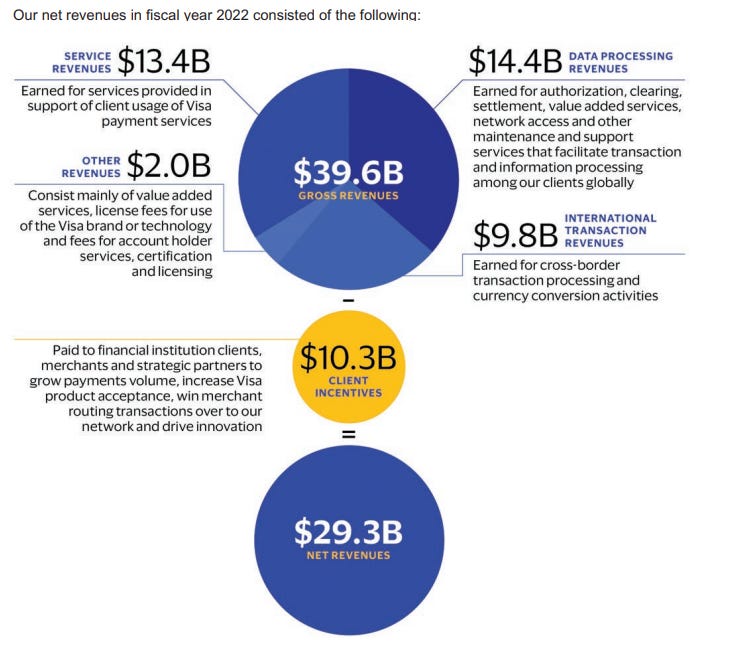

In contrast to what one might think, Visa does not directly profit from the interchange fees resulting from the abovementioned process. Visa’s profits come from overall transaction volumes and the total number of transactions processed.

There are four ways Visa makes money from this:

Data Processing Revenues - These consist of revenues earned for authorization, clearing, settlement, value-added services, network access, and other maintenance and support services. We’ll get to a further explanation of value-added services and the “Network of Networks” soon.

Service Revenues - Visa generates service revenues from payment volume on Visa-branded cards and payment products for goods and services.

The more money is spent on a Visa-branded card, the more money Visa makes. A particular strength of this business model is its integrated inflation protection. When products get more expensive, Visa makes more money.

Of course, consumers will generally spend less in an inflationary environment, which is still bad for business, but the margins of this segment remain the same. And as we will see in the discussion of the financials, the margins are extremely strong.

International Transaction Revenues - International transaction revenues are earned for cross-border transaction processing and currency conversion activities.

Cross-border transactions arise when the country of origin of the issuer or financial institution originating the transaction differs from that of the beneficiary.

Other Revenues - Other revenues consist mainly of value-added services, license fees for using the Visa brand or technology, fees for account holder services, certification, licensing, and card benefits, such as extended account holder protection and concierge services.

In 2022, all of this led to net revenues of $29.3B. At the end of 2023, this number is expected to be around $32.6B.

We now know how the core business of Visa works and how they make money. But we still need to talk about the other products and services that Visa offers. They grow in importance year by year and will become the main driver of growth in the following years.

Consumer Payments:

Most of Visa’s revenues and cash flows stem from its core products dealing with consumer payments. The core products are:

Credit: Credit cards and digital credentials allow consumers and businesses to access credit to pay for goods and services. Credit cards are affiliated with programs operated by financial institution clients, co-brand partners, fintechs, and affinity partners.

Debit: Debit cards and digital credentials allow consumers and small businesses to purchase goods and services using funds held in their bank accounts. Debit cards enable account holders to transact in person, online, or via mobile without needing cash or checks or accessing a line of credit. The Visa/PLUS Global ATM network also provides debit, credit, and prepaid account holders with cash access and other banking capabilities in more than 200 countries and territories worldwide through issuing and acquiring partnerships with both financial institutions and independent ATM operators.

Prepaid: Prepaid cards and digital credentials draw from a designated balance funded by individuals, businesses, or governments. Prepaid cards address many use cases and needs, including general purpose reloadable, payroll, government and corporate disbursements, healthcare, gift, and travel. Visa-branded prepaid cards also play an important part in financial inclusion, bringing payment solutions to those with limited or no access to traditional banking products.

New Flows:

Visa’s long-term strategy includes growing its operations and capturing new sources of money movement through card and non-card flows for consumers, businesses, and governments worldwide by facilitating P2P, B2C, B2B, B2b, and G2C payments.

The five components of this strategy include:

All Endpoints - Access points senders and receivers use to move money

All Networks - Infrastructure that enables money and data movement between endpoints

Guaranteed Settlements - Confidence in sending and receiving money

Trusted Standards - Frictionless, secure, and common money as well as data movement experience

Capabilities Unbundled - Capabilities that can be deployed across networks

A further look into…

All Endpoints: Visa is expanding its network of endpoints by opening traditionally closed-loop ecosystems.

They help non-traditional payment entities expand their payment capabilities and tap into Visa’s digital solutions, for example, the digital issuing of a credit card.

Visa also expands geographically and focuses on industries where digital payment isn’t widely used yet. Those industries can benefit from Visa’s expertise and establish global best practices faster.

All Networks: You already know VisaNet from my explanation of Visa’s core business model at the beginning of this article. In addition to VisaNet, there are also Visa B2B Connect and Visa Direct Payout Services:

In its ambition to become the “Network of Networks,” Visa is building, acquiring, and partnering with non-card networks to further extend its reach.

Guaranteed Settlements:

Visa’s guaranteed settlements ensure that all money movements get to where they’re supposed to go, when they’re supposed to.

To hold this promise, Visa uses the Visa Settlement Service, which consists of the following four functions:

Trusted Standards:

Companies that operate in the payment industry rely more than many other companies on trust. Visa has earned that trust over many years and is one of the most powerful brands worldwide. There’s an interesting study about Visa’s brand and its impact that we’ll discuss later when we analyze Visa’s moat (competitive advantage).

The trust Visa built relied on their high standards regarding operational-, security-, and network rules.

With six data centers distributed across the world, Visa services over 15,500 clients in 200 countries. They claim to ensure a 99,999% uptime for their operational services.

Capabilities Unbundled:

There are more and more ways to make transactions happen.

And more places where commerce can happen (e.g., face-to-face, online, in-app, smart devices). That’s why Visa decided to unbundle its services so that every client can decide individually what he needs and isn’t paying for services he won’t use.

Visa wants to be inevitable when- and wherever the consumer needs payment systems. They’ve realized that the payment experience isn’t the key driver for consumer behavior. It’s more important to offer your services regardless of the channel or mode of purchase. The payment ecosystem must be able to support the transaction when and where it occurs.

Today's users have many different payment options depending on where and what they buy. Different apps for food delivery and online shopping, paying by card, phone, or smartwatch in offline stores, etc.

Value Added Services:

The value-added services branch is another way for Visa to diversify revenue streams and pull the customer closer to the Visa network. There are five services that Visa offers:

Issuing Solutions: Visa Debit Processing Service, short Visa DPS, is one of the largest issuer processors of Visa debit transactions in the world, with more than 40 billion transactions a year and 190 million active cards.

In addition to multi-network transaction processing, Visa DPS provides various services, including fraud mitigation, dispute management, data analytics, campaign management, a suite of digital solutions, and contact center services. The capabilities in Application Programming Interface-based (API*) issuer processing solutions, like DPS Forward, allow Visa’s clients to easily integrate Visa DPS into their existing infrastructure while relying on Visa's security features.

*An API establishes an online connection between a data provider and an end-user. They allow companies to access some of their services without fully migrating into their ecosystem.

Besides these services, Visa also offers the following services: account controls, digital issuance, branded consumer experiences, and “Buy Now, Pay Later” (BNPL) capabilities.

BNPL or installment payments allow shoppers the flexibility to pay for a purchase in equal payments over a defined period. Visa is investing in installments as a payments strategy — by offering a portfolio of BNPL solutions for traditional clients and installment providers who use Visa cards and services to support a wide variety of installment options before, during, or after checkout, in-store and online.

Acceptance Solutions: The main part of the acceptance solutions is Cybersource, a subsidiary of Visa since 2010 and a global e-commerce credit card payment system company that provides streamlined fraud management and simplifies payment security in addition to the traditional gateway function of connecting merchants to payment processing.

Let’s take a closer look at what Cybersource does. There are three key operations we should look at: (1) Payment Acceptance, (2) Fraud Management, and (3) Payment Security.

Payment Acceptance: Payment isn’t the same around the globe. Different countries and cultures prefer different ways to pay and different banks or companies.

Cybersource offers clients their preferred (local) payment methods, including cards, direct debits, bank transfers, eWallets, and more. The platform is based on Visa’s security and global network of issuers and acquirers.

In terms of cards, Cybersource offers 13 different cards covering all major international credit and debit cards and a wide variety of regional and local cards. Besides that, there are local and global BNPL alternatives, all four global wallets (Apple Pay, Samsung Pay, Google Pay, Click to Pay), several Direct Debit and ACH (Automated Clearing House) payments, as well as online bank opportunities available.

Fraud Management: “Decision Manager” is Cybersource's machine learning program to guarantee fraud security. It can be optimized for each business individually and learns with each transaction. It also uses data from other merchants (cross-merchant data) to improve its ability to recognize “good/honest” customers even when they visit your shop for the first time.

Decision Manager Replay is another feature with which clients can test the effect of fraud strategies against their historical transaction data.

In 2022, Decision Manager screened over $347B of transactions and prevented the equivalent of $22 billion in potential fraud.

Payment Security: To keep sensitive payment data safe, Cybersource offers solutions to keep them off the client’s network. One way to do that is by tokenizing the data.

The customers’ stored credit or debit card information gets removed from the network environment, and the Token Management Service (TMS) exchanges the sensitive payment data for unique identifiers or tokens that cannot be mathematically reversed.

In addition, Visa provides secure, reliable services for merchants and acquirers that reduce friction and drive acceptance. Examples include Global Urban Mobility, which supports transit operators to accept Visa contactless payments in addition to closed-loop payment solutions; and Visa Account Updater, which provides updated account information for merchants to help strengthen customer relationships and retention. Visa also offers dispute management services, including a network-agnostic solution from Verifi that enables merchants to prevent and resolve disputes with a single connection.

Risk and Identity Solutions: Visa’s Acceptance Solutions’ main operation was to prevent fraud in the payment process. Another risk factor for financial institutions is the identity of customers.

Online card applications are increasingly targeted by using stolen personal information to apply for credit and using those credit lines for fraudulent activities.

That’s why Visa came up with solutions to stop this kind of fraud from the get-go. Two services that follow this goal are Visa Advanced Authorization and Visa Advanced Identity.

Visa Advanced Authorization provides global issuers with sophisticated in-flight risk scoring for more targeted and better-informed authorization decisions based on:

In 2020, Visa launched its Advanced Identity Score, which combines Visa’s artificial intelligence and predictive machine learning capabilities with application and identity-related data from the only centralized U.S. database to generate a risk score for new account applications.

All of these services strengthen the Visa network and its position as the safest payment company in the world while opening another market opportunity primarily based on maintenance and expansion services.

Open Banking: The acquisition of Tink AB (Tink), an open banking platform, in 2022 was another step in widening Visa’s network and exploring new ways of online payment.

Tink AB is a fintech startup that enables financial institutions, fintechs, and retailers to develop financial products and services and make payments.

Through a central Application Programming Interface (API)*, Tink enables customers to transfer funds, access aggregated financial data, and use intelligent financial services such as risk insights and account verification.

*An API establishes an online connection between a data provider and an end-user. Companies like Tink create APIs to allow companies to access some of their services without fully migrating into their ecosystem.

Tink is a market leader for open banking in Europe, integrated with over 6,000 banks and financial institutions and more than 10 billion transactions annually.

Advisory Services: Last but not least, there is Visa’s payments consulting advisory arm named Visa Consulting and Analytics. As the name suggests, this branch offers advisory services to clients (issuers, acquirers, merchants, fintechs, etc.) on all the topics that Visa has exceptional expertise on.

This includes:

Strategy - Helping clients formulate payment strategies to drive growth and profitability, compete in the digital economy, and address key topics such as crypto, open banking, real-time payments, and emerging third-party platforms.

Portfolio optimization - Helping clients identify the right customers and best portfolio actions that drive acquisition, engagement, and retention. For example, lifecycle management, loyalty program optimization, and usage growth.

Digital - Supporting clients to develop and execute digital strategies that address issues such as top of wallet, card on file, activation, and ongoing engagement. For example, Digital banking experience, Digital bank strategy, and Digital card acquisition optimization.

Risk - Helping clients manage risk and fraud while optimizing the customer experience. For example, Fraud management, Authorization performance review, Cybersecurity assessment, and enterprise fraud strategy.

Implementation Support - Supporting the execution and implementation of recommendations and wider value-added services product enablement by mobilizing teams on-site and partnering with clients to help scale competitive advantage and operate to succeed in the digital age.

Foundations and the Network of Networks

Alright, we’ve worked from the inner circle (Consumer Payments) to the outer circle (Value Added Services). All of these services and products combined are what Visa calls the “Network of Networks.”

The Network of Networks is Visa’s approach to becoming the leading global payment company and a single point of access for initiating multiple transaction types and enabling the secure movement of money worldwide.

The Foundation of this Network are the core characteristics that make Visa’s business model successful: Security, Brand, Talent, and its Technology Platforms.

Those are the factors that drive Visa’s competitive advantages. So let’s talk about them.

Visa’s Competitive Advantages / Visa’s Moat

Brand

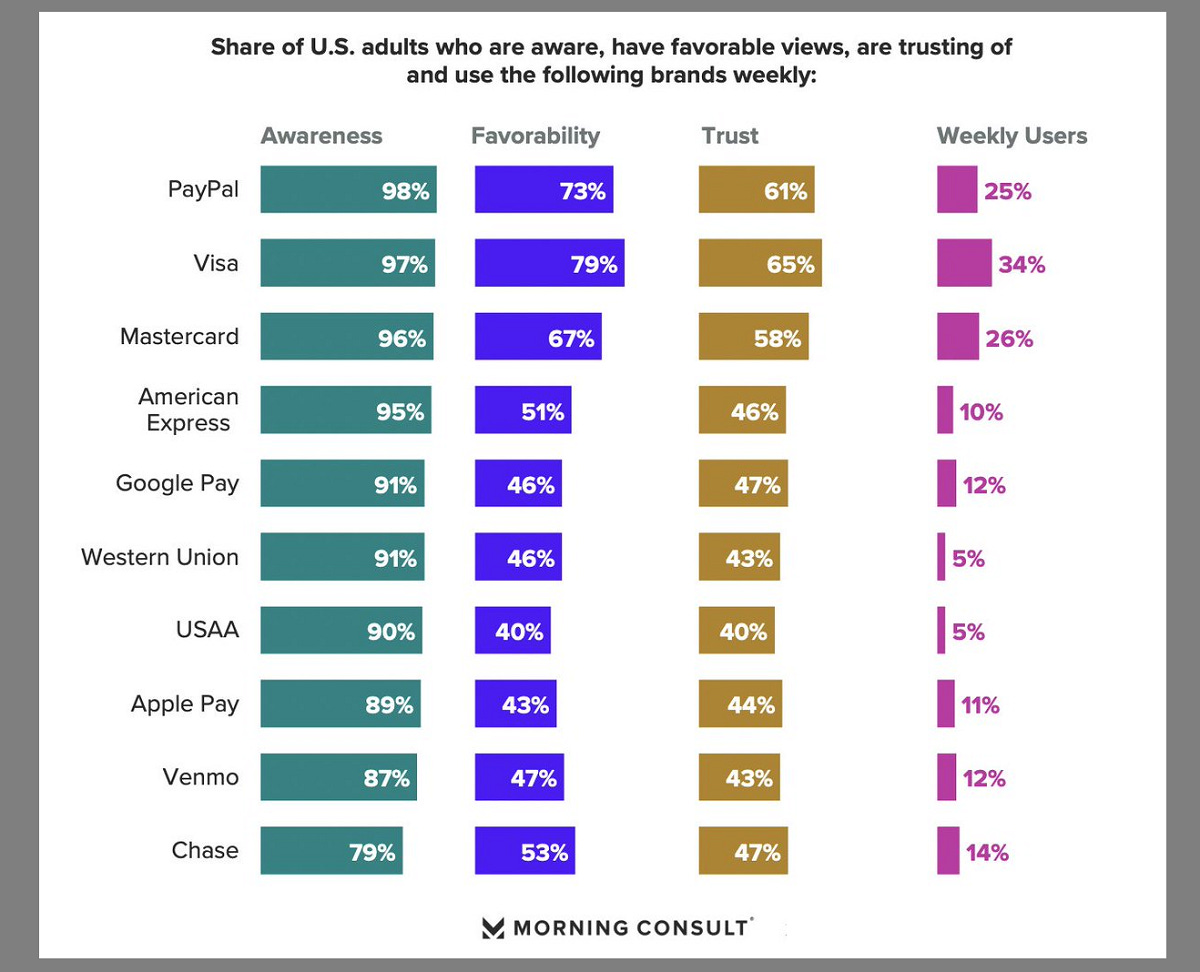

If we look at Brand Rakings, Visa often scores in the global top 10 and repeatedly among the top six, following, unsurprisingly, other big U.S. firms. However, the exact criteria for these rankings are mostly unknown, so I wouldn’t place too much weight on them.

What is clear, however, is that Visa is a well-known and globally accepted brand associated with security and trust. Although, as mentioned in the beginning, most people don’t even know what Visa really does as a company.

Many believe Visa is the company that gives out credit cards. And while it might seem like bad marketing if the customer doesn’t know what your company is doing, this isn’t the case here. In fact, it’s a pretty genius idea to place the Visa logo on all these credit cards. No one would know about a payment processor if the logo wouldn’t be visible every time they take out their card.

So, for Visa, the benefit of more people recognizing the brand is more important than them knowing in detail how Visa operates. All that matters is that this brand recognition creates trust, and the name Visa stays in the minds of the consumers.

And Visa seems to have achieved that goal. A Visa-led study from 2017 showed that Visa is by far the most trusted brand in the payments sector and can also benefit from that financially. The study found that consumers are 2.6x more likely to think a merchant is reputable when they accept Visa and 1.9x more likely to enter an unfamiliar store.

**Affluents have a household income of $100,000 or more. Millennials are defined as aged 18-34.

Visa’s brand strength also comes from its worldwide marketing campaigns with a particular focus on global sports events. Visa is active in over 200 countries and sponsors, as the only brand in the world, FIFA World Cups, the Olympic Games, the NFL, and women’s football across the globe.

Visa also has a reputation for innovation. Visa is not a payment processor; it is the payment processor. Innovations like contactless payments, mobile payments, and digital wallets built the digital payments industry and set the groundstone for our payment systems today. This is an advantage that consumers know little about, but the other side of clients, financial institutions, merchants, etc., know about this reputation, and it reinforces Visa’s network.

In contrast to other big companies, Visa also credibly positioned itself as a sustainable and environmentally friendly company. In 2020, Visa reached its goal to purchase 100% renewable electricity. Their overreaching goals are in line with other market-leading companies and governments around the world.

Apart from the ecological aspects, initiatives like the Visa Foundation support programs that provide access to financial services for underserved communities around the world.

However, the most impactful part of Visa’s brand remains the trust people have in Visa. Apart from their own study in 2017, the most recent Morning Consult Report from 2023 still has Visa as the most trusted brand in banking, investment, and payments for the third consecutive year.

Morning Consult is one of the leading online survey companies, and their rankings are based on global surveys with thousands of consumers to gather their opinions of brands.

Network and Infrastructure (Barriers to Entry and Scale)

Visa connects more than 4.1 billion account holders to over 100 million merchants (the largest number of merchants in any payment system), ~15,000 financial institutions, and governments in more than 200 countries.

Those numbers show the strength and global reach of Visa’s network, which is one of Visa’s strongest competitive advantages since this scale of network is why there is a very low risk of emerging competitors (High Barriers to Entry).

Both consumers and merchants benefit from having an option that is accepted worldwide, in offline retail stores and online. The more users the network has, the higher the benefit for every participant within the network (Network Effects).

A competitor would need to build a network as reliable and safe as Visa’s and replace Visa for 4.1 billion cardholders, 100 million merchants, and 15,000 financial institutions. That would be quite a challenge…

Innovation and Acquisitions

Another advantage that Visa has is its innovation and research capabilities. Instead of betting on its current market position and defending the status quo, Visa remains focused on innovating the payment industry and being on top of new trends and developments.

Its financial strength and brand enable Visa to spend money on research and development in-house and acquire companies and startups in the payment industry.

We’ve already talked about two acquisitions earlier. Tink AB, which strengthens Visa’s open banking system, and Cybersource, a company focusing on payment security and fraud management.

In 2022, Visa also acquired Currencycloud for $963 million. A global platform that enables banks and fintechs to provide innovative foreign exchange solutions for cross-border payments, transact globally in multiple currencies, embrace digital wallet technology, and embed financial tools into their businesses.

Two months ago, Visa acquired the Brazilian payments infrastructure startup Pismo for $1 billion in cash. Pismo is one of the fastest-growing fintech startups in South America.

Pismo enables customers to launch products for cards and payments, digital banking, digital wallets, and marketplaces.

According to Visa, “Pismo will be positioned to provide core banking and issuer processing capabilities across debit, prepaid, credit, and commercial cards for clients via cloud-native APIs.”

The startup’s platform will also enable Visa to provide support and connectivity for emerging payment rails, like Pix* in Brazil, for financial institution clients.

*Pix was created by the Brazilian central bank (Banco Central Do Brasil) and enables its users (citizens, companies, and governmental entities) to send or receive payment transfers in a few seconds at any time.

Growth Outlook

Visa is already valued at ~$500b, generates net revenues of over $30b, and has a nominal payments volume of $11.6 trillion. Is there even room for growth left? Let’s take a look at the Total Addressable Market (TAM) of Visa.

Visa sees enormous opportunities for growth through an expanding payment ecosystem. The Total Addressable Market is estimated at around $185 trillion (estimated by Visa) and over $200 trillion (different estimates).

Besides Visa’s main operation, Consumer payments (C2B), which has a TAM of around $30T and is already dominated by Visa with a market share of 40%-50%, B2B transactions are expected to be a $120T market that is not yet taken by any player. Visa currently only has about 1% market share (~$1.5T) and, therefore, enormous opportunity for growth. The New Flows P2P, B2C, B2b, and G2C offer an accumulated market opportunity of approximately $65T.

Consumer Payments (C2B):

Visa’s total payment volume in 2022 was $11.6 trillion (excluding cash volume), up 8.5% compared to 2021. That’s about 40% market share of global card volume and about 60% of the U.S. market share.

Growth opportunities in this segment are often underestimated since we believe that consumer spending and credit card use can’t accelerate much more. The mistake here is to draw conclusions from ourselves to everyone else. According to Gapminder, an educational non-profit organization fighting global misconceptions, there are four income levels worldwide.

Level 1: The world’s poorest people. They earn less than $2 a day, and meeting even the most basic of their needs is a struggle. For these people, it’s tough to find a drink of water on a hot day, or to stay dry when it’s raining. There are approximately one billion people on this level.

Level 2: People at Income Level 2 live on $2 – $8 a day. They can afford basic medicine, some warm meals, and electrical power suppliers that are typically unstable but can allow families to have a few lightbulbs in their homes.

Yet, it only takes one unfortunate event, illness, or extreme weather, and they’re back on level 1 and live in poverty. About 3 billion people are living at this level.

Level 3: People at Income Level 3 earn between $8 – $32 a day. The lives are much more stable than for people at Levels 1 and 2, and they can afford to buy things beyond the basic necessities. About 2 billion people live on this level.

Level 4: And then there is level 4. The fact that you read this makes it very likely that you are on this level. People at this Income Level are able to buy consumer goods, fly abroad with their families on holiday, eat out at restaurants, and think about whether Visa is a good investment opportunity…

To us, the other levels of living are almost unimaginable, and thus, we barely think about them. But those are the markets that will develop and grow in the future. That’s where consumer payment has tremendous room for growth in the next decades.

A smaller yet more recent opportunity for C2B growth is Europe. According to the ECB, cash is still the most frequently used form of payment at the point of sale in Europe.

Cash was used for 59% of point-of-sale transactions in 2022. However, in 2019, this number was significantly higher at 72%, so the trend is declining, and card payment volume should see a sharp increase in the next few years.

Business-to-Business (B2B):

Visa’s 2022 B2B business had ~$1.5 trillion in payments volume, while the global B2B market has a potential of over $120T.

Hence, New Flows will be the main drivers for future growth, and Visa focuses on positioning itself as the future market leader in those industries.

The idea is to provide a single connection point so that Visa clients can enable money movement for businesses (B2B), governments (G2C), and consumers (P2P), regardless of which network is used to start or complete the transaction.

Visa’s three-part strategy to grow the B2B business is to focus on investing and growing card-based payments ($20T market), accelerating efforts in non-card, cross-border payments ($10T market), and digitizing domestic accounts payable and accounts receivable processes ($90T market).

To advance in the B2B cross-border market, Visa has created the Visa B2B Connect network, which is gaining market share quickly and is already active in over 100 countries.