Discussing 5 Stocks in 5 Minutes Episode #1

This is the first episode of "Discussing 5 Stocks in 5 Minutes." We'll discuss what they do, the quality of the business, and how the relationship between Value and Price is.

In this series, I’ll present to you large caps as well as small and micro caps through One-Pagers and a closing comment.

I will include industry-leading companies and interesting asset plays that might have an attractive valuation but are not world-class businesses.

It’ll be a mix of opportunities, and I believe no matter your investing style, you will find something interesting eventually.

Today, we will feature two well-known, high-quality businesses and three very interesting, little-known companies. One of them might be a great compounding opportunity. The other two are attractive due to their valuation.

The idea is to give you a concise overview of the business, the investment thesis, if there is one, or the reason why I’m not interested in investing.

All One-Pagers will be made available to Paid Subscribers in a One-Pager Archive.

Also, feel free to make company suggestions for the next episode.

Now, let’s get started.

1. Adobe

Comment: I’ve been waiting for a good entry on Adobe for a couple of years now. The business is fantastic, which is also why there were no opportunities to buy at lower prices yet. However, I’m not willing to buy this business at a Forward P/E of 33.

Adobe can still be a great compounder and investment over the long term. But it is priced to perfection, and whatever happens that doesn’t fit this perfect narrative, the stock will react strongly. When that happens, Adobe might become more attractive from a risk/reward perspective.

If not, I’ll probably miss out on the next decade of great returns.

2. Dino Polska

Comment: Dino Polska is an interesting Polish retailer. Strong growth, high insider ownership, excellent management, profitable. It has everything that you could ask for.

I’ll probably take a closer look, but I’m once again skeptical about the price. The retailing business is tough. There are low barriers to entry since capital requirements are low and sustainable competitive advantages are rare.

Still, if there is a great retail business with lots of growth ahead, it’s Dino. Maybe they’ll miss estimates in some future quarter, or investors will get scared investing in Poland. I’ll wait and see for now.

3. Costco Wholesale

Comment: An example of how a retailing business can be highly successful for years and decades. Yet, Costco is another expensive company, and I highly doubt it could deliver on my hurdle rate of 15% per year.

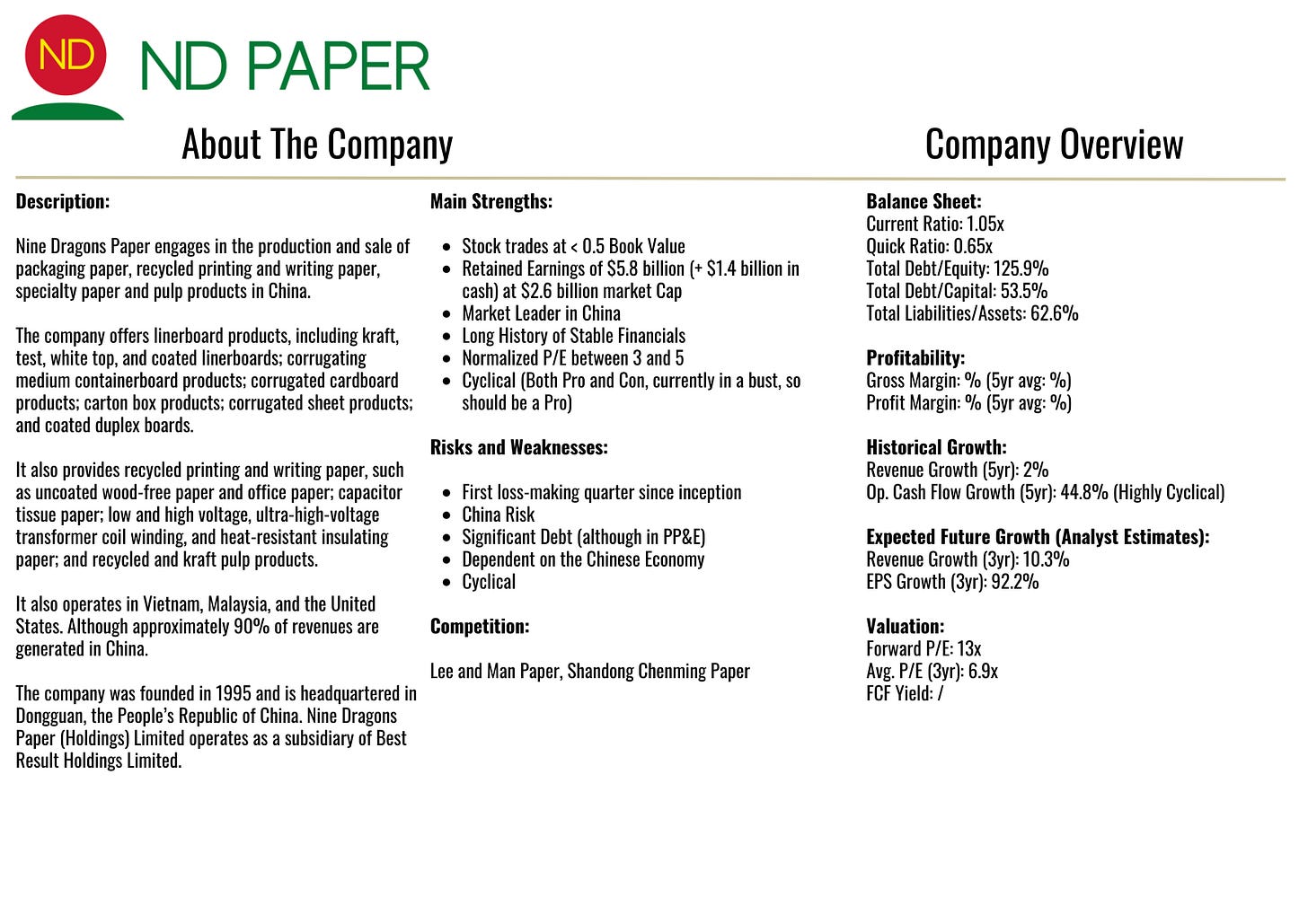

4. Nine Dragons Paper

Comment: Now we are in new territory. Nine Dragons Paper is the biggest Chinese paper manufacturer. It’s a cyclical business and currently facing strong headwinds.

However, it is well-equipped to withstand the current problems and trading at a very attractive valuation. Normalized P/E should be around 3-5, and it’s trading at less than 0.5 book value. The Forward P/E you see above seems high, but that’s because earnings are estimated to be low. As soon as the business gains traction again, the P/E will drop significantly.

An investment, however, comes with the typical China risk, which is currently omnipresent with investments in China. If you’re okay with that risk, it is an interesting opportunity. If you read my Alibaba/China Deep Dive, you know I’m okay with that risk. I’ll research Nine Dragons in more detail and might open a position. If I do, I’ll email Paid Subscribers, as always.

5. Flow Traders

Comment: Flow Traders is another company currently facing (probably) short-term headwinds. Flow Traders is a liquidity provider/market maker. It has great management and a risk-averse approach, which results in lower margins than other liquidity providers but seems to be the way to long-term success in this industry (in my opinion).

I would rather own a company that forgoes a few percentage points of margin in order to stay in business in the long term. The problem of the business is the low volatility in the current market.

With a Vix below 20, it is hard for Flow to make profits. And the Vix has been below 20 for quite some time this year. However, I highly doubt that we won’t see times with higher volatility in the markets anymore. And when we do, Flow could make a jump.

Same as with Nine Dragons Paper, I’m interested and will take a closer look. I’ll keep you up to date.

That’s it for today! Let me know what you think of this format!

What can I improve? What stocks should I cover next? Just write me an email.

Just a quick heads up, my next Deep Dive will be published on December 1st (first of the month, as always).

If you don’t want to miss that, upgrade now:

My Current Portfolio:

My Last Deep Dives:

My Investing Checklist System (Free for Paid Subs):

https://danielmnkeproducts.com/