Young Warren Buffett‘s Investment Strategy

I analyzed the first Decade of the Buffett Partnership Letters. Here‘s how he used to invest and achieved his best ever performance.

Today‘s Topics:

Short Summary of how “modern“ Buffett invests

Deep Dive into Young Warren Buffett’s Investment Strategy

Portfolio Construction

Categories of Investments

Yardsticks, Measurement, and Goals

The Role of Conservatism and Confidence

Forecasting and the State of the Market

Why most Money Managers can’t beat the Indexes

The Question of Size

Summary of Learnings

(Don’t worry; this looks more complex than the article is going to be…)

1. How “Modern” Buffett Invests

I allow myself to keep this section relatively short since I expect that most of you are already well-educated on Buffett’s current investment philosophy.

If not, here are the core principles.

Today, Buffett focuses on buying high-quality businesses that’ll compound his money over a long time horizon. His preferred holding period is forever. And while this is more of a theoretical concept, it implies the most important characteristics that Buffett is looking for.

A strong moat, in short, is a competitive advantage that protects a company’s ability to earn high returns on capital and keeps competition from entering the market or at least gaining a significant market share.

For such a company, he’s willing to pay a premium. Or at least a “Buffett Premium.” Meaning he is okay with not getting a bargain compared to book value or other metrics but pays a fair price for the ability to compound that money over decades, preferably.

This strategy allows for relatively little turnover, a highly concentrated portfolio, and no need for many great ideas that consistently need to lead to new investments.

It’s a strategy that works great if you have to manage almost 700 billion(!) dollars.

But it’s not optimum, and Buffett knows this. While the whole investment world seems to look at this strategy and define it as the holy grail, most investors would benefit a lot more from the investment strategy he used half a century ago.

(Except when you also have 700 billion dollars ready to deploy in the capital markets, then you can stop reading at this point)

In case you’re still here… let’s talk about what I learned from reading all Partnership Letters from 1956 to 1966, the first decade of his legendary Partnership.

2. Portfolio Construction

2.1.1. Categories of Investments

Buffett used to distinguish between 3 categories of Investments. In 1964 he decided to add a fourth one.

These were:

Generals - Private Owner Basis

Work-Outs

Control Situations

Generals - Relatively Undervalued (added in 1964)

Generals consist of generally undervalued securities in which Buffett didn’t plan on building any controlling positions or interacting in other ways with the management. This also means that no apparent catalysts could set free the actual value of the business. He had to wait until the market realized its mistake.

This was the largest category of the portfolio and mostly consisted of five to six positions, each weighted at 5-10% of total assets, and another ten to fifteen more minor positions.

Work-Outs are better known as “Special Situations” today. Joel Greenblatt is probably the investor best known for such investments. But they used to be a big part of Buffett’s portfolio.

The biggest difference to the General category is that the price of these situations doesn’t depend on supply and demand created by buyers and sellers of securities but by corporate action.

This condition makes the investment a lot more predictable than the Generals, and Buffett often knew pretty well how much payout he could expect and even when this payout should occur. Catalysts are usually very clear, and thus the right situations offer pretty safe returns.

This is why Buffett also “broke” a rule that is often mentioned when people talk about him. No leverage.

As mentioned in the excerpt, this category has another advantage, its low correlation with the market. While generals can be influenced a lot more by the market’s mood, this isn’t the case for work-outs since their prices aren’t bound to supply and demand of investors as much.

In Buffett’s portfolio, work-outs were the second biggest position (at least from 1956 to 1966, more on that later) with 10 to 15 positions.

Control Situations are the third category. These are companies in which Buffett bought enough stake of the firm to influence the policies of that company actively. Sometimes he bought the whole company.

These are the most long-term investments Buffett made. They often took several years before they played out how he wanted to. Like the work-outs, the assets correlate relatively little with the general market.

On rare occasions, an investment of the category “General” also switched buckets to the “Control” Situations when the price was cheap long enough to buy a stake with the potential to influence the board and policies.

One of these occasions was a little textile firm Buffett started buying in 1962, you might know it, it’s called Berkshire Hathaway.

Generals - Relatively Undervalued

This category might be the most unexpected one in Buffett’s repertoire. It consists of companies selling at relatively cheap prices compared to other companies of the same general quality.

This is especially surprising because he “abandons” one of his main principles. The “Value to Private Owner” Criterion which is the main idea behind the first Generals category and critical to his strategy today.

Because he moves away from this concept, he demands an extra substantial discount to the compared companies. It’s also crucial to choose companies that are actually comparable. Not only shallow but in great detail.

The risk with this investment category is that general overvaluations can quickly turn a seemingly cheap asset, compared to the alternatives, into an expensive one when the other prices correct.

This sounds untypical for Buffett since this also demands keeping an eye on the overall market and investing upon the market’s mood, not only the company in question—something he usually doesn’t do.

Now that we know what type of investments Buffett was looking for let’s talk about something that was of great importance to him, measuring his performance.

2.1.2. Yardstick, Measurement, and Goals

What is the goal of investing? Why do we even choose to invest actively if we could just buy an index fund (the better choice for most people, according to Buffett)?

For probably everyone, the goal is to outperform the market and thus earn better returns and grow their money quicker.

This seems like the obvious answer. But notice that I said, “better than the market.” Many people would agree with that without questioning it. But it’s not the only way. Seth Klarman, for example, talks a lot about the importance of absolute performance.

If the market loses 10% and you only lose 8%, you outperform but still lose money. Can that be a win?

Interestingly, Buffett emphasizes exclusively relative performance to the market. And this makes sense, provided you believe that the market, in the long run, will not end up with negative returns, as can be expected from a historical standpoint.

Under this condition, comparing your results to the market makes the most sense.

Ultimately, even thinking in absolute terms must beat what the market did in the same period. Otherwise, you “lost” money—keyword opportunity costs.

Thus, Buffett is very clear about his goal. Ten percentage points better than the DOW. In the 1950s and 60s, and even longer, the DOW was the most popular index and the most reasonable yardstick. Today, it’s probably the S&P 500.

For Buffett, having a reasonable yardstick in place prior to deploying capital is critical for assessing your success and methods.

“We feel it is essential that investors and investment managers establish standards of performance and, regularly and objectively, study their own results just as they study their investments.”

This way, past successes can’t cloud the judgment of current results, and if the results are not as expected, opportunity costs can be minimized by switching to index investing.

However, when comparing your results, less is more. The advantage of an individual investor is that he doesn’t need to report to anyone besides himself. Comparing your results monthly, even yearly, is too short of a time frame to get reliable results.

Buffett preferred to think in three to five-year performances even better when you had both strong and weak markets in those periods.

2.1.3. Conservatism and Diversification

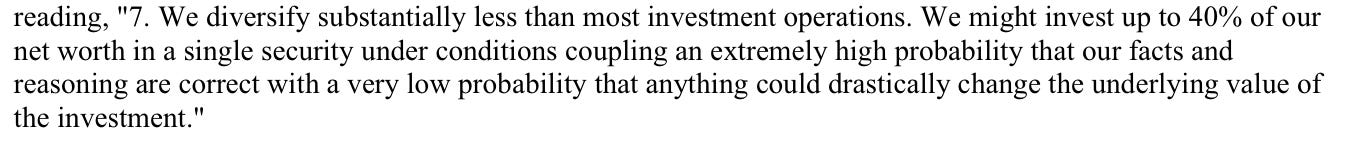

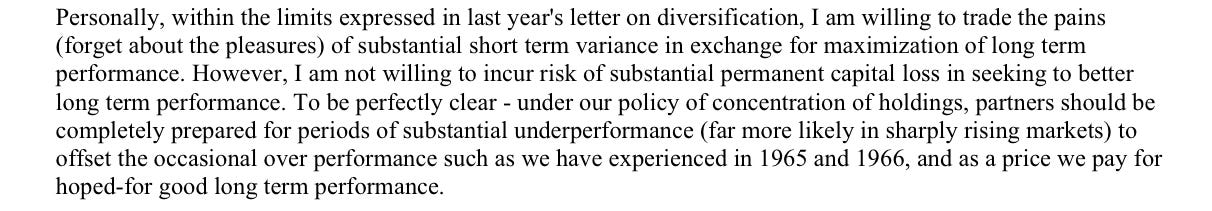

Buffett was and still is known for his love of concentrated portfolios. At the same time, he is an investor interested in minimizing the downside instead of maximizing the upside of an investment.

Following the classical portfolio theory, this would be a contradiction since diversification is how you minimize specific risks. Owning many different stocks instead of a concentrated portfolio with a small number of securities or at least the vast majority of assets held in only a handful of those investments.

For Buffett, in the past and present, this has never been a contradiction. Conservatism and risk control do not necessarily lead to (over)diversified portfolios.

Buffett has a term for over-diversification: The Noah School of Investing - two of everything.

The main question is, “How much do I put into my best idea?” The best idea is defined as the one with the highest expectation of relative performance and, perhaps more important, the lowest probability of very poor performance and, thus, permanent loss of capital.

Applying these rules, the optimal portfolio depends on the various expectations of choices available and the degree of variance in performance, which is tolerable.

Buffett’s definition of conservatism also differs quite a lot from those of other money managers.

While most managers define conservatism the old-fashioned way, owning assets like government bonds and blue chip stocks, following the crowd, and holding dozens of stocks, Buffett has his own way of conservative investing.

“True conservatism is only possible through knowledge and reason.”

There are no conservative assets by default, not even government bonds. We don’t need to lock back long to get proof of that…

It’s the same with buying big tech stocks or other blue chip companies. Speculating how high the P/Es can get has nothing to do with conservative investing.

Following the crowd is the third in the group. Being right isn’t measured by how many people hold that opinion. It’s measured by the facts.

2.2. The Role of Portfolio Size

The fact that Buffett’s investment strategy back then differs from today has one main reason. Size. When Buffett started the Partnership in 1956, he managed a little over one hundred thousand. At the end of the first decade, the capital grew to almost $55 million.

At that time, Buffett reached out to his partners and said that from now on, finding investments and deploying capital would become more difficult.

Especially work-outs became increasingly hard to find. That’s why Buffett eventually focused more on the Generals. Over the years, this led to an even bigger change in his investment style—the change to long-term compounders at fair prices.

But we will dig deeper into this in the following parts of this series, in which we study all Writings of Warren Buffett, not only his letters, chronologically.

This series is based on the PDF on my Resources Page, “All Writings of Warren Buffett.”

New episodes come every one to two weeks.

3. A short Summary of Learnings

In his early days, Buffett focused a lot more on special situations (work-outs and control situations) than on buying great compounders. His investment philosophy, known as value investing, was the same, but the investment actions were very different.

Work-outs and controlling stakes were not only more common, they also led to investment decisions, like working with leverage, that he wouldn’t use anymore, considering his modern investment strategy. But they used to be essential for his extraordinary returns back in the day.

Today, he focuses a lot more on the Generals categories and is paying more attention to the quality of businesses. And while Buffett makes it seem like a natural learning process that he went through, I think the main reason for this change was size.

I’m confident Buffett would still invest like he used (at least in part) if he would’ve less capital to work with. For us, that means that we should learn a lot more from the younger Buffett than we currently do.

Buffett isn’t the only successful investor who went through this process. Many investors did. They had to reinvent themselves when success brought in more capital.

As Greenblatt once said, special situations are the most profitable place, but everyone who is good at exploiting them sooner or later becomes too rich to keep looking there. That’s the chance for new investors to come into that field.

I will post more regarding investing in special situations soon.

When Buffett told his partners that size is going to make it harder in the future, he also said this:

I think that’s a great end to this little deep dive into the first decade of his Partnership Letters.

If you enjoyed this article, please like and share it so more people get to see it. Since this is a reader-supported publication without any ads, I would also appreciate your support by subscribing.

See you in the next Episode!