🕰️ Walter Schloss - 7 Lessons from 47 Years of Outperforming the Market

Warren Buffett and Walter Schloss were good friends. But Schloss never listened to Buffett when it was about Investing Strategy. He build the perfect strategy for himself. And it worked phenomenal!

Only a handful of investors have outperformed the market over decades. One of them is Walter Schloss. He achieved an annual return of more than 15% (after fees) over 47(!) years. Without fees, he compounded at over 21%!

1. Correctness of Judgment

Most people fail to question their decisions regularly. How you respond to new information on your investments is critical for an accurate judgment.

You shouldn't need to convince yourself of an investment. It should be convincing because of the facts.

2. Never Sell on Bad News

One iron rule for Schloss was to never sell a stock on bad news. When bad news comes out, the first reaction is always the strongest. Everyone who has had doubts before or is just a short-term holder sells at that moment.

Statistically, stocks recover shortly after that first downturn. So, even if his thesis was broken and he wanted to sell the stock, he avoided being in the first wave.

3. Talking to Management

This is a controversial topic for investors. Many swear on talking to management to get an idea of how they think and behave.

Schloss didn’t like that idea. He didn’t trust his ability to judge the character of managers and, therefore, avoided these talks.

One has to keep in mind that many managers are not where they are because of their professional competence but because of their charisma. They know what you want to hear and will say exactly that.

4. Focus on Numbers

Because he didn't talk to management and was an old-school value investor focused on very cheap stocks, he prioritized the quantitative side of an investment.

His favorite metric was book value.

“Asset values fluctuate more slowly than earnings do.”

He preferably bought at 1/2 or 2/3 of book value. Now, that might be hard to do in today’s markets, but we can still avoid overpaying for “quality” that is not backed by numbers.

5. Diversification

Schloss didn't dig too deep into his investments. He bought very cheap stocks, and he bought a lot of them. His portfolio ranged from 60 to 100 positions.

Not all of them will be winners, but the low price was his Margin of Safety. And the winners drove the performance.

The idea is simple. If you buy a lot of undervalued stocks, there will be companies that are too damaged to recover. But the loss on them isn’t big. The ones that do recover, however, have a lot of upside.

Due to the sheer number of investments, he came out on top on average. Peter Lynch followed a similar approach, although his idea was to find companies with a lot of growth potential instead of recovery situations.

6. Averaging In

Another reason for his large portfolio was his “Average-In-Principle.”

Schloss believed that one can not know a stock by just watching from the sidelines. That’s why he established many small positions to observe them. Over time, he averaged into these positions and built them up.

Another advantage of averaging into positions is that it limits the impact of market timing.

7. The Math of Investing

Through his investment strategy, he benefited from two simple principles.

7.1. Losses Weigh More than Gains

If you lose 20%, you need to gain more than 20% to get back to zero. Solution: Focus on the Downside

7.2 Compound Interest Frequency

By buying and selling undervalued companies, he compounded faster than he would by buying great companies and letting them compound.

Of course, finding many undervalued companies requires more work, but the higher frequency is very profitable. Buffett used to do the same.

Want More?

Become a Premium Member and access Exclusive Research & My Personal and only Portfolio (with Live Updates)

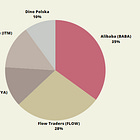

My Portfolio:

My Research:

Check out my Investing Checklist: https://danielmnkeproducts.com/

Check out all Free Investing PDFs:

Need Inspiration for your next Read? Check out my Bookshelf:

Get yourself in front of 17,000 Investors and promote your brand!

Contact Me: daniel.mahncke@gmx.de

See you again on Sunday (at the latest) :)