John Bogle - 7 Investing Lessons from the $7 Trillion Man

John Bogle was one of the most influential people in finance ever. He founded Vanguard, the second-largest Asset Management firm in the world with $7.6 trillion under management.

He also wrote phenomenal Books and Papers that you can find on my Bookshelf and Investing resources.

Here are 7 Investing Lessons of Mastermind John Bogle!

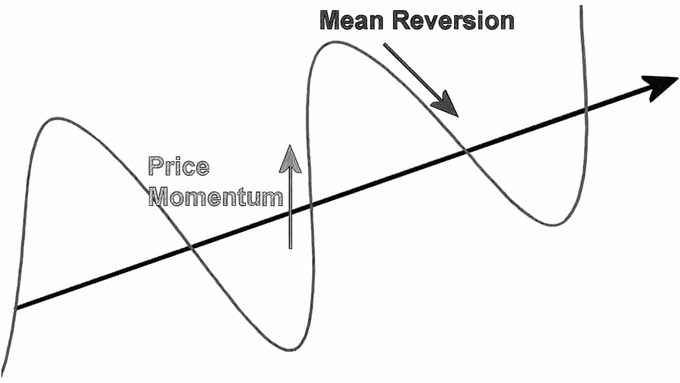

1. Reversion to the Mean

“Don’t think the past is prologue; it rarely is. Sometimes it’s anti-prologue.”

All extreme deviations from the mean will be short-term.

No matter if over- or underperformance, eventually, stock prices reverse to their mean (the underlying business value).

2. Leverage Time in the Market

Great wealth is built by compounding. Two things should be your primary focus.

a) Start as early as you can. The longer you invest, the larger the leverage of time.

b) Never interrupt the process. As Buffett said, never lose money. This might sound undercomplex to you, but these three words have far-reaching implications.

(I’ve covered this in a more extensive article that is linked at the end of this post)

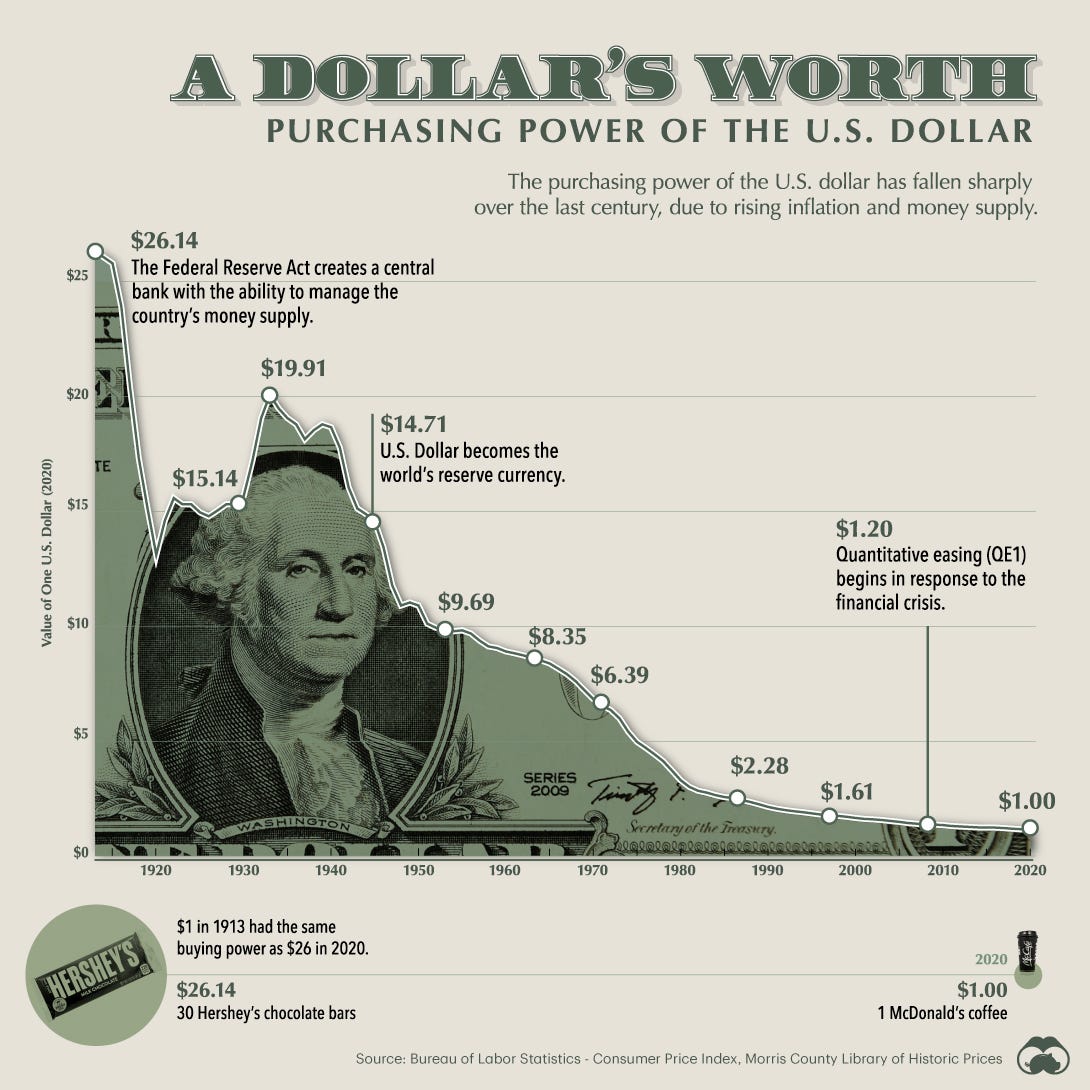

3. Invest You Must

There is no alternative to investing. Not investing is the biggest financial risk people can take.

Without earning a sufficient return on one's capital, it’ll certainly lose value over time.

There’s no equal alternative to participating in the markets.

4. Research Right and Hold Tight

Most people aren’t traders by choice. Their research before establishing a position is insufficient. Because of that, they lack the confidence to hold positions for the long term.

Small changes in price and rather unimportant news are intimidating enough to panic-sell.

Best Protection: Extensive Research

Since I’m a marketing genius, this is where I’ll let you know that I share all my research and my personal portfolio with Paid Members of this Newsletter ;)

5. Forget the Needle, Buy the Haystack

Speaking about index funds. Very few people succeed with stock-picking.

(Of course, we are the exception…)

According to Jack Bogle, choosing a broad, diversified index fund will serve most people a lot better.

In hindsight, the above-seen performance of the magnificent seven looks great. But how many people actually owned them throughout this time period?

As you can see, most investors can’t even remotely match the indexes.

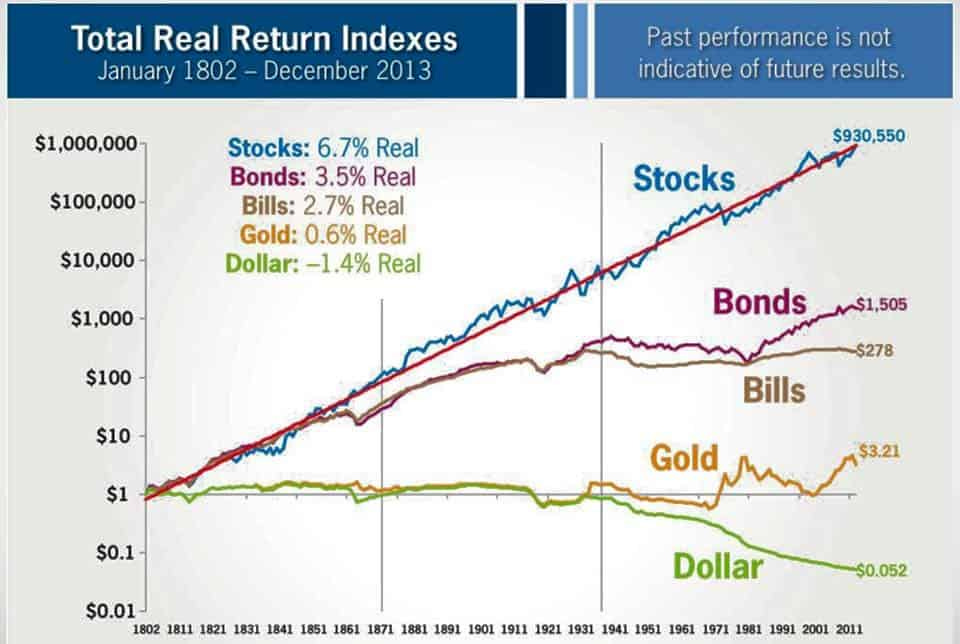

6. Expectations

The historical return for stocks as an asset class is about 7%. This is the return you can expect from owning a globally, diversified index fund in the long run.

At 7%, your money doubles every ten years.

My long-term personal goal is 15% per year. With that hurdle rate in mind, I make investment decisions. At that rate, the invested money doubles every ~5 years (slightly less than five years).

That’s a pretty high hurdle rate. Many people have the wrong expectations going into investing, thinking that doubling their money in two days through crypto investments is how investing works.

That’s not the case, while some might get lucky and do that, that’s gambling, not investing.

7. Inactivity is Hard but Necessary

You’re bombarded with news every day. You’ll hear that everything will go south thousands of times, the same goes for bullish news.

Remaining unaffected by this has been the most profitable thing to do historically. Stay the course.

Quick Summary:

1. Everything Reverses to its Mean

2. Time is your Friend

3. Investing is without Alternative

4. Buy Right and Hold Tight

5. Buy the Haystack, not the Needle

6. Have Realistic Expectations

7. Inactivity is King

Thanks for reading, and have a great Sunday!

Daniel

Margin of Safety (Never Lose Money) Article: