My Thoughts on Alibaba's Earnings September 2023

Yesterday, Alibaba released the Earnings Report for the Third Quarter of 2023. The stock reacted with a 10% decline. Let's discuss why and what this means for Alibaba Investors.

Yesterday, Alibaba released the results for the third quarter of 2023 (and the stock plunged by 10%), so here’s a brief update on the numbers, additional information given by the company, and what I take from it.

Business Highlights Overall:

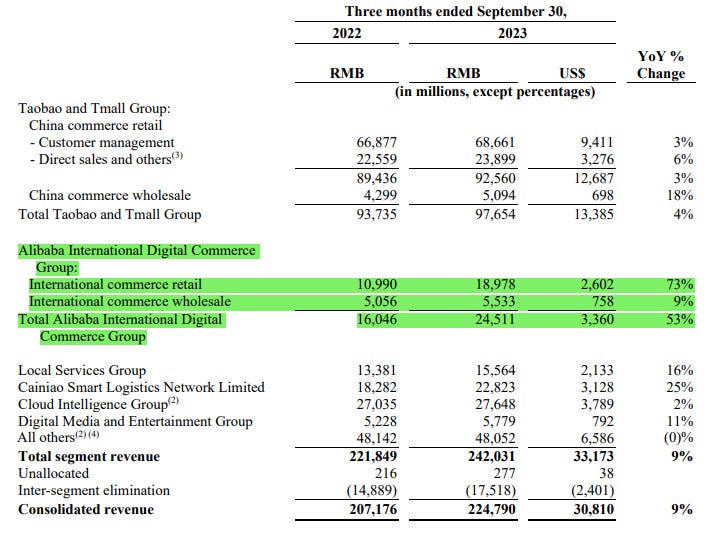

Alibaba’s numbers were solid and in line with what I expected from this quarter if the overall Chinese economic situation doesn’t turn out worse. Revenues grew 9% YoY to almost $31 billion, and Free Cash Flow came in at $6.2 billion, up 27% YoY and well on course to hit annual cash flows between $22 to $25 billion.

Business by Segments:

Taobao and Tmall:

International Digital E-Commerce:

The International E-commerce business did great, with 25 YoY growth combined over all retail businesses and revenue growth of 53%. The next step for these businesses, besides expanding, will be profitability.

Local Services Group:

Revenue from the Local Services Group grew 16% YoY to a little over $2.1 billion, primarily driven by growth in Ele.me (Food and Grocery Shopping) and Amap (Chinese Google Maps equivalent).

Cainiao Smart Logistics:

Cainiao’s revenues grew by 25% YoY to $3.1 billion, driven by cross-border fulfillment solutions, which shows that international expansion works out fine so far.

Cloud Intelligence Group:

Once again, the big disappointment. Slow growth with 2% YoY overshadows improvements in profitability with 26% YoY EBITA growth. While I did not expect the Cloud business to improve as quickly as this quarter, it’s more a question of two or three years, I would like the management to communicate more about what’s wrong with the business.

Yes, the overall environment in China is currently not great for Cloud (explained this in my Deep Dive), but there are problems unique to Alibaba’s cloud business and the company would be better off communicating them.

Digital Media and Entertainment:

This segment is still relatively small, with revenues of $792 million but was able to grow 11% YoY primarily through their offline entertainment businesses that still benefited from the Covid reopening.

I’ll spare you the “All Others” segment and continue with discussing the planned Spin-Offs of Alibaba.

Spin-Offs

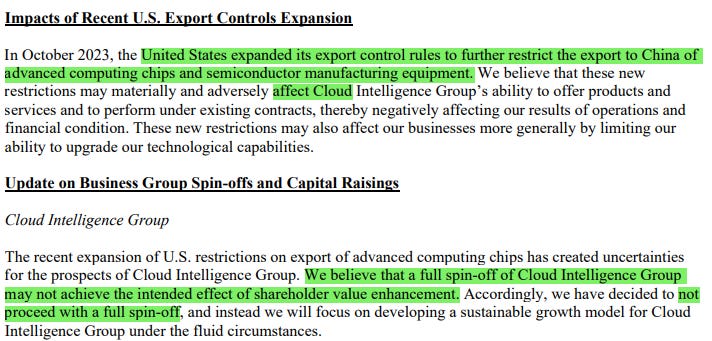

First things first, the spin-off of Alibaba’s Cloud business will not happen.

According to the company, the US sanctions regarding the export of semiconductors are affecting the Cloud business and its ability to operate so the current circumstances make a spin-off less beneficial to shareholders.

Generally, I agree. The market sentiment is bad and as we’ve seen with this reaction to the earnings, Alibaba can only lose. Spinning off the Cloud business now will only result in more bad news and not in enhancing shareholder value.

However, that this news wouldn’t be welcomed by the market was pretty obvious also.

As I said in my Deep Dive, the only business segment that could work as a catalyst for Alibaba’s stock is the Cloud business. This also works on the downside, as long as the cloud looks ugly, Alibaba will too.

Cainiao Spin-Off:

The Cainiao spin-off happens as planned and is already in progress. The spin-off will take place at the Hongkong stock exchange.

Freshippo Spin-Off:

The Freshippo spin-off was also put on hold, which was expected since Alibaba’s perception of value was a lot higher than what markets are currently willing to pay.

These spin-offs only make sense when they’re freeing value. That’s currently not the case. The sentiment is too bad. I think Alibaba hoped that the announcement to spin off businesses could work as a catalyst to boost the whole stock price.

This didn’t happen. Now spinning-off companies below their fair value doesn’t make much sense and they have to pull back, which doesn’t look that good.

Dividend:

Another questionable announcement was a dividend program of $2.5. I don’t know what the plan behind that dividend is but I would much rather see a buyback program that actually reduces shares…

The stock trades at $79. Why would you prefer a dividend over buybacks? I highly doubt that this will suddenly change the opinions of foreign investors and cause a run for the dividend.

There are some people who welcome this decision, I don’t belong to them. However, they already have a huge buyback program in place. It’s time to act on that and use the funds to repurchase shares, without(!) issuing new ones simultaneously.

Conclusion:

The quarter was good but Alibaba is an unpopular stock. This is how unpopular stocks get treated by the market. One (perceived) bad news in the report (canceled cloud spin-off), and the company gets punished badly. Good numbers don’t matter, then.

If fundamentals would matter, Alibaba wouldn’t trade where they trade…

Right now, I won’t add to my position, though. My price basis is low and I would only add if we see a price close to $60 again (which is not unlikely ;) ).

Become a Paid Subscriber and read the full 45-minute Deep Dive on Investing in Alibaba and China here:

Now, have a great day!

Best, Daniel

As always, this is not investment advice! Do your own due diligence!