Understanding Risk - How Investors should think about Risk

Why should Investors care about Risk?

An investor’s goal is to make money. If you’re a smart investor, you also know that the best way to do that is to compound your money over a long period of time.

The main rule to do so is to never lose money.

Buffett once said:

“There are two rules to investing. Rule number one: Never lose money. Rule number two: Never forget rule number one.”

Never losing money is so important because there’s nothing more harmful to compounding than interrupting that process by experiencing a severe loss.

And loss is a great keyword to really get into risk.

What is Risk?

In academia, risk is called volatility and measures the range of fluctuations over a period of time.

But for an investor, this definition of risk seems insufficient. If I know that I’ll turn $1000 into $10,000 in the next 5 years, then I don’t really care about volatility (assuming that liquidity is not an issue).

But why is volatility used if it’s insufficient in explaining risk?

The answer is pretty straightforward, it’s quantifiable. And academia needs to quantify risk to come up with their theories.

“Volatility can be an indicator of the presence of risk - a symptom - but it is not risk itself.” - Howard Marks

But what is risk?

Risk is the probability of a permanent loss of capital.

Permanent is important here. If you buy an index representing the market, downturns will (with as much certainty as you can have) be temporary. Until today, the MSCI World has always recovered from its drawdowns, no matter how severe.

Individual companies don’t act that way. They come and go. Some strive, some die. And if you bet on the wrong company, your investment is gone. Permanently.

This is the risk an investor faces every day.

Understanding the Uncertainty that comes with Risk

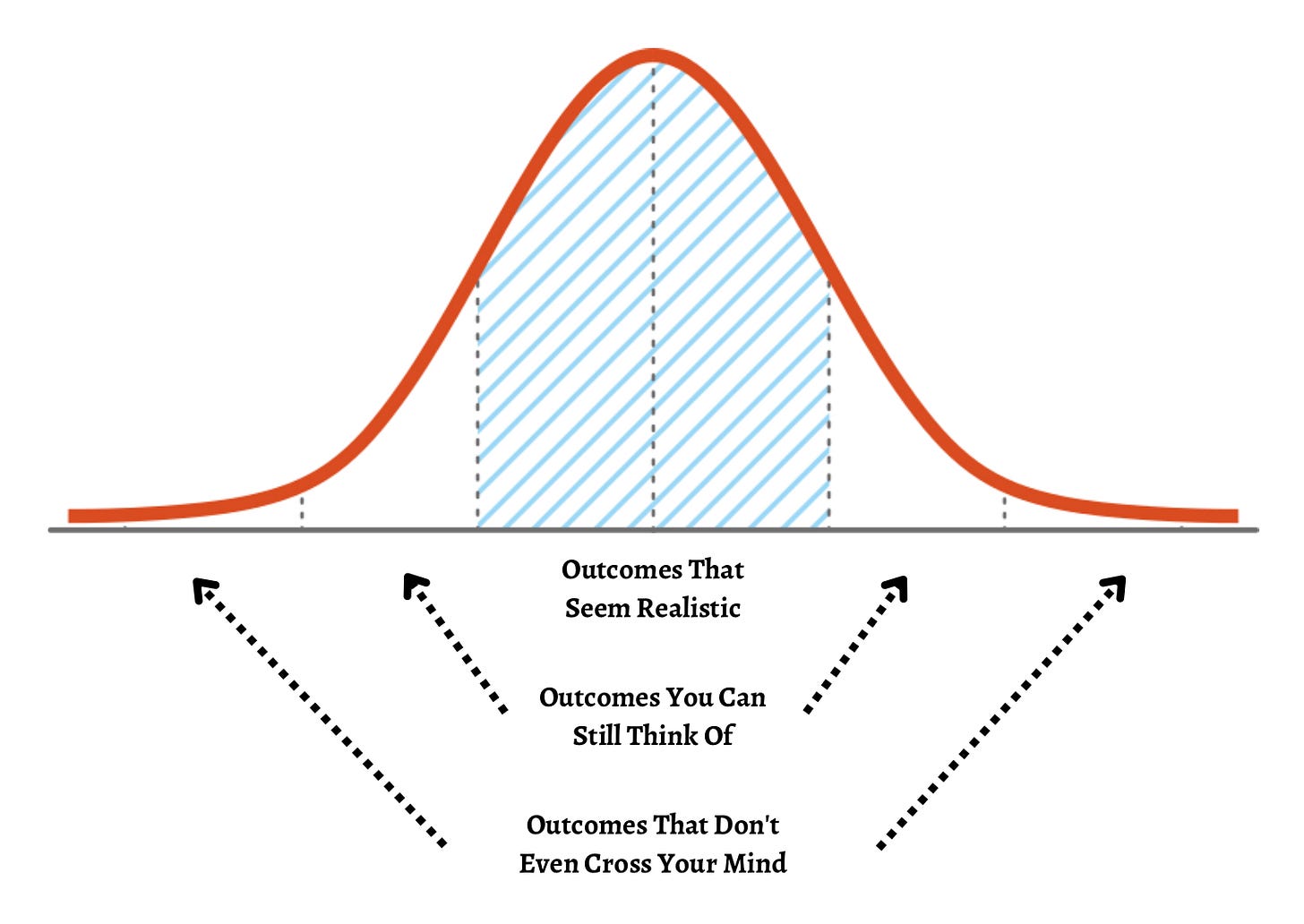

“There is a range of outcomes, and we don’t know where the actual outcome is going to fall within the range. Often, we don’t know what the range is.” - Peter L. Bernstein

We can think about the future as a probability distribution, and we never know which outcome will happen.

We wouldn’t even know if we knew the exact probabilities and all possible outcomes.

This Newsletter offers Additional Research to the Paid Community:

The additional features are:

Monthly Deep Dives

Regular Company Valuations

Real-Time-Access to my Personal Portfolio

Free Access to all the Products I’ll release

If that sounds interesting:

The most unlikely things happen all the time, and the most certain things fail to happen all the time.

‘We live in the sample, not the universe.” - Chris Geczy

The markets are a great example of that. A reason for that is the behavior of the market participants.

The risk of an activity often lies in the behavior of participants, not the activity itself.

When investors think there’s no risk involved, usually at the market top, the risk is the greatest. The same goes for downtrends. The higher the perceived risk, the lower the actual risk.

The Relationship between Risk and Return

At business school, you will see the graphic below a lot. It indicates a positive relationship between risk and return.

The more risk you take, the higher your return will be. This doesn’t sound right, does it?

That’s because the “risk” mentioned in this graph is volatility, as we discussed in the beginning.

But we are smarter now and know that risk is the possibility of permanent loss of capital and the uncertainty that comes with all the possible outcomes.

Yet, the graph below isn’t completely wrong. In general, investments with higher uncertainty produce higher returns. And higher uncertainty also means higher risk.

But how can we upgrade this graph so that uncertainty and the risk of losing money become more clear?

Howard Marks comes up with the graph below. You still see the same line as within the traditional theory since the idea of higher returns demanding higher risk is, more or less, right.

But now you can see bell-shaped curves that represent the uncertainty of outcomes. The more risk you take, the less certain the outcomes get and the worse the outcomes can become.

Knowing about what risk is and the relationship between risk and return, let’s discuss how investors should go about handling risk.

How should Investors handle Risk?

Think of investment performance as pulling a ticket out of a bowl filled with hundreds of tickets. All of these tickets represent different outcomes. But the only one that matters is the one you pulled out of that bowl.

The task of the investor is to know about as many tickets (outcomes) as possible, how likely they are (not precisely but vaguely), and what each outcome would mean for their investment.

Obviously, you can’t know any of that. But superior investors stand out for having a better-than-average sense of the tickets in that bowl and their possible consequences.

Joel Greenblatt talks about context when analyzing companies. The same context plays a role in managing risks.

The best investors are great at putting things into perspective.

But what can we do to improve our senses?

There are a variety of ways to improve our senses and to get better at putting things into perspective. Here are the 3 most important ones:

Psychological Biases

One reason why we misjudge risk are biases that distort our perception of risk and do not allow us to make rational decisions. If you want to learn more about such biases, there’s a link to an article I wrote on biases below.

Learning about History

History doesn’t repeat itself, but it rhymes. When assessing risk, it makes sense to look at history and find instances in which something similar happened. How did that scenario play out, and what can you learn from it?

Understanding Risk

Obviously, understanding risk is also crucial in assessing it. That’s why I wrote this article in the first place.

Conclusion

Risk cannot be measured, which makes it extremely hard to assess risk, both in the future and even in the past.

As an investor, you need to be aware that you’ll never know about all possible outcomes and that it’s impossible to be certain about anything.

Your challenge is to be prepared for outcomes you were unaware of before and survive them when they occur.

One key element of investing is looking for asymmetrical bets. Bets that have unlimited upside but limited downside.

Mohnish Pabrai used to say: “Heads, I Win; Tails, I Don't Lose Much.”

But asymmetric bets will be discussed in a later article.

Thanks a lot for taking the time to read this. I hope you learned something new.

If you did, consider following my Substack and my Twitter to keep up to date with my latest posts.