A Deep Dive into Valuing Companies and Intrinsic Value

Investing can be simple. Figure out what something is worth and pay less. But how do you figure out what something is worth? That's what you'll know at the end of this article!

Content

Valuation Models

An Introduction to Valuation Models

Valuation Metrics

Per-Share Metrics

Total Company Metrics

Today’s Value / Present Value

Discounting in General

The Discount Rate

Future and Growth

The Timeframe

The Growth Rate

The Terminal Value

Terminal Growth Rate

Terminal Multiple

Multiple Scenarios

Base Case, Worst Case, Best Case

“Intrinsic value is the number, that if you are all-knowing about the future, and can predict all the cash that a business can give you between now and judgment day, discount it at a proper discount rate, that number is what the intrinsic value of a business is”. - Warren Buffett

There are two obvious problems with this. First, we are not all-knowing about the future, and, second, we are generally terrible at making predictions.

Unfortunately, there is no way around these two circumstances. A good valuation is therefore characterized by minimizing these two problems and trying to get as close as possible to the true intrinsic value.

How you can do that is what we’re discussing today.

1. Valuation Models

There are many valuation models. The Discounted Cash Flow Model (DCF), the Reverse DCF, the Sum-of-the-Parts Model, the Delta of the Delta, and many others or combinations of these. Their goal is the same. Figuring out how much value (cash) an investor can get out of the business at point x in the future (or, in some cases, at the current moment).

There are many different models because there are many different companies. You are probably aware of some labels that companies are given. There are growth companies, value companies, large-caps, small-caps, mid-caps, etc. In my opinion, labels always come short of describing the actual business. However, valuation-wise, it makes sense to differentiate between companies.

Growth companies, for example, are often not profitable yet, and thus, you can’t value them based on the same metrics as companies that are mature and in the phase of generating tons of cash but with lower future growth.

To account for these differences, we can use different metrics and models when we value a company. Today, I will use the Discounted Cash Flow model to explain the details of valuation in this article. First, because this is the best-known and most-used model in finance and also because it is the most intuitive way of explaining valuation.

As Buffett stated in the beginning, we want to find out how much cash a company produces in the future and discount it with an appropriate discount rate. That’s precisely what a DCF model does. So let’s stick with that for the moment and talk about what metric to use for the different types of companies.

2. Valuation Metrics

As the name Discounted Cash Flow model suggests, the most commonly used metric is the cash flow of a company. However, as mentioned before, not every company produces cash flow.

If a company doesn’t produce cash flow, you have two options.

Option 1:

You stop right there and don’t value the company. Buffett would say that he puts it on the “too-hard” pile. If you can’t predict how much cash the company can produce, it’s very hard to invest in that company. It’s a lot closer to gambling than investing. This is probably true for 90% of unprofitable companies.

Option 2:

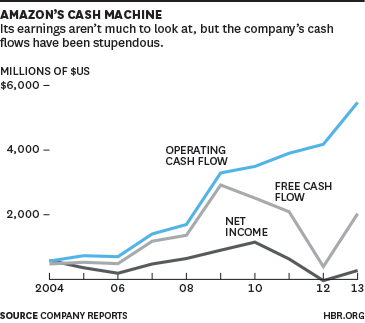

But the other 10% of companies are capable of producing cash flows. They simply choose not to. Sounds weird, but take a look at Amazon’s financials in the earlier stage of the company when it was writing red numbers every quarter.

As you can see, their business has been very profitable all along (as seen in operating cash flows); however, their free cash flows are all over the place and even negative from time to time (not visible in this chart).

That’s because Amazon very aggressively reinvested in their business. Now, as we know today, that worked out pretty well. As an investor, you could’ve said that you are simply not interested in this business since it doesn’t produce cash flow. And many investors did just that. The stock only really exploded after 2016.

A second look, however, would’ve made it obvious that the underlying business is a cash-generating machine. So, sometimes, you might want to look for another metric than cash flow.

Besides choosing between free cash flow, net income, operating cash flow, etc., there’s also a difference between per-share metrics and total company metrics. Once again, you can use both, but they have different advantages/disadvantages.

When to use Per-Share Metrics

I’ve found that most people intuitively understand per-share data better. The share price is what they see and have in mind when they talk about a company/stock.

Therefore, using Cash Flow per Share or Earnings per Share is better understood than the total company numbers. Besides the intuitiveness, there’s another advantage with per-share data. Companies that have either high dilution or buy back a lot of shares are better valued with the per-share data. It makes things easier.

If a company buys back a lot of shares and you use total company numbers, you have to constantly update the share count that you divide your results with. The same goes for dilution (issuing of new shares).

When to use Total Company Metrics

If there is no dilution or substantial share buyback program, I think there are advantages to using the total company metrics in regard to investment philosophy.

The focus on per-share data abstracts from the idea that you are buying part of a business and plays into the gambling character of the stock market. You are more focused on the share price than on the development of the underlying company.

Using total company metrics is a constant reminder that you value a business, not a stock or piece of paper.

Conclusion:

If a company has a volatile share count caused by dilution or share buyback programs, use per-share data. If the share count is stable, total company metrics provide a better understanding of the underlying business and its development.

Dividend Stocks

Above, we have discussed using net income or cash flow as metrics to value a business. But there are also businesses where their dividend is the key metric to look for.

However, this does not change how you approach the valuation. You still need to figure out how the dividend will grow in the future and apply an appropriate discount rate to get to today’s value.

3. Today’s Value or Present Value

We’ve talked a lot about discounting now. But what even is discounting, and how do you do it?

Discounting is the process of figuring out how much money you get in the future is worth today. Since $100 in ten years can’t be valued the same as $100 today. There are two main reasons for that. The first, and the one most people name when asked why this is, is inflation. The buying power of $100 today is very likely less than in ten years.

But this is not the main reason why we discount future earnings. The main reason are opportunity costs. If I have $100 today, I could buy a risk-free bond and earn (risk-free!) interest on that $100. So, if I instead choose to invest that money in a company, I want to know that I’m rewarded for taking that extra risk.

The formula for discounting is the following:

The Discount Rate

As you can see, since the discount rate is in the nominator, it decides how much future cash flows are worth to you. The bigger it is, the less future cash flows are worth today. Because of this, growth companies with lots of earnings potential in the future are worth less when interest rates (as a benchmark, most people use the 10-Year US Treasury) rise. Future cash flows are getting discounted at a higher rate.

But the risk-free rate (10-Year US Treasury) is not the only way to interpret the discount rate. At university, you’ll learn many different ways to come up with a discount rate. While most use the risk-free rate, others prefer calculating the weighted average cost of capital (WACC), stock market premiums, or country-specific risks (country risk premium).

I won’t dive deeper into that since it is not relevant for real-world valuation, in my opinion. The most successful investors never use any of these methods.

Buffett keeps it simple. Instead of using the risk-free rate, he uses his desired annual return. If he wants to make 15% per year on an investment, he will use 15% as his discount rate.

This has multiple advantages. First, the risk-free rate can change radically, as we’ve seen in the past year.

If you stick to using the current risk-free rate, your valuations won’t be comparable as soon as the interest rate changes. Secondly, if you calculate with an interest that’s too low, you’ll come up with a high valuation for future cash flows. If the interest rate goes up afterwards, you won’t have any margin of safety in your valuations.

Imagine you would’ve discounted growth stock with a discount rate of 1% in 2020; at a current discount rate close to 5%, you would’ve lost a lot of money…

Therefore, to improve comparability and have a margin of safety, use your expected return and, preferably, do not go below 7%.

4. Future and Growth

We now know that we need to discount future cash flows to value a company. But to do that, we first need to estimate these future cash flows. How much money will the business generate in the future?

For our estimations, we will use the company's current cash flows, come up with a growth rate, and extrapolate that into the future.

The Timeframe

When we extrapolate the cash flows into the future, we need to set a timeframe for estimating them. Usually, you go with ten years. This is not a rule set in stone but a number that proved to be somewhat(!) predictable and gives the company enough time to execute its plans.

Everything above ten years is pure speculation, especially in industries with high innovation rates. Using less than ten years is possible, but you might miss out on some companies that think and plan very long-term. And those tend to do the best in the long term. So, missing out on them could prove costly.

What you can do, and what I prefer to do, is to work with a so-called “Two-stage DCF.” A Two-Stage DCF Model works with two different growth rates, one for the first five-year period (Years 1-5) and a second for the second five-year period (Years 6-10).

The Growth Rate

Estimating the growth rate is one of the trickiest parts of a DCF and the reason why you should never think of your model as perfect but rather as an estimation of intrinsic value.

Intrinsic value might sound like a precise number, but it’s more of a range that you want to narrow in as best as possible. So, expect your growth rate to be wrong cause it most likely will be. However, take an educated guess, be conservative, and you will be fine.

“It’s better to be vaguely right than precisely wrong.”

An “educated guess” is based on knowledge of the company, the industry it operates in, the country or countries it operates in, and some other factors, partly individual to each company.

In my Alibaba analysis, for example, I focused a lot on the growth rates of China in the near term to figure out what we can expect from the macro environment since this is the main drag on Alibaba’s stock (and business in the short-term). For the long-term outlook, the company’s growth rate was more important.

In my Visa analysis, the industry’s growth rate will be the primary driver for Visa’s growth. If the industry performs well, so will Visa. (If you want to read the deep doves, I’ve linked them below)

Another important factor is linearity, or rather non-linearity. In our valuation models, we assume linear growth. In reality, this won’t be the case. Reality is non-linear, and you need to be aware of that. Don’t adjust your growth rates every year because your growth estimates don’t match. Think of your growth rates as averages over the entire timeframe.

Only adjust them when it becomes clear that the growth rate for multiple years will differ greatly from your estimates.

5. The Terminal Value

What happens after year ten? Chances are that the company you value won’t just vanish or suddenly go bankrupt after ten years (at least, we hope not). So, how do we account for the growth and cash flows after our estimated time period?

The answer is a Terminal Multiple or Growth Rate.

The Terminal Growth Rate

The idea of a Terminal Growth Rate is that we assume a growth rate for eternity. The most common solution is to go with the estimated GDP growth of the country the company operates in or has most of its business. The logic behind this is simple.

If we assume a growth rate higher than the country’s GDP and we assume that this growth will go on forever, eventually, the company will be bigger than the whole economy of the country.

The Terminal Multiple

The Terminal Multiple is my preferred method for a DCF. You simply assign a multiple for the company after year ten. That multiple is what investors, at that point in time, will be willing to pay for the company.

Keep in mind that these multiples are primarily based on future growth. So in most cases, it will be lower than the multiples investors are willing to pay today since you’re assuming that the company is ten years closer to maturity.

When assigning a terminal multiple, you have to be very careful not to overstate it since it has a huge impact on the result of your valuation. So, just as with the growth rate, conservatism is key here.

Generally, whenever you value a company, play around with the numbers a little and try to figure out what makes sense and what does not. If you come up with numbers that are either way too high or way too low, chances are your mistake is either in estimating the growth rate or the terminal value.

As you can see in the example above, I adjust the Terminal Multiple depending on the scenario that I estimate. In a bullish scenario, the Terminal Multiple ends up being higher than in a bearish one.

6. Scenario Diversification

Since the future is unknowable and we have the tendency to anchor numbers as soon as we see them, it makes sense to create multiple scenarios in our valuation.

If you just come up with one (the base case), you might get too focused on the result of your valuation, and you start to get nervous as soon as the stock/company heads in another direction.

What I like to do is to make assumptions for a base-case scenario, a worst-case scenario, and a best-case scenario. In the end, you can weigh them according to the probabilities that you assign to each scenario.

If you include a best-case scenario is up to you, but I would highly recommend creating a worst-case scenario so that you have a better understanding of the margin of safety of the investment and are prepared for worse-than-expected news.

Next Sunday, I’ll complete this Valuation Deep Dive with stock examples for a Discounted Cash Flow Model and a Reverse Discounted Cash Flow Model. These are the models that I mainly use for valuing companies.

In my next Deep Dive, which I’ll publish on December 1st, I will use a Net Asset Value Approach since it’s the most suitable for the company in question.

If you don’t want to miss that, consider subscribing:

Paid Subs will also get the First Episode of the new Series“Valuing 5 Stocks in 5 Minutes” on Thursday.

Have a great day! See you in the next article!

My Current Portfolio:

My Last Deep Dives:

My Investing Checklist System (Free for Paid Subs):

https://danielmnkeproducts.com/