High Tide Earnings Update - Thank you Mr. Market!

High Tide released its Q4 Earnings Report yesterday after market close. It was a great quarter, in line with the growth trajectory I expected. However, the stock is down 7% pre-market. Why? Well, Mr. Market seems to be in a bad mood and focus on missed EPS estimates. As mentioned in my initial pitch, though, GAAP EPS is a bad measure for High Tide.

Anyway, good for me, I decided to add to my position if the earnings call, which is in the next hour, won‘t have any surprises.

Quick Note: Since Evolution ($EVO) is releasing earnings today, I decided to send the Evolution Deep Dive next week so it‘s 100% up to date.

I invested on the premise that we have one of the few very well-managed companies in this beaten-down sector.

This quarter showed that High Tide is in fact that company.

Here’s an overview of the reported numbers:

Revenue of $138,3M vs. Est. $135M → Beat ✅

Adj. EBITDA of $8,2M vs. Est. $7.6M → Beat ✅

GAAP EPS of $-0.06 vs. Est. $0.00 → Miss ❌ (EPS is masked by Depreciation and Amortization)

2024 FCF of $22M vs. Est. $20.5M → Beat ✅

ELITE Members up 171% YoY → Tremendous growth! ✅

*All numbers in CAD

Now, let’s dive into the earnings report in more detail.

In case you haven’t read my initial stock pitch, it might make sense to do that first:

Store Count

High Tide increased its store count by 29 to a total of 186. It aims for annual store count growth of 20-30, so it reached the high end of its guidance this year. The ultimate goal is to have around 300 stores in Canada.

As long as the same-store sales grow (+5%) and the company generates cash flows (spoiler: they did), store count growth is a reasonable goal. Evidence for its strong brick-and-mortar performance is shown in the fact that HITI only owns 5% of all cannabis stores in Canada but holds a market share of 11%.

Membership Program

One of HITI’s biggest successes has been its loyalty program, released in 2022. It has 5.3M members globally and 1.7M in Canada alone. Even more important is its paid ELITE subscription, which followed in Q4 of 2024 and surpassed 76.000 members.

The growth of HITI’s ELITE Member Program:

6,000 Members in Q4 2022 → 28,000 Members in Q4 2023 → 76,000 Members in Q4 2024.

Growth Rate from 2022-2023: 366% Growth Rate from 2023 to 2024: 171%

In Q4, growth even accelerated compared to prior quarters as can be seen in this little visualization of the growth:

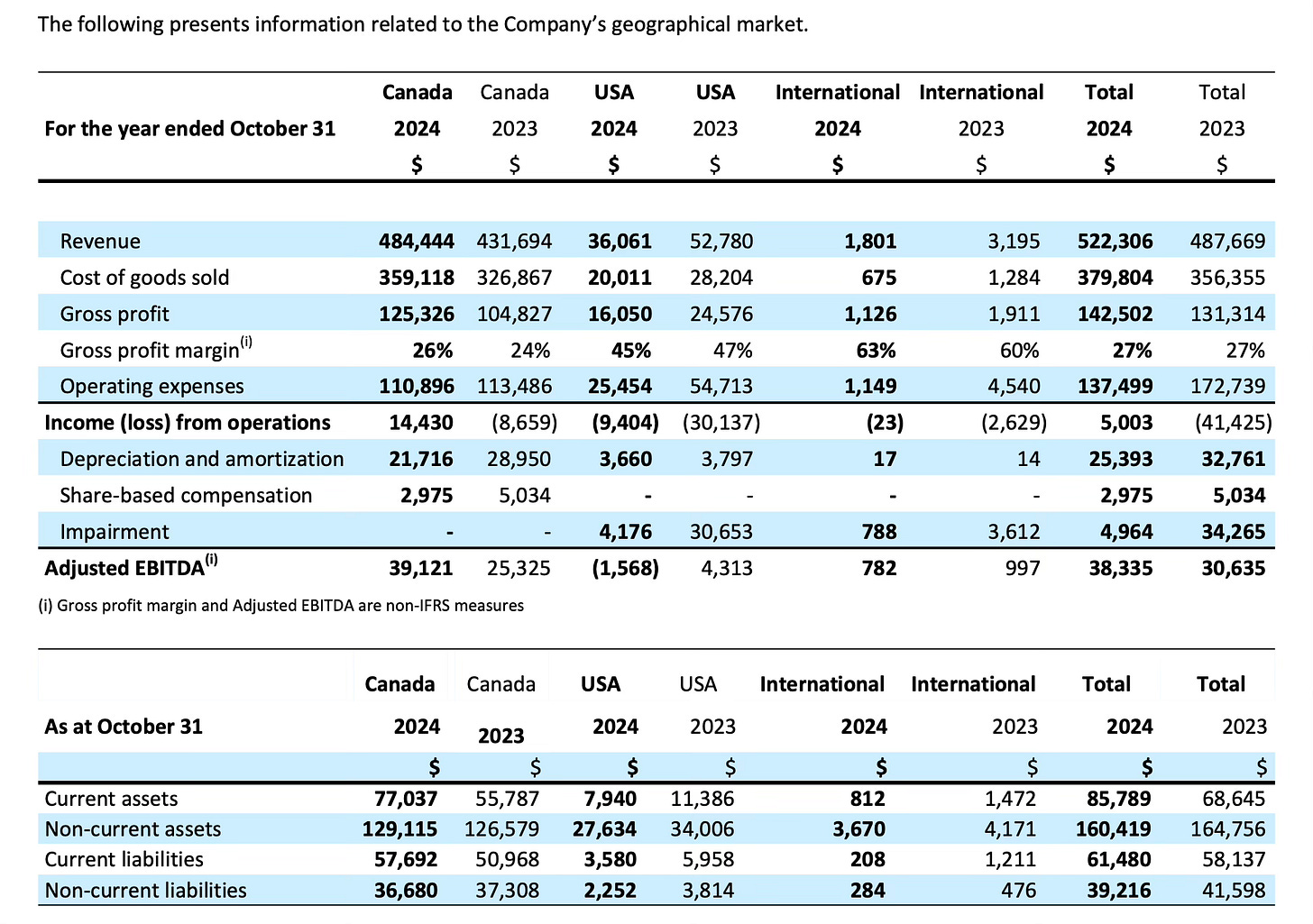

Geographical Breakdown

After Trump got elected, all cannabis stocks dipped. My thesis was that HITI wouldn‘t be hit by changing laws even if they would come.

I turned out right (every dog has his day), and HITI rallied after that dip. The table below shows why US regulation would have little effect on HITI.

The US and international business (both exist only as e-commerce) have been significantly reduced in recent years (see original article).

Revenues for the Canadian operations grew 12% YoY, while the US and international revenues declined 32% and 40%, respectively. Competitive pressures in the CBD sector caused the decline. While you never like to see declining revenues, I wouldn’t interpret too much into this since High Tide’s primary and successful business model is Canada’s brick-and-mortar business.

Additionally, the downsizing of loss-making operations is what made High Tide the cash-flowing business it is now. It was a strategic decision to move away from e-commerce—a good decision by the management, especially considering the growth in e-commerce during the pandemic and the high gross margins that could easily fool someone into thinking that the trend continues. It is not easy to step away from that business when it deteriorates.

Many would hold on and try to save the loss-making business.

Overall Revenue grew 12% YoY, driven by the store count expansion and 5% same-store sales. It’s safe to say that after the focus have been on profitability and cash flows, revenue growth also returns. Accessories and the Data analytics business were growing quickly as well, and data analytics could soon become a more significant contributor to total revenue.

You may wonder what the Data analytics business is. It’s called Cabanalytics Business Data and Insights Platform, and it's a subscription service offering a monthly report of anonymized consumer purchase data (dispensaries, consumer behavior, sales trends, product performance, etc) that can be used to optimize operations and marketing strategies.

Its revenues grew from $12.2M in 2021 to $36.7M in 2024. Unfortunately, we don’t know the margins (HITI doesn’t report margins of individual segments).

I would like to see a more detailed breakdown of the segments in the future. How much revenue comes from the data business, and how much from advertising? Based on the growth rates, advertising is unlikely to play a big role.

The one international market HITI wants to focus on more is Germany. More on that later. Let’s discuss the most important part now - High Tide’s cash flows…

Free Cash Flow

Q4 of 2024 marks the 6th consecutive quarter of FCF. Cash grew by almost $20M as a result of that. Overall FCF of 2024 was almost $21,991M compared to $6,940M in 2023 - an increase of 217%.

In case you wonder why the EBITDA margins decreased throughout the year, this was due to a decrease in the e-commerce EBITDA margins. EBITDA margins for the core business remained stable at 8%.