A 3-Step Strategy to 50% Investing Returns!

I asked you what topic you want for the Sunday Episode and you wanted to know about the 50% p.a. Return Approach. So here it is! Comment Ideas for the Next Episode below!

“I think I could make you 50% a year on $1 million. No, I know I could. I guarantee that.” - Warren Buffett

Now, you and me aren’t Warren Buffett. But many more investors have returned 50% a year in the past, and many do so today.

They’re not famous because they do it with a small amount of capital. They aren’t on CNBC or running huge funds. When they finally get on the investment community's radar (if ever), they have a lot more capital and can’t keep returning 50%.

And since we only get to know them when they “only” (still great) return 15%, we think that’s all that’s possible. The same problem applies investing-strategy-wise. Because they invest in big companies, we believe that’s the way to go.

But that’s not the case. They are just forced to do so.

Size is a huge disadvantage in investing. Why? Because your investing universe gets significantly smaller. Investing in micro- and small-caps wouldn’t move the needle for your portfolio anymore. But that’s where the big returns are.

Step 1 - The Place to Look

The highest possible returns are in Micro- and Small-Caps. Those are companies with a market capitalization below $2 billion (Micro Cap: $30m-$300m, Small Cap: $300m-$2b)

The characteristics that make micro- and small-caps so attractive:

1. Overlooked

It sounds so simple, but it’s true. You would think that stock screeners and the sheer amount of global investors find every good opportunity out there before you can.

But that’s not what happens. Great opportunities are not obvious. You won’t find companies that trade at a P/E of 2. They would be screened instantly, and prices would go up (efficient market hypothesis).

However, you can find adjusted P/Es deep into the single digits. Adjusted means you “correct” the earnings for irregular or one-time events that skew the numbers up. Sometimes, companies have P/Es of 10, but if you take a closer look, you’ll realize the true (adjusted) P/E is much lower.

Those stocks can’t be screened. Thus, such opportunities are overlooked all the time.

2. Low-Coverage

A factor that adds to the overlooked theory is the low analyst coverage. Stocks that are too small to be bought by institutions are not as interesting for Wall Street. They have low volumes, and there’s not much money to make in fees.

Thus, analysts don’t cover small stocks, which additionally increases the possibility that they’re overlooked.

3. Competition Leaves

As Joel Greenblatt said, if you’re good at finding undervalued micro- and small-caps, you’ll be too rich to keep investing in them eventually. Thus, the best investors, sooner or later, have to leave the space.

This is the chance for new investors to come in and benefit from the opportunities.

I don’t limit my investments based on market cap, but, naturally, most of my personal investments are in smaller companies.

If you want access to my portfolio and exclusive stock research, become a paid member. For the next five days, you can lock in today’s price forever.

He taught his way of doing that in his Columbia Class. The Class Notes can be found at my Investing resources.

On Friday, monthly prices will increase to $24, and the annual plan will be $199. For existing subscribers and everybody subscribing until Friday, prices will never rise!

I’m already excited for February and March. There will be many updates and reports on my portfolio companies. For everyone looking for Large Cap write-ups, those will also come as Deep Dives. Disney is coming on Thursday!

Step 2 - Say “No” a Lot

If you aim for 50% returns, you must be concentrated and very selective about your investments. Have high hurdle rates and reject most ideas.

This takes patience. But the urge to invest as soon as we analyze a company is what hurts most investors’ returns.

It’s hard to invest the time only to pass on the company. But that’s necessary to only go for the best investment opportunities.

I always invest based on the question: “How much do I lose in the worst case, and how much can I win in the best case.”

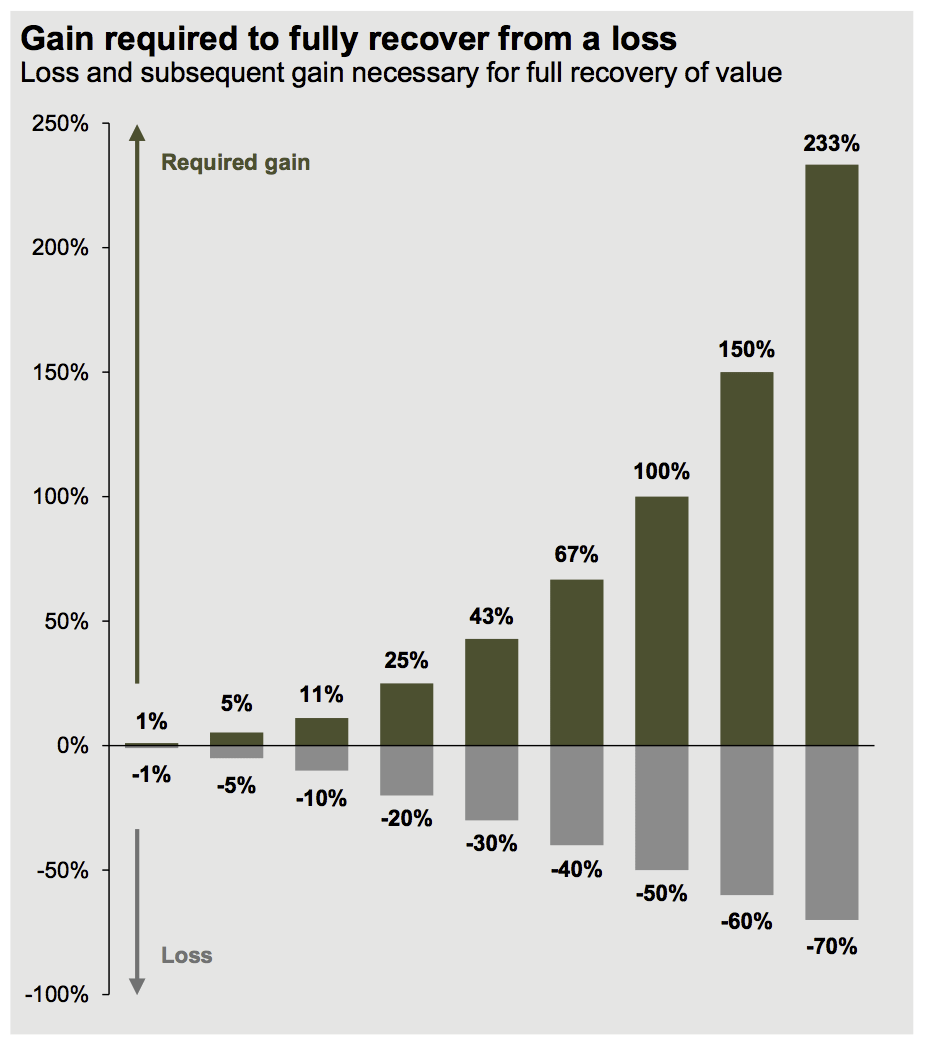

The more asymmetrical (Low Losses/High Rewards) the investment, the better. To compound your returns, it’s actually more important to protect the downside.

So, while it might seem counterintuitive, prioritize a protected downside over a high upside.

Step 3 - Putting it Together

Let’s get more practical. You know where to look and why to look there. You also know about the importance of patience and saying no.

Now, let’s combine this!

I currently hold four positions (My Portfolio). At least three of them have the potential to return 50% in the coming years.

(Note: Be aware that potential does not mean this is a certainty. “Risk is more things can happen than will happen. And the most unlikely things happen all the time.”)

What do they have in common? Not all of them are small caps (3 out of 4, though). Alibaba ( BABA 0.00%↑ ) is currently my only large-cap company. But as you might know, it hasn’t been very popular.

That’s the first common trait. All of them are either little-known or unpopular. If they’re unpopular, you might not need to find hidden value; the value is obvious, but most people choose not to see it.

If they’re unknown, we likely have a situation, as mentioned above, where you need to adjust numbers to see the real value. My latest portfolio buy is a good example. It’s everything but linear in growth. If you don’t adjust the numbers, you won’t see the enormous possibility of the company.

Generally, combining all of this is different from company to company. That’s why only valuing companies (or reading company valuations) can ultimately make you a better investor.

You can read the write-up on the company mentioned here:

For the sake of keeping this Episode at a nicely readable length, I will end it here.

But there are some more things that play a significant part. If you want more insights, I once wrote an article analyzing Buffett’s early Shareholder Letters (from times when he still returned high double digits per year).

Joel Greenblatt returned 50% a year (after fees and costs) for a decade, even after starting his fund, so he had already managed quite some capital then.

That’s it for today! See you on Thursday for the Disney Deep Dive and Sunday for the next weekly Episode!

Best

Daniel