Update on the Liberty Spinoff and Italmobiliare

Today we discuss the finalization of the Sunrise Spinoff and Italmobiliare's Q3 earnings Report!

Liberty Global and Sunrise Spinoff

Was it a good deal?

Liberty Global shareholders have now received the Sunrise shares. I must admit that I was a bit confused when my Liberty Global position was suddenly 40% down yesterday😅. It took me a minute or two to realize what day it was.

Liberty A stock is now trading at $12.42, and Sunrise stock is a bit over $50 (Update: now trading at $46.45; naturally, still very volatile).

Depending on the exact close and open numbers you got, the breakeven prices for Liberty and Sunrise stock should be $10.99 for LBTYA and $48.75 for SNRE shares.

I arrive at this by taking LBTYA’s closing price before the spinoff, $20.74, and subtracting the opening price of $10.99. This gives us $9.75, which we multiply by 5 due to the ratio of LBTYA to Sunrise shares. This gives us the price of $48.75 for SNRE shares.

What Now? What are the fair values?

As mentioned, both LBTYA and SNRE shares currently trade above these values (Update: SNRE is currently lower, as mentioned above). However, this raises the question: What do we do now? Hold the SNRE shares? Sell them? The same goes for LBTYA shares.

Since today, SNRE shares will trade on the SIX Swiss Exchange, which should bring more volume and paint a clearer picture of how the stock will be valued in the next couple of weeks.

I consider SNRE’s fair value much higher than $50. In one of its reports on the spinoff, Liberty Global said that after the deleveraging, which we discussed in prior articles, future FCF should be about $460m and the payout ratio 70%+. This would result in $320m+ for dividends, divided by the share count of 72.43m shares; this is a $4.45 dividend or a ~10% dividend yield (on current prices).

Investors get a high-quality business with a double-digit dividend yield. That’s a unique proposition on the Swiss market, and I’m confident it will eventually drive the price up. I would sell in the range of $65-$70.

For Liberty, the thesis remains largely unchanged since this was only one of the many ways to deliver value to shareholders. The main part of the thesis remains the buybacks. If you want to read more on that, read my initial pitch:

If you have any specific questions, please ask me on Discord, either in one of the community channels or in private (only for paid subscribers)!

Italmobiliare - Q3 Report

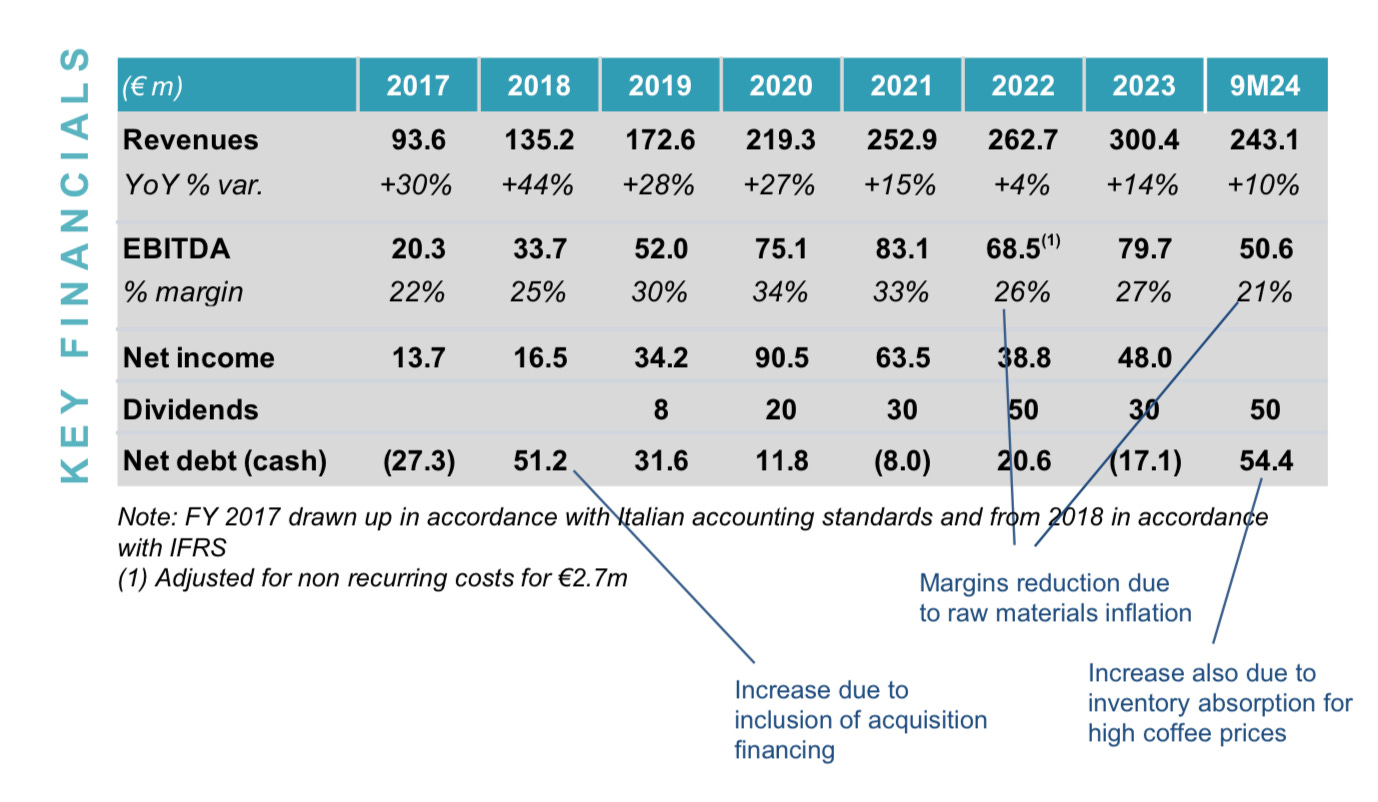

Caffe Borbone

Caffe Borbone operated in a very tough environment in 2024. The prices for raw materials (coffee beans) reached all-time highs. Robusta reached 5.50 dollars.

This obviously impacted margins. However, with an EBITDA margin of 21% and an EBIT margin of 17%, Borbone still performed quite well. I’m not at all concerned in the long term.

Borbone remains a very strong brand and business for ITM and is essential to its future success.

Santa Maria Novella

Santa Maria keeps on delivering on promises. Revenue growth reaccelerated again (26%), pushed by 43% growth in retail sales and 30% growth in E-commerce sales. ITM didn’t give much information on the Japan expansion, but it seems it was very successful, and Santa Maria had no difficulties getting into the market.

Those are very good news since Asia is and will be hugely important to the luxury market, and Santa Maria shows it can expand internationally without any problems.

Margins are also impressive, considering the expansion expenses and overall luxury downturn in 2024.

Italgen

Italgen is in the process of delivering a phenomenal year. Revenues grew 26% YTD, and margins more than doubled YoY.

However, the 2022 and 2023 results also looked worse than they were since the regulatory price caps lowered revenues and margins. On top of that, rainfall was historically low, while the first nine months of 2024 have been extremely rainy, benefitting Italgen.

And as bad as such a climate change would be, I think it might be a long-term phenomenon and tailwind for Italgen.

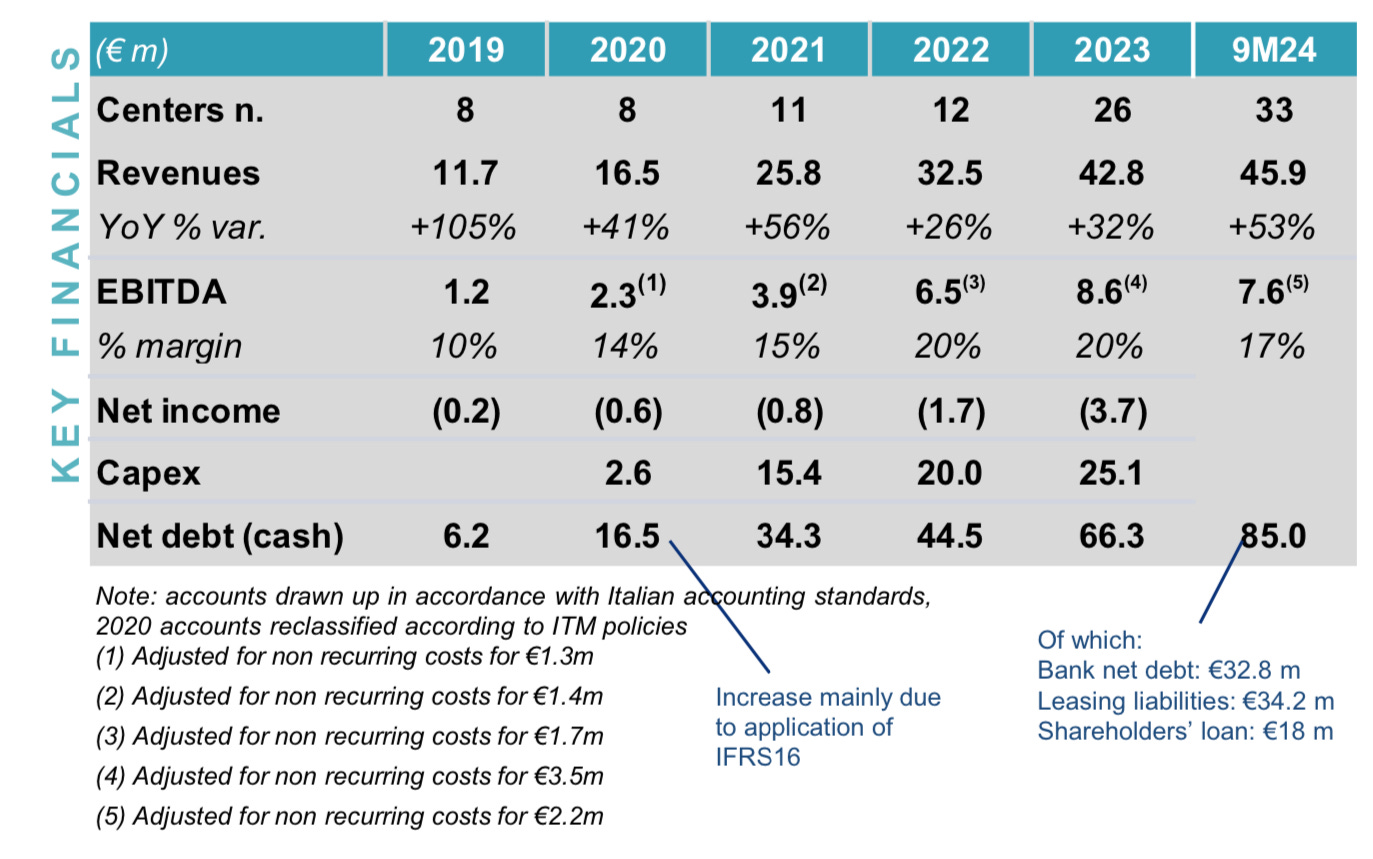

Casa della Salute

CDS again showed phenomenal growth (53% revenue growth), fueled by new acquisitions and openings. In Q3 alone, 3 new clinics and a new surgery theatre were completed, for a total of 6 new structures in the year.

Like-for-like sales growth has been 17%, showing the effectiveness of clinics. EBITDA growth YoY stands at 69%. I guess it will still be a rather long time until CDS reports profitability, but looking at the underlying business model, I’m confident it is a great business that deserves all the investments.

Sidi Sport

Sidi Sport remains in the process of restructuring. However, 2024 results show that it’s heading in the right direction. Revenues grew 23% due to strong performance in European markets and product-wise, especially in the motorbike market (26% growth).

The necessary investments in personal, new projects, etc., decreased margins, though.

Capitelli

Maybe you remember the swine fever that broke out in some regions of Italy in the last years. This has been a huge questionnaire for me regarding Capitelli. How big will the impact be? How bad will it get?

Well, by now, we can definitely say that Capitelli is incredibly resilient. Capitelli reported revenue growth of 5.1%, and margins seem to be recovering and outperforming the 2022 and 2023 margins.

Still, margins have again been impacted by high raw material prices and price decreases linked to swine fever.

In the long run, I expect Capitelli to come close to 2019 and 2020 margins again.

Bene Assicurazioni

Bene has reported excellent premium growth numbers again (33%). The growth was primarily driven by the Motor insurance sector, which represented 70% of the business and contributed 80% of total growth.

Strong sales channel performance across the board:

Agency Network Channel: 29.5% growth YoY

New Agencies: 24 net openings compared to last year

Partnership Channel: 66.7% growth

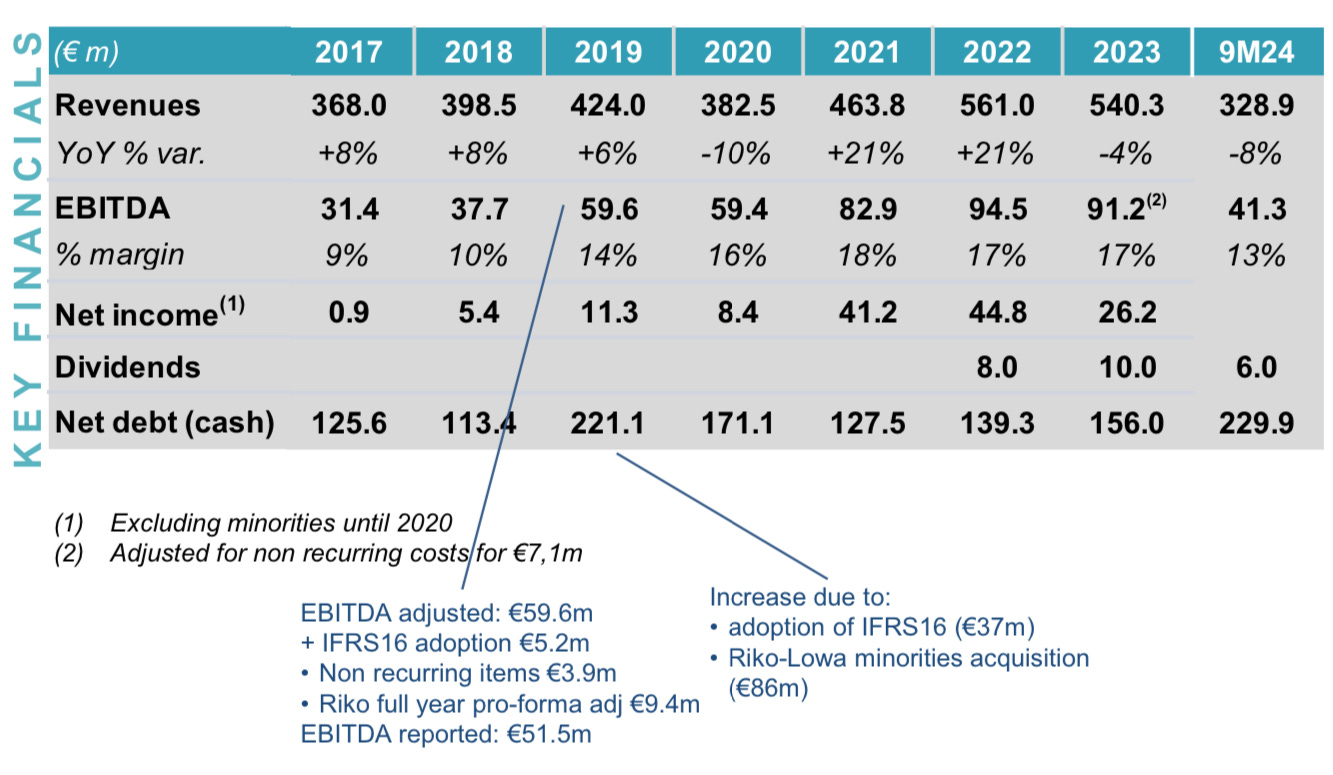

Tecnica

Tecnica struggled in 2023 from the aftermath of the pandemic. However, it has since failed to recover, and to me, it seems like there are deeper problems within the business than just the covid aftermath.

It remains an important cash flow generator for ITM, but the worsening rather than improving situation is not a good sign. I hope we will get some structural changes or at least long-term plans for the business to get back on track.

Iseo

Iseo is another company that is not doing well right now. Problems with the new ERP system caused production and logistic problems, which in turn delayed revenue.

However, it seems that those problems were mostly fixed in Q3. Turnover grew by 11.7% compared to the same period last year, and revenues decreased only by 3.9%, which suggests that revenue losses have been almost absorbed.

The graphic below shows how much better the financial position now looks compared to H1 2024.

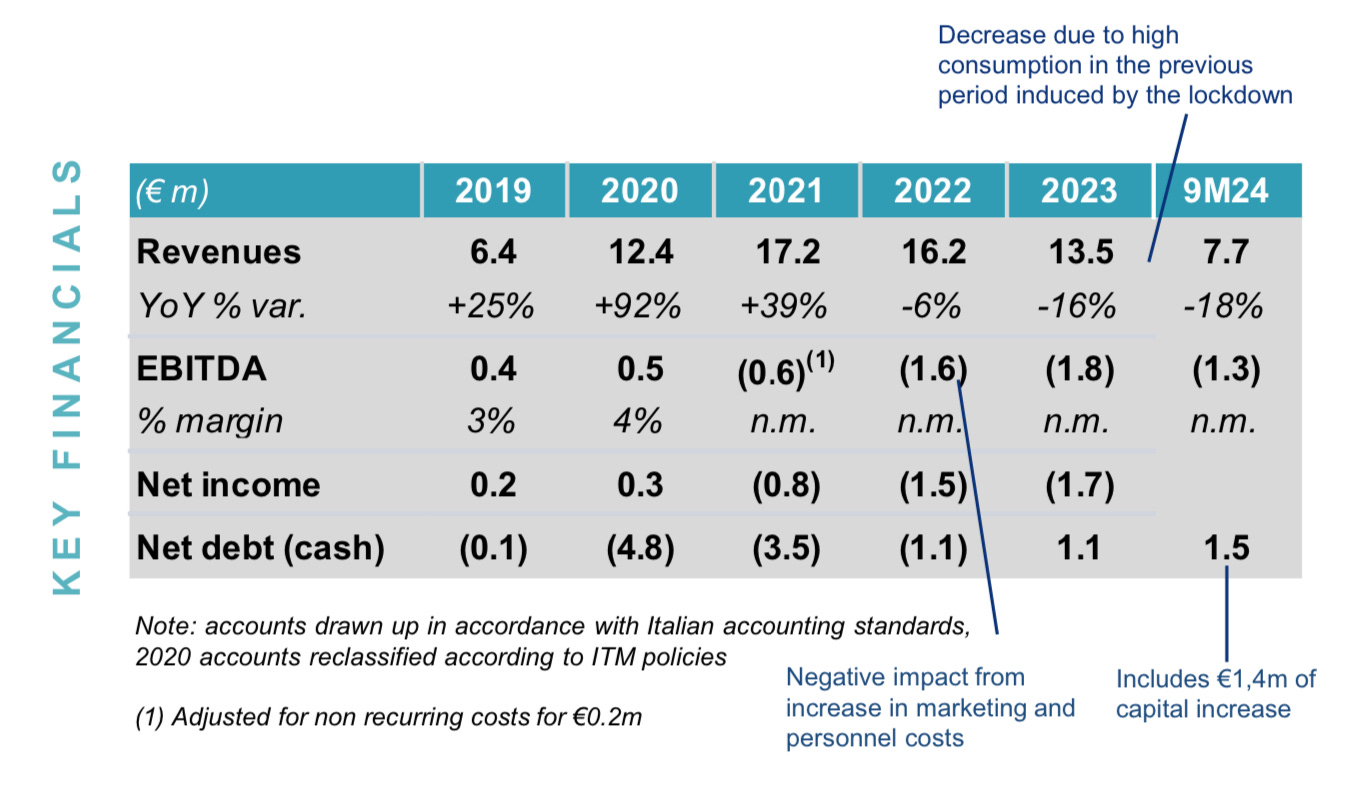

Callmewine

Last and least ;) Callemewine reported another bad quarter, and it is becoming increasingly clear that the business model is not working. While the financial impact on ITM is negligible, it still confuses me why ITM holds onto this company.

There are no signs that ITM is considering selling it. According to ITM’s report, not only Callmewine but the wine and spirits market as a whole is facing some uncertainty right now. While that might be, I think Callmewine’s business model alone is problem enough.

I’m not saying it cannot work (I think it is a very interesting model), but looking at similar models like Nakedwine, we can see how tough the business is.

Okay, that’s it for the two updates today!

Have a great weekend!

Daniel