Warren Buffett: The Only 3 Chapters Investors Need to Read!

According to Warren Buffett, there are only three chapters an investor should read. After that, he knows everything he needs to succeed in investing.

“If you understand chapters 8 and 20 of The Intelligent Investor and chapter 12 of The General Theory, you don’t need to read anything else and you can turn off your TV.” - Warren Buffett

Content

Learnings from The Intelligent Investor Chapter 8

Liquidity

Timing vs. Pricing

The Paradox of Timing

Mr. Market

Money for Investing

Learnings from The Intelligent Investor Chapter 20

Margin of Safety

The Math behind the Margin of Safety

Why do Margins of Safety exist?

Learnings from The General Theory Chapter 12

Long-Term Expectations

Once again, Liquidity

Investor’s Psychology

The Intelligent Investor Chapter 8 - The Investor and Market Fluctuations

1. Liquidity

The unique power of the stock market lies in its liquidity. You can buy and sell securities in a matter of seconds. Other assets are a lot more illiquid.

Take a house as an example. No one knows the price of his house every second of the day. Nor would anyone expect the price of his house to fluctuate by 3% or more on any given day, although nothing has happened to it.

However, that is what happens to companies listed on the stock market. The price of the businesses fluctuates every day and every second without anything meaningful happening.

2. Timing vs. Pricing

The intelligent investor will want to benefit from these changes in market levels. There are two ways to do this. (1) The way of Timing and (2) the way of Pricing.

If you try to time the market, you bet on your ability to forecast the future better than other investors can.

If you go the way of pricing, you want to pay less than what you assume to be the stock’s fair (intrinsic) value. Once the stock reaches fair value, you sell. A lighter form of this method would be to ensure you don’t overpay.

Instead of looking for a significant discount to fair value, you are okay with paying a price close to the fair value because you assume that the company has excellent growth prospects and will perform well based on that.

Graham is convinced that timing the market will turn an investor into a speculator sooner or later. There is no natural edge you can possess to outsmart the crowd in anticipating what happens in the markets.

3. The Paradox of Timing

“It is absurd to think that the general public can ever make money out of market forecasts. For who will buy when the general public, at a given signal, rushes to sell out at a profit?” - Benjamin Graham

4. Mr. Market

Graham refers to the daily market fluctuations as Mr. Market, insinuating it’s a moody person selling you stocks at prices far too high one day and at prices far too low the other.

Your job as an intelligent investor is to take advantage of those mood swings and buy at times when Mr. Market is depressed and offers you bargains way below the intrinsic value of the company.

The psychological realization behind this is that the market is here to serve us. As investors, we aren’t forced to buy or sell at any point. It’s always up to us to use the liquidity and unstable nature of the market to our advantage.

5. Never Invest Money You Need

To benefit from this circumstance, however, you must never invest money that you might need in the short term. If you do, and you suddenly need to sell, it’s Mr. Market who has the upper hand and might force you into a trade where you sell at bad prices because you have to.

The Intelligent Investor Chapter 20 - “Margin of Safety” as the Central Concept of Investing

1. Margin of Safety

“This is the thread that runs through all the preceding discussion of investment policy - often explicitly, sometimes in a less direct fashion.” - Benjamin Graham

If you would only apply one investing concept for the rest of your life, make it investing with a margin of safety. The idea is simple. As we discussed above, one way of investing is based on pricing. Buying an asset for less than it’s worth, it’s fair value.

That’s all the margin of safety is about. It protects you from making mistakes in your assessment of intrinsic value because this is where investing becomes tricky.

There is no formula to arrive at THE fair value of a company. Because that one number that is fair value doesn’t exist, it’s not a fixed number that you either get right or wrong. It’s more of a range. You try to come as close to that range as you get.

The rule of thumb: Better be vaguely right than precisely wrong.

And because your estimate of fair value won’t be precise, you need to calculate with a margin of safety. So that, if your idea of how much the stock should be worth isn’t correct, your mistake isn’t too costly.

2. The Math behind the Margin of Safety

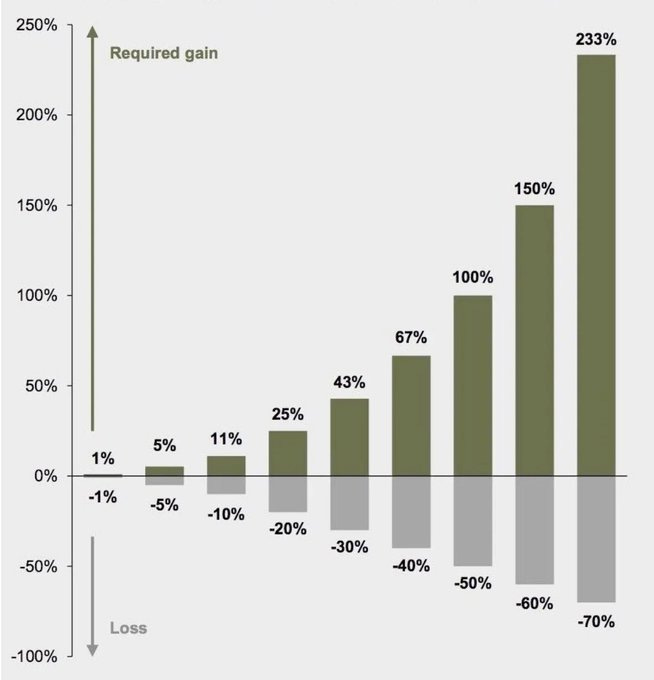

There are two beautiful mathematical advantages to having a margin of safety. The first is downside protection and the math of investment losses.

If you lose 50% on your investment, you need a 100% gain to get even. That’s a bad deal. The more you lose, the worse your situation becomes.

That’s why downside protection should be an investor’s number one priority. And the best downside protection is a margin of safety.

Besides that, you also have exponentially higher returns the larger your margin of safety was when you bought the stock.

Take a stock that you think is worth $10 (Fair Value) currently selling for $8. That’s an upside potential of 25%.

Now, if that same stock weren’t selling for $8 but for $5, the upside potential would suddenly become 100%.

As you can see, the math of a margin of safety is quite compelling.

3. Why do Margins of Safety even exist?

Remember when we talked about Mr. Market and how he offers you stocks at exorbitant prices on some days and depressed ones on others?

And do you remember why that was the case? Because prices change every second of the day and fluctuate significantly.

And why was that? Because of the liquidity the modern stock markets provide.

As Graham said, the concept of a margin of safety is like a thread that runs through all preceding discussions…

A Short Announcement on my behalf:

Starting on October 1st, this Newsletter will have additional content and new features.

The additional features will be:

Monthly Deep Dives/Valuations of Companies

A Comparative Intrinsic Value Sheet with all analyzed Companies

A Community Portfolio starting with $1,000

Free Access to all the Products I’ll release (Starting with my Investing Checklist System)

Direct E-Mail Access to Me

These features will be available to all Paid Subscribers at $17/Month.

All current Paid Subscribers will stay at the current pricing level ($7/Month). (The same goes for everyone subscribing before October 1st)

The General Theory Chapter 12 - The State of Long-Term Expectation

1. Long-Term Expectations

Long-term expectations are mainly based on two things: (1) Existing Facts and (2) Future Events.

(1) Existing facts are about the existing assets of a company, the current financial situation and earnings power, and the customer’s demand for the company’s products.

(2) Future events can include a change in the customer's taste, future financial power, or corporate changes like a changing CEO or management.

It’s in the nature of things that future events are uncertain, and, therefore, an investor should focus on the things that he can know, in this case, the existing facts.

Of course, projecting the current situation into the future also bears risks. Most irrational market behaviors, both to the upside and the downside, are based on projecting recent trends far into the future.

The intelligent way to go about this is to focus primarily on the existing facts while being open-minded to the possibility that future events can change the course of a company at any time.

2. Once again, Liquidity

Like Benjamin Graham, Keynes points out the absurd behavior that liquidity and constant access to the capital markets cause to companies' prices.

Shareholders no longer feel like they are a part of a company. Instead, they are only interested in finding someone who will buy their shares at a higher price than what they paid. This has resulted in a situation where the focus is no longer on the company’s growth and success but on making a quick profit from the sale of shares.

3. Investor’s Psychology

Apart from the instability that speculation causes in markets, Keynes sees another problem. Human nature. There are three main problems:

First, many of our positive actions (things that we choose to do) depend on spontaneous optimism rather than a mathematical expectation.

Second, we have a tendency to act rather than inaction.

Third, human nature desires quick results.

If you enjoyed this Post, please Like and Share it!

Subscribe if you want these weekly articles coming straight into your Inbox.

Have a Great Day!

You can find PDFs of all 3 Chapters here: