A Smoking Multibagger in the Cannabis Industry? - Stock Pitch #11

I‘ve spent the last weeks mostly researching companies in two sectors: cannabis and online education. Both are beaten-down industries, good places to look for bargains.

Today, I want to show you the best company I found in the cannabis market. Two or three showed good execution compared to the vast majority of the sector, but this one was outstanding.

Next week, I‘ll pitch two companies from the educational sector, either in one article or in two separate ones. We‘ll see.

Despite both industries being punished by investors, there are huge differences in their long-term outlooks, or better said, the outlook for their incumbents. While both markets are expected to grow quite significantly in the future, the online education market is much more likely to be disrupted, and current market leaders are already losing share at an increasing pace due to AI applications like ChatGPT.

In the cannabis market, I consider it more likely that some of the established companies will also be the big winners of the future growth in the industry. Up until then, however, there will be many bankruptcies and business failures along the way.

That’s why I focused my research on companies that execute well and focus on fundamentals and cash flows instead of “growth at all costs.” Today’s company did that very well.

But that‘s enough for the intro. Let's get to the pitch! (By the way: The next free-to-read Investment Post will be published on Friday!)

High Tide ( HITI 0.00%↑ )

Overview:

Price: US$2,98; CAD 4.12

Shares Outstanding: 80,68MM

Market Cap: CAD 332,39MM

TTM Revenue: CAD 511,12M

Interest Bearing Debt: CAD 28MM

Cash: CAD 35,25MM

EV/Trailing Revenue: 0.71x

EV/2024 Adjusted EBITDA: 9.1x

Since I started researching High Tide, its price has increased by over 40%. Intuitively, this is a downer for me. However, as mentioned in my last article, micro and small caps, and especially companies suffering from weak overall industry performance, can be good buys at recent highs.

It prevents you from buying companies that don‘t get anywhere for months or longer, which can lead to high opportunity costs.

High Tide is also a very volatile stock. There‘s a good chance „being late to the party“ quickly turns into a bargain again. Additionally, I estimate the fair value to be closer to $5 with the potential for higher returns in the future, so there’s still room for growth even after the current price increases.

High Tide is one of Canada‘s biggest cannabis stores. It’s profitable and fast-growing, benefiting from good acquisitions, a healthy balance sheet, unprofitable competition, and increasing bankruptcies in the sector, leading to a consolidation of the market and the potential for cheap acquisitions.

As you can see in the overview, HITI trades at low multiples, has enough cash to pay off debt, and is free cash flow positive. These are things the vast majority of competitors cannot claim to be.

In the first nine months of 2024, and most likely also at the end of the year, High Tide will be net income positive for the first time, currently standing at CAD 991,000 in profits. The main reason for the profit is higher revenues combined with lower expenses due to savings in G&A, less SBC, and depreciation and amortization. While profits are low, you‘ll see that they mainly and successfully focused on free cash flows instead of GAAP profitability. Also, Depreciation and Amortization hide the actual profitability.

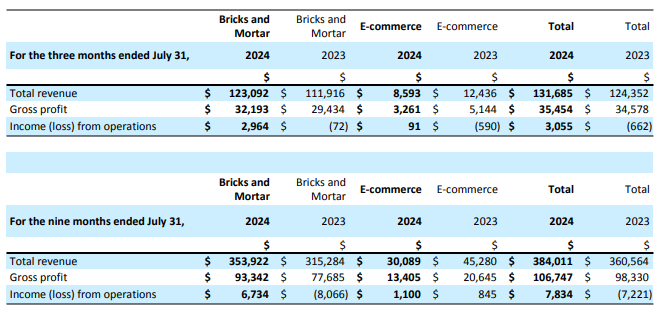

Another good sign is that both brick-and-mortar and E-commerce businesses have become profitable. Both online and offline businesses are mainly run through the Canna Cabana brand.

Retail:

Since the majority of revenues and profits come from the physical retail business (93%), let’s take a closer look at the stores. Despite the Canadian cannabis industry struggling in 2024 (decline of 1-2% YoY), HITI grew sales by ~6% in Q3 and 6.5% in the nine months ended.

The reason for HITI’s outperformance in the sector is also visible in the store economics. The average store in Alberta, one of the five provinces HITI is active in, generates 2.4x the revenue compared to peers. In Ontario, it’s 3.5x.

On average, it takes only 10 months to pay back the costs of building a new store. One of the many reasons for the good store performance is the focus on good areas for new stores instead of increasing store count for prestige reasons or empire building.

A potential problem to look out for in the future is margins. More on that later. The average 4-wall gross margin is 25%, and the 4-wall EBITDA margin is 12%. So, on a per-store basis, they look fine. If you haven’t heard this term before, “4-wall margin” refers to the margin within one retail store.

So, it’s based only on the operations within one store and does not account for any overhead costs caused by the overall company.

The annualized sales per square foot stand at 1,658 CAD, which is not only great for a cannabis store but puts HITI in the top five of all retail stores nationally.

Brands:

As mentioned, HITI also strategically acquired companies to increase its product variety or automate and accelerate the retail process. Two of the more recently acquired companies are Fastendr and Queen of Bud.

Fastendr is an automation tool that employs retail kiosks to facilitate a better buying experience through browsing, ordering, and pick-up. The technology catalyzes faster transaction times, lowers overhead and labor costs, and provides a seamless end-to-end customer experience.

It’s already installed in 160 stores and is planned to be in every store within the next few weeks.

Queen of Bud is a premium cannabis brand focused on high quality and leaning into the spiritual side of cannabis consumption. It’s one of the white labels HITI plans to build out within its stores. The longer-term goal (3-5 years) is to have 20-25% white-label products. High-quality labels like Queen of Blud are a good opportunity to increase margins.

In recent years, HITI has seen some slight gross margins decrease due to store growth (new stores first need to ramp up before reaching full margin potential), less e-commerce after covid (which has higher margins), and the Canna Cabana membership programs, which drive higher revenues but also decrease margins slightly. Gross margins went from 37% in 2020 to 27% in 2024.

However, this decline seems more drastic than it is since it cannot be extrapolated into the future. The high gross margin of 2020 was due to E-commerce being much larger in Covid times. While this increased margins significantly, revenues only stood at 83MM CAD compared to ~550MM CAD for 2024. Currently, e-commerce is still shrinking and responsible for only 7% of revenues.

Membership Programs:

In 2021, HITI launched the Canna Cabana Discount Club, which offers members discounts between 10 and 25% and special discounts on consumption accessories of up to 80%.

It’s linked to a loyalty program and is growing at an enormous speed, having already reached close to 1.6 million members and still growing at 41% YoY.

In November 2022, Canna Cabana launched the first paid membership program, ELITE. It offers greater discounts, flash sales, exclusive access to branded products, and other perks.

The idea was to benefit from the strength of subscription models, increase the loyalty loop, and create a high-margin business that delivers predictable recurring revenues. ELITE was well received, and due to the high demand, prices were raised from $30 a month to $35.

ELITE reached 57,000 members in September and has shown YoY growth of 203% (despite the price increases).

I‘m relatively confident that more white-label products, paid membership programs, and increasing e-commerce sales will help margin expansion in the future.

Cannabis Industry:

I’m sure most of you are aware of this, but contrary to popular belief, young industries are often capital destroyers even though they keep growing in the long run.

Buffett once used the early beginnings of the car industry as an analogy. Although everybody knew that cars would replace horses, almost no one profitably invested in car companies. Most companies went bankrupt, and most of the first movers were replaced by new entrants (Fun Fact: While not important to young industries, despite the automobile success story, the car industry remains tough for companies and investors until today).

As Buffett said, the safest investment would’ve been to go short on horses. And while there is no obvious short created by the rise of the cannabis industry, it seems like the cannabis industry has been such a capital destroyer in recent years. And I’m sure there will be plenty more opportunities to bet on the wrong horse in the years to come. The companies that will succeed will be the ones executing like High Tide.

Will they turn out on top in the end? I don’t know. Nobody knows that. But they seem to do anything right to get themselves into a strong position. They’re focusing on the fundamentals, on cash flow, instead of fast growth fueled by losses or accounting tricks to look more profitable than they are.

Last year, they reduced the number of new stores built to 11 instead of the usual 30-40 to focus on becoming free cash flow positive. After achieving that, they are now on track to build 20-30 new stores in 2024 while remaining free cash flow positive. In the last four quarters, HITI generated 21.8MM CAD in free cash flow, representing 6% of the Enterprise Value.

What remains very unclear about the industry is how cannabis regulation will evolve in the years ahead. The Canadian market has been one of the most liberal in terms of cannabis. In the US, it depends on the state; in Europe on the country.

While some US states like California or Oregon have fully legalized cannabis for recreational and medical use, others still prohibit the use or possession of cannabis. And even in California, despite the legalization, up to 70% of cannabis sold still comes from the black market due to high taxes and regulatory costs.

In Europe, rules and laws vary greatly. In Spain, there‘s the concept of cannabis social clubs where members are allowed to use cannabis. Private use and cultivation are decriminalized, but cannabis remains technically illegal.

The Netherlands allows the sale of cannabis in licensed coffee shops, which can sell small amounts for personal use. However, cultivation and wholesale supply remain largely unregulated and technically illegal, creating a “gray market” for production. This partial tolerance model results in a relatively unregulated backend, with coffee shops sourcing cannabis from unregulated suppliers.

Countries like Portugal, Luxembourg, and the Czech Republic have decriminalized Cannabis, allowing personal use and growing 4-5 plants per household, but have no legal framework for purchasing or selling cannabis.

The German market is talked about a lot by cannabis companies worldwide since legalization would quickly turn it into the biggest market in Europe, with an expected size of over 4.5 billion USD by 2034.

However, I would be cautious about how much emphasis one puts on this market opportunity. Initially, the current German government, consisting of three parties (the Greens, Social Democrats, and the Liberals), planned to get the Cannabis regulation done quickly after taking over in 2021. Instead, it took years until the first concepts were developed. In 2023, they announced a model similar to Spain's.

Personal possession is allowed up to 25 grams, home cultivation of up to three plants, and Cannabis social clubs to grow and share cannabis. This is supposed to be the first stage of what should become a free commercial market in the long run.

But there are multiple reasons to doubt that this will happen anytime soon.

First, the current government has been struggling internally for the past two years, and it does not seem certain they will continue with their original plans. Next year, there are elections, and it looks like this government will be replaced by the more conservative CDU, which is a loud critic of Cannabis legalization.

Additionally, EU law prohibits the commercialization of recreational cannabis. So, there would need to be a change in EU law or a model that bypasses it. I’m not an expert on EU law or each country’s opinion on cannabis, but judging by the general sentiment around cannabis, I wouldn’t count on any changes in the near future.

Risks:

As always, there are risks involved in this investment. However, I must say that the company-related risks I will list do not concern me a lot. It’s more about the risks involving the industry and the investor’s sentiment and sensitivity to news regarding regulation.

Company Related:

Dilution:

As the chart below shows, HITI has experienced considerable dilution in the last five years, with a slowdown in the last two years. Most of the issued shares were used to fund acquisitions, many of which happened in 2021. Examples include Smoke Cartel, FAB Nutrition, DHC Supply, and NuLeaf Naturals. Besides these acquisitions, High Tide also issued 8 million shares via an At-The-Money offering (30 million are authorized in total), and in late 2023, it restructured CAD 8.9 million of outstanding convertible debenture debt by issuing shares.

The ATM offerings and the debt reduction were smart moves, in my opinion. This year, HITI only issued 1.05 million shares through ATM, and looking at its balance sheet, there is no need for further large issuance. Acquisitions were necessary initially, but dilution through acquisitions should be done carefully going forward. There will be opportunities for smart M&A, but the risk-reward of such acquisitions from a shareholder perspective must be closely monitored.

Revenue Growth:

Revenue growth YoY has only been ~6.5% compared to 37% last year and close to 100% in 2022. However, there are two reasons for that that I consider short-term. First, as mentioned, the Canadian cannabis industry shrunk slightly in 2024. Second, HITI focused on becoming FCF-positive and, therefore, built fewer stores, which led to slower growth.

By increasing the store count again, I’m positive they will increase growth rates again. Without tailwinds from the industry, though, I don’t think we will get close to the 37% last year. I would expect growth rates between 10-15%.

Industry-Related:

Regulation: Studying the sector, I’ve seen many investment theses or forecasts betting on full legalization in the US, Germany, and, longer-term, more European markets.

I do not include any of these hopes in my valuation or thesis for High Tide (HITI’s management isn’t either) or any other cannabis company. The good news constantly gets canceled out by bad ones. In the US, the rescheduling of cannabis from Schedule 1 to Schedule 3 has been discussed for quite some time now. This should bring tax benefits to cannabis companies and open more research opportunities. However, even if this happens, approval by the FDA is still nowhere in sight, which causes sales by cannabis companies to remain unlawful, making it more difficult to get banking services.

The problems in Germany have already been discussed above.

Investor Sentiment: HITI stock and the cannabis sector, in general, are very volatile since investors react very sensitively to news on regulation. At first sight, this can make this sector less attractive to investors. I would argue that this can be a huge benefit.

Having companies like HITI on your watchlist and buying them when the market punishes them for news on the sector is a great way to benefit from low prices without fundamental reasons.

Now, you might argue that bad news for the sector is also affecting the fundamentals of HITI in the long term. And while that’s not wrong, I think HITI’s setup makes it relatively immune. Doing business in Canada, where the regulatory environment is pretty stable.

Legalization can be seen as an additional upside if it should happen, but there’s no immediate need for legalization to make HITI an attractive investment opportunity.

Valuation:

Below, I have listed some of HITI's biggest competitors. As you can see, even after the price increases, HITI remains undervalued relative to the competition. This is most obvious in the EV /Sales and Price to Cash Flow metrics, but the differences in the EBITDA metrics are also larger than they appear here if we take the adjusted EBITDA numbers.

In HITI’s case, adjusted EBITDA for the nine quarters of 2024 came out at 30.1MM CAD, while EBITDA stood at 25.7MM CAD. A difference of 4.4MM CAD.

When the discount to competitors was still larger due to the lower stock price, the discount combined with the strong operating performance could’ve justified an investment already. Although I’m usually not a fan of relative valuation, it can make sense in beaten-down industries since there’s less risk of buying companies that are relatively “cheap” but in an overall overpriced market.

Also, the problem with valuing HITI based on earnings or FCF is that its track record of profitability is still too young, and FCFs, while positive, are very volatile. Thus, our best shot to get an idea of where High Tide should trade without making it too complex is using EV/Adjusted EBITDA. Dividing the 365MM CAD / 40MM CAD gives us 9.1x. Most competitors are closer to 20x or higher.

Assuming an EV/Adj. EBITDA multiple of 15, which would still be considerably below the sector median, HITI could trade at ~USD 4. Looking at the EV/Sales multiples from the table, it could also trade closer to USD 5 or USD 6. However, as always with relative valuation, companies have many differences and cannot be compared 1 to 1. Instead of focusing on price targets, these calculations should show that HITI is valued below its peers despite being a superior company.

The table below shows the operational performance based on the longer-term estimates HITI provided in earnings calls and presentations. I broke them down into what they would mean for the business on an annual basis if I distributed the growth equally over the years. They do not include any expansion into the US, Germany, or other jurisdictions. Most of the growth will come from new stores in Ontario.

I think these goals are very achievable. Based on these estimates, I will build a valuation model that breaks down the financial statements in more detail to see what I consider realistic estimates for profits and, more importantly, cash flows in the years ahead. This should give a clearer picture of HITI's fair value.

Investment Decision:

I said that it can be advantageous to buy micro or small caps even after they appreciate a lot. However, the value investor in me doesn’t yet feel comfortable buying this company after seeing it run up 40% in a matter of weeks and over 100% in the last twelve months. Especially since the industry has a history of volatility (and boom and busts), which might eventually give me a better entry price.

I might be a great example of how the anchoring bias works right now. I started researching the sector and came across HITI when it was slightly over 2 USD. I’ve probably anchored this price as the price at which this investment offers the margin of safety I want.

I justify this thought process by arguing that HITI is not a micro-cap, where buying at recent highs is even more helpful since the discovery process is in the very early stages. Also, with a market cap of 336,26M CAD (241,94 USD) and the status of one of the largest cannabis retailers in Canada, HITI is not really under the radar (although it kind of is since it’s mostly traded in the US, but less known there due to its operational focus on Canada and the big number of US cannabis companies).

The stock price depreciation was largely due to the fact that it has now become a profitable company. The strong Q3 results fuelled this rally. This also means that a loss-making quarter or bad news concerning the cannabis industry (regulatory problems, reclassifications, and legalizations taking longer than expected, etc.) could cause the stock to depreciate in the short term.

Because of this, HITI is going on my watchlist with price alarms set at 2,50 USD and lower. If those prices are reached and the fundamentals remain strong, as I expect, I will start building a position.

That’s it for today! As mentioned, you’ll get another pitch next week and an article on general investing wisdom in the meantime!

Cheers!

Daniel