Disney Analysis - Huge Turnaround or Massive Downfall?

In my January Deep Dive, I took a closer look at the Streaming Sector. Today, I'll double down on one of the players. We'll analyze Disney and see whether it's a Lifetime Opportunity or a Value Trap!

Content

Disney’s (Stock) Situation

Fundamentals

Fundamental Story

Disney’s Management failures

Problems beyond

Disney+

Disney Theme Parks

ESPN

ESPN’s Cable Deal

ESPN Streaming Service

Conclusion - Will Disney Stock Recover

Disney Valuation

DCF Model

Reverse DCF Model

Will I add Disney to the Portfolio?

Disney’s (Stock) Situation

Historically, Disney has not only been a great company positively influencing millions of young children around the globe, but it has also been a great investment for anyone who bought the stock. Since its IPO in 1940, although I can hardly imagine any of my readers were born then, the stock crushed every index.

An investment of $100 would’ve turned you into a millionaire. But you didn’t need to invest at IPO levels. Basically, throughout Disney’s lifetime, it would’ve been a winner for every portfolio.

Unfortunately for more recent Disney investors, the past few years have been an exception to this rule. After a massive downfall that started in March 2021, Disney stock continued to plummet, underperforming the S&P 500 on a 10-year basis by more than 130%.

Today, we will figure out what happened to Disney. Is this the best turnaround opportunity of the past decade, or will it be a value trap that never returns to its old glory?

Let’s do a vote at the beginning and the end of the article:

Fundamentals

The Fundamental Story

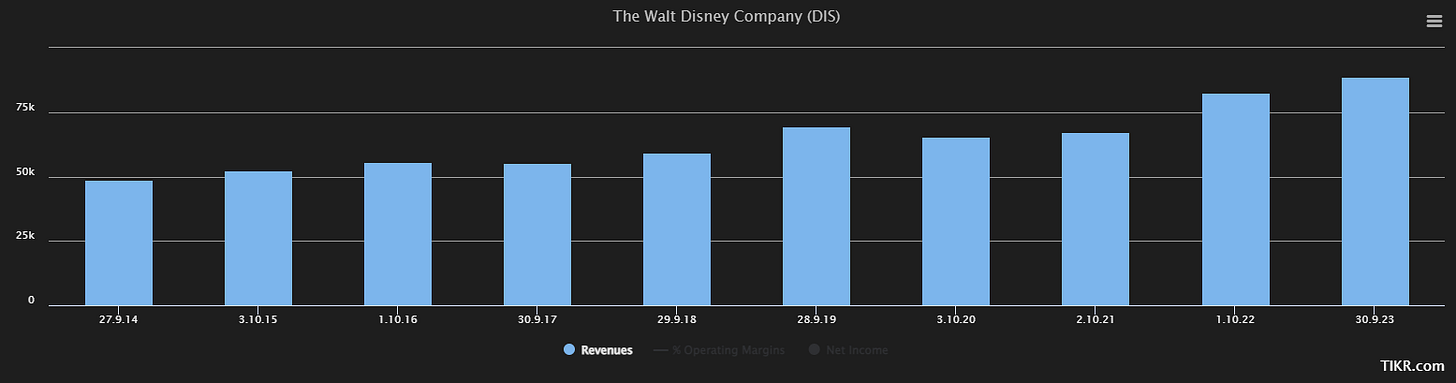

Disney’s fundamentals tell us a whole lot about why the stock had a rough couple of years. Although the top line of the income statement doesn’t reveal the problems at first sight.

Disney was able to grow revenues quite steadily over the last ten years. We only see slight stagnation in 2020 and 2021, but that’s a minor impact, and growth got back on track the years after.

Disney’s profitability, however, paints a very different picture.

What you see in this chart are Disney’s free cash flows (orange) and net income (green), with the respective margins in purple and white. In contrast to the revenues, we see huge decreases in net income since 2020 and in free cash flows since 2019.

The decreases in 2020 and 2021 are largely due to the COVID-19 outbreak and the following restrictions that forced Disney to close the Disney Parks around the world, which, as we will see later on in more detail, are essential to Disney’s business.

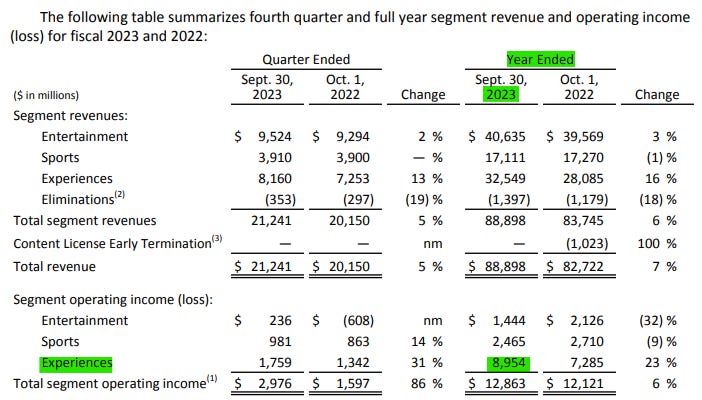

The Parks are part of the Experiences segment, which also includes resorts and cruise lines. The experience segment was responsible for 37%, or $32.5b, of the total segment revenue and 70%, or close to $9b, of Disney’s operating income in 2023.

If we compare this to the 2020 numbers, we can see why the net income and free cash flows were down in the years impacted by COVID.

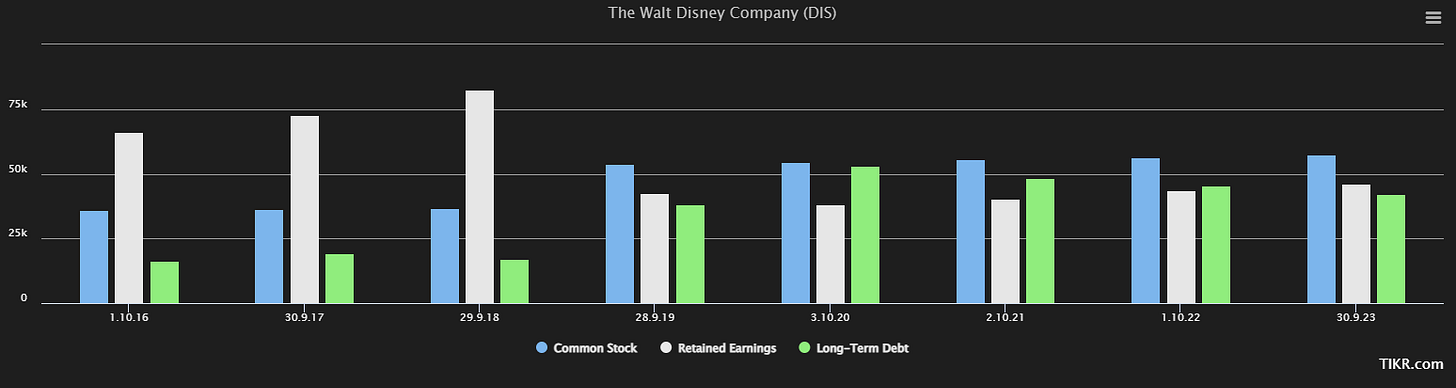

But you might ask yourself why the free cash flow already dropped significantly in 2019. The reason is an acquisition that Disney closed that year. On March 20, 2019, they closed a $71b deal to acquire 21st Century Fox. The deal was initiated in 2017 and originally valued at $52b.

After Disney got competition from Comcast, also wanting to acquire 21st Century Fox’s assets, the deal got more expensive, and Disney ended up paying almost $20b more than expected.

The result of this deal was a significant increase in long-term debt (green), a decrease in free cash flow (as seen before), and retained earnings (white), as well as a dilution of shareholders by newly issued shares (blue).

Balance Sheet

Since that acquisition and the COVID restrictions, Disney's balance sheet has also changed for the worse. While long-term debt grew from $17b in 2018 to $42b in 2023, Disney’s assets mostly increased due to Goodwill and “other intangible assets.”

Cash And Equivalents did triple in this time period; however, they only make up 0.7% of total assets, and retained earnings decreased by over $35b to approximately $45b at the same time, which more than offsets the increase in cash in absolute terms.

If we look at the more recent trend, however, we can see that debt levels have decreased again. Nevertheless, it’s questionable if that trend will continue when Disney acquires the remaining part of streaming service Hulu.

The so-called “floor” (minimum amount that must be paid for the rest of Hulu) is set at $8.61b, resulting in an overall acquisition price of about $27.5b. However, likely, this will not be the final price. How much it will eventually cost is not yet known. If Disney doesn’t completely overpay, this deal should be much better than the 21st Century Fox deal, though.

That one can probably be considered another management mistake, a recurring problem for Disney in recent history.

Disney’s Management Failures

At the end of 2022, Disney CEO Bob Chapek was fired and replaced by Bob Iger, the former Disney CEO who had only given up his position to Chapek two years earlier.

Chapek was fired after two years of questionable management decisions, poor stock performance, and an earnings call in which he failed to communicate a coherent plan for turning Disney+ profitable and strengthening Disney’s franchises again. Investors and analysts weren’t happy, and the stock dropped another 13%, which was the nail in the coffin for Chapek as Disney CEO.

Wall Street and investors loved the idea of Iger returning, and the stock surged almost 10% after the announcement. Since then, however, the stock went mostly sideways.

And I don’t see Disney’s problems disappear because of a change in the CEO position either. At least not as fast as investors seemed to hope for. And let’s not forget that Iger was the one acquiring 21st Century Fox and initiating the launch of Disney+ and its content strategy.

Problems Beyond

Now that the pandemic is over, Disney parks are back, and their revenues and operating income exceed pre-pandemic levels.

So why is Disney’s profitability still not remotely where it used to be?

The answer is Disney+… Disney’s streaming service also launched in 2019 and perhaps the driving factor for Disney’s current position. I’ve already analyzed Disney+ in my Streaming Sector Analysis; if you read that, you already know much about the following.

But I’ve updated and added some key numbers and statistics and rewrote the section to focus on the most important aspects of the overall Disney story instead of the streaming sector.