The 10 Pillars of Investing by Nick Sleep

Here are the 10 most important Investing rules and learnings that I found when researching all Investment Letters by Nick Sleep.

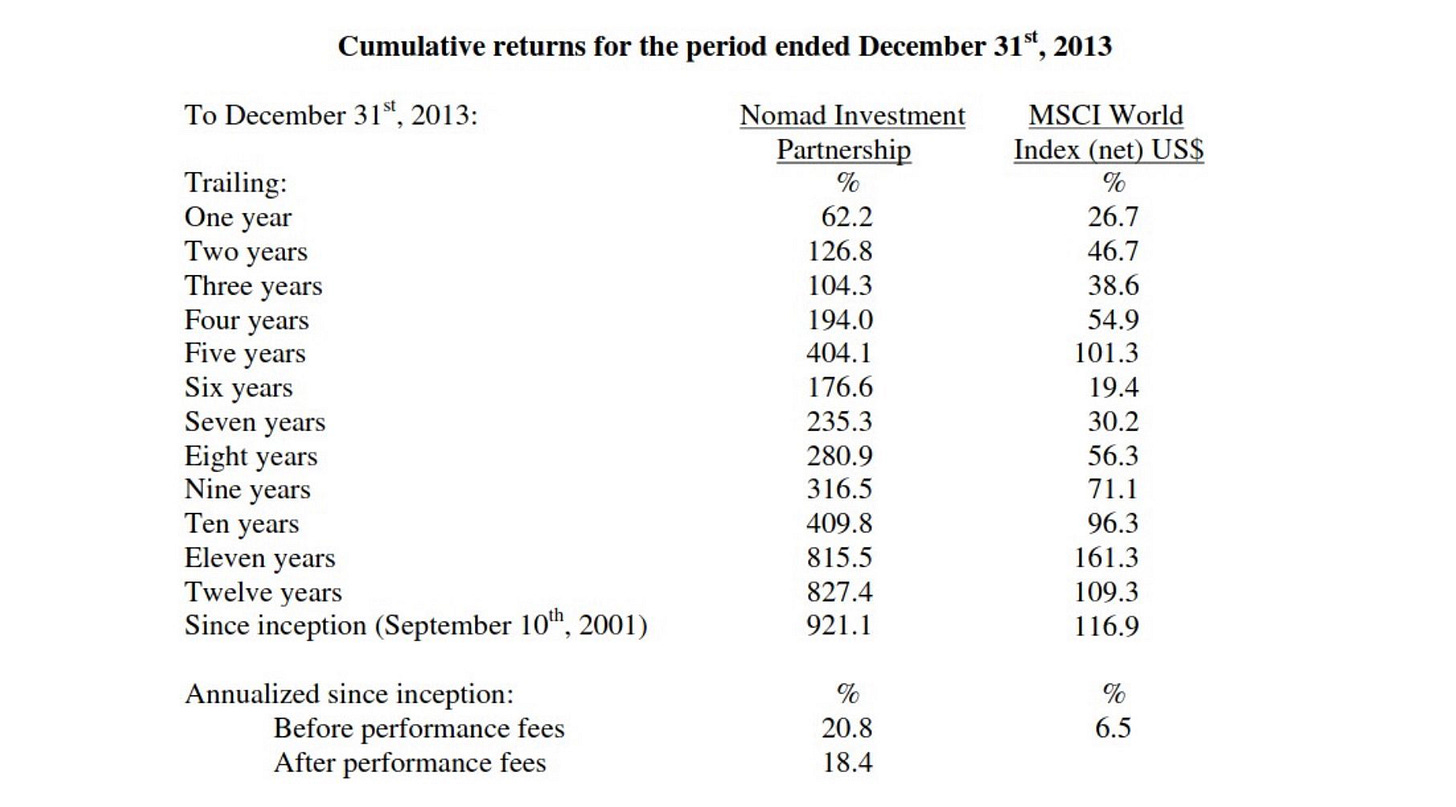

Nick Sleep crushed the market with a 20.8% annualized return. He did it by focusing on these 10 Rules:

1. Stop Collecting. Start Thinking

“We think far less than we think we think.”

There’s so much information that we are busy collecting.

Instead, take more time thinking about information. We can’t come up with different conclusions by only collecting.

2. Scaling Laws

Scaling Laws turn the size of a company into an asset instead of a burden.

The two important tenets:

1. The ability to self-fund growth

2. Increasing Barriers of Entry with increasing size

Such businesses support growth with little re-engineering necessary.

3. Micro vs. Macro

Macroeconomics acts as a call to action.

Always something seemingly important happens, and you feel the urge to act on that news.

This is a negative, killing your long-term success. Your success stems from inaction.

4. Destination

Where will the company be when it exits the growth phase?

You want to know:

- The markets it operates in

- The size of those markets

- The position in those markets

Of course, you can’t know specific numbers. Being vaguely right is better than precisely wrong.

5. Thesis

In hindsight, it’s easy to assess what information mattered and what didn’t.

At the moment, it’s not.

The biggest mistakes are made when selling a great investment because of short-term noise.

Only act on information that directly influences your investment thesis.

6. Lollapalooza Moats

Lollapalooza Moats consist of many small competitive advantages.

Those add up and create a strong and well-diversified competitive advantage.

Due to their diversification, these are the most durable moats and found at any great compounder.

7. Spawner

Spawners have one big and profitable business, which is responsible for the cash flows.

Simultaneously, it invests in many small, low-cost ventures with huge potential.

Most of them will fail.

But the ones who succeed become huge and profitable new businesses.

8. Scale Economics Shared

A win-win value proposition between companies and customers.

As the firm grows in size, scale savings are given back to customers through lower prices.

Those prices attract new customers who, in turn, increase scale economics even more.

9. Intentional Disconnection

How can we filter out important information?

Generally, we already know what’s important and what's not.

It’s just more convenient to collect further information than to take a step back and think about it.

Thus, that’s what we do.

To avoid this bad habit, Sleep uses slight inconveniences.

His Bloomberg terminal is at a desk in an office he rarely uses, and it doesn’t even have a chair.

Unlikely he will spend hours in front of that terminal. When he has what he needs, he shuts down for unnecessary noise.

10. Founder-Led Businesses

Nick Sleep preferred founder-led businesses.

If not the founders, then the management that followed after him.

Since the founder had a say in that decision, he was likely convinced of their approach.

Founder-led businesses also have very different incentive structures than most other companies.

The executives are not only focused on collecting the highest possible premiums but on growing the business and serving the customer.

That’s it for today. Thanks for taking the time to read this article.

I hope it added value and helped you become a better investor.

Have a wonderful day!