Portfolio Update and Discussion - Buys and Sales for 2025!

Today, I want to discuss my portfolio and my plans for each holding going forward.

While the portfolio below covers all my current investments, I have a relatively large cash position (not large in absolute terms, unfortunately…). Over the course of this year, I want to invest that money in both current and new investments.

Let’s go through the holdings now, discuss updates if there are any, and then how I plan to proceed with the company/holding.

Flow Traders ( FLOW 0.00%↑ )

Flow Traders is currently my largest position, with a ~35% portfolio share. However, because of the cash position, the weightings of the holdings do not reflect my conviction in the company one-to-one. That’s why we’ll also discuss the outlook of each position today.

The Flow Traders position became my biggest holding because I got the opportunity to invest at good entry prices. These grew the position, and it performed well from there.

Business News:

We have had no updates from Flow directly since the last earnings report, which I covered here:

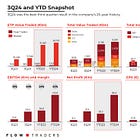

So, let’s look at the most important indicator for Flow’s business: volatility. This can give us an idea of how the next quarter might look.

As you can see, the overall level is still low. We had a short spike at the end of December, reaching 27.6, but most of December showed extremely low volatility. October and November were slightly higher, at a level between 19 and 21.

However, in the above-linked article, I calculated with only €0.35 EPS for Q4 based on the Q4 results of 2023. As I said then, this was a conservative estimate, and this claim should hold true. In Q4 of 2023, the Vix was mostly around 12. Thus, I expect €0.35 at a minimum, giving us a P/E of 8.

My View:

You must consider the following regarding Flow Traders: Flow is a company with a very asymmetric risk/reward profile. When the markets become volatile and go down, Flow thrives.

I could buy Flow at low valuations (avg. Buy-in: ~€16), which further reduces risk. At the same time, the market environment is already the worst case for Flow, although they did a good job navigating this market.

That’s a good setup. Low entry prices + current market environment = Downside limited, and surprises should be to the upside

However, if the market maintains its low volatility for years to come, Flow is unlikely to produce outsized returns. So, the risk is opportunity costs.

You know me. I’m not a macro investor. Still, I believe it’s realistic that there will be more or less severe market setbacks in the near future (could be in a month from now, could be in three years), which leads to my conclusion.

Conclusion:

I want to hold a position in Flow for that scenario. However, it will not be as large as it currently appears. I aim for 20% annualized returns, and that’s tough to achieve if a position that acts as a hedge against market turmoil (in this market environment) plays such a big part in the portfolio.

Because of Flow’s nature, a 5-7% position should be ideal for me. If we see a market downturn, the returns will be huge, and a 5-7% position is enough to have a significant impact on the portfolio. At the same time, this position size doesn’t hurt returns too much if the market keeps increasing.

Does this mean I sell stock? No, I will use cash inflows this year and the cash I currently have to build up other (and new) positions, so Flow will naturally shrink.

Alibaba ( BABA 0.00%↑ )

Here we go again…😏

Let's start with some news and updates before we discuss my view of the future of my Alibaba investment.

Business News:

Unsurprisingly, Alibaba (and China overall) has had some news since my last update. Here’s a short overview:

China's 10-Year Bond Yield is at Historic Lows

China’s interest rates have collapsed recently, increasing the deflation and currency problems. Experts expect the rate to go even lower, closer to 1%, since the real interest rates are still too high compared to historical averages.

While this is generally bad news for the economy, bad news might be good news right now in China. Sounds confusing, I know. But here’s why → A worsening macro environment forces the government to act and deliver more stimulus. And stimulus is what drives Chinese stocks at the moment.

Since Alibaba’s stock didn’t react to the macro news either, and we’ve been in the same range for over a year now, it also feels like we are at a bottom where surprises, if they come, are to the upside.

However, this should not downplay the risk of deflation or a weak yuan, which could severely impact Alibaba’s fundamentals. I’ll keep you up to date.

Selling Businesses

Alibaba also sold two smaller parts of its operations. A stake in a department store chain named Intime for $1 billion and a stake in the hypermarket chain Sun Art for $1.58 billion.

In my opinion, it is a good decision. Technically, they’re realizing a loss of $3 billion combined over both sales, but it shows that they’re back focusing on what works, slimming down operations and shutting down loss-making businesses.

Price reductions for Large Language Models of up to 85%

Alibaba continues on its journey to reduce prices in order to win market share. They did the same with the cloud, which seemed to work pretty well (see latest update). Let’s see if it works here as well.

My View:

I know many people hold a grudge against this company—especially those who owned it for a while. I don’t have the same feeling. Although I have thought about and discussed this investment a lot in recent years. So much, there’s an argument to make that a good investment shouldn’t cause so much “worry.”

And I can’t deny that I’m conflicted. My average buy-in price is $78, and, as I have often mentioned, I traded the stock in the range between $80 and $110. This has allowed me to earn a decent return on my Alibaba stock.

Unfortunately, I don’t know the exact returns since I concentrated all my investments in one place now but traded Alibaba stock on another broker due to cheaper transactional costs. If I subtract all the costs and taxes involved in the trading, I probably made less profit than it felt 😅.

Rough Calculation: For perspective, I traded with 50% of my overall BABA position. When I compare the start value of my BABA position to the end value, I should’ve made a net return on my position in 2024 of ~15-16%. Compared to the ~12% Alibaba returned in 2024 (if held without trading).

I take that. However, as with every other investment, you must compare this to all alternative investments you could’ve made. Doing so, it doesn’t look that great anymore.

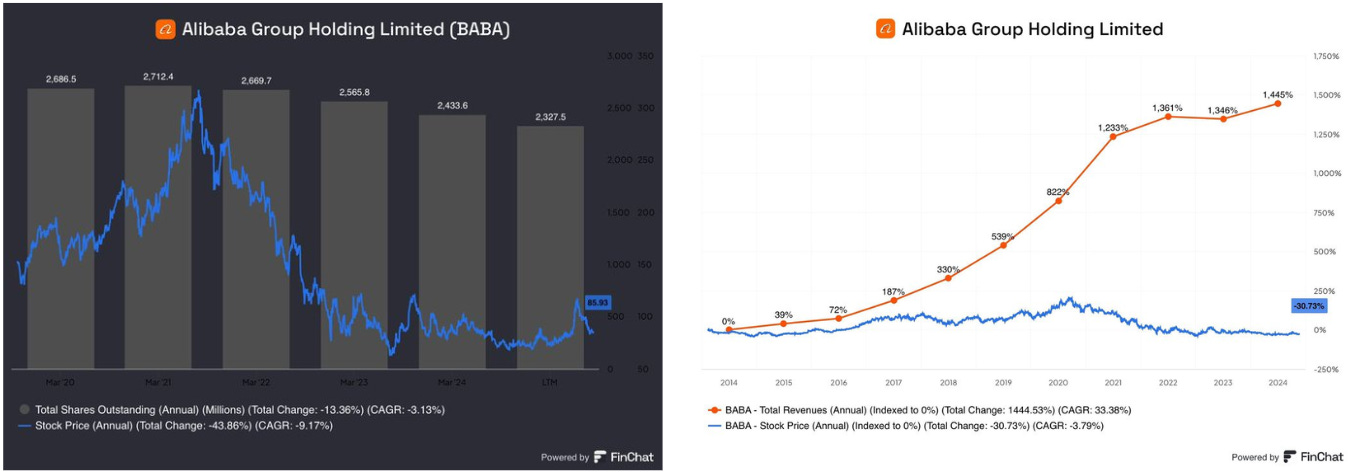

Be that as it may. Alibaba remains incredibly cheap on a fundamental basis (I had to include the charts below… sorry), and we seem to be at a bottom in the $75-$80 range. The Setup: minimized downside risk (on a fundamental basis), and most surprises should be on the upside.

(For all new readers, I differentiate between a fundamental and a macro margin of safety with BABA. Fundamentally, you have a huge margin of safety, thus limited downside. If you believe, however, that a war with Taiwan is possible, there is obviously no limit to the downside. For details here, check recent articles.)

So what to do?