Flow Traders - Potential Multi-Bagger with Hedging Ability

Today, I tried to keep the investment case a little shorter. I’ll explain the business, Key Indicators, stock movements, and my Investing strategy, but all in close to 10 minutes of reading time ;)

Two reasons why. First, in February, we’ll have the Q4 report and the annual report, and I will use those to write again about Flow and dig a little deeper into the numbers and underlying trends. View this article as an introduction to Flow Traders.

Second, some of you said that you would also prefer some shorter investment cases besides the very long-form (40-50 minute) deep dives and 15-20 minute research articles I publish.

I want to offer the formats you like the most, so let me know how you feel in the poll. (Of course, my Deep Dives and other research articles will always stay)

Background

Flow Traders is a Dutch company founded in 2004 by Roger Hodenius and Van Kuijk, who quit another Dutch liquidity provider to start their own. They were responsible for the ETF investment arm of Optiver (the company they quit) and thus had the knowledge to go on their own.

Flow Traders is a liquidity provider (market maker) that operates based on quantitative algorithms. Flow’s philosophy is not to take risky bets and squeeze as much profit as possible but to focus on safety and longevity. Minimizing risks is the priority.

Business

As a so-called market maker, Flow’s job is to determine a price that strikes a balance between supply and demand. The difference between the bid and ask price is the market maker’s profit.

For explanatory purposes, let’s consider a simplified example:

If Apple shares trade at $190, the market maker will offer a bid price (the price at which it is willing to buy) of, for example, $189.95 and an asking price (the price at which it is willing to sell) of $190.05. The $0.10 difference is the profit of the market maker.

Ten cents may not seem much, but think about the volume of shares traded. Yesterday, about 55 million Apple shares were traded. That would result in a profit of $5,5 million. That already sounds a lot better.

Although, in reality, margins are even smaller, and 0.10€ on a trade would be astronomically high. To give you an idea, we’re talking about trade margins of 0.025% to 0.030%.

Advantages of this Business Model

The market makers business has a lot of very attractive characteristics.

1. Profit from Up- and Downswings

Market makers don’t care whether the market goes up or down. They make money in both cases. The higher the volume, the better. Volume is usually up in volatile markets, so that’s where liquidity providers shine. Volatility also benefits market makers by offering higher spreads between bid and ask prices, increasing the margins.

2. Shock-Resistant / Hedging Potential

Since market makers make money in up-and-down markets, they are great hedges in bad times.

The Covid crash in March of 2020 was a prime example of that. The volatility index VIX (orange line) skyrocketed, and while the S&P 500 (blue line) crashed, Flow Traders (purple line) started a bull run and outperformed the S&P by a wide margin.

3. Asset-Light

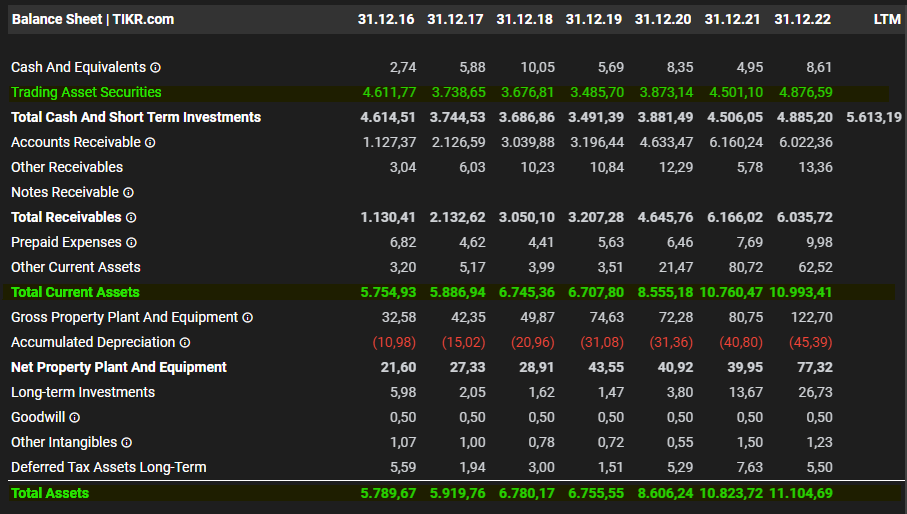

Since the business is based on algorithms, companies like Flow are very asset-light business models. Taking a look at Flow’s balance sheet, we see that almost all of their assets and liabilities are short-term and directly connected to their trading activities. Flow has no long-term debt at all.

Composition of Assets:

Composition of Liabilities:

On the current market cap of €745m, there’s close to €585m of equity.