Should you Sell Alibaba Pre-Earnings??

Let's take a quick look (only 3-minutes) at Alibaba's recent price action and what investors should consider before earnings next week.

Alibaba Stock: A 40% Rally—What’s Next?

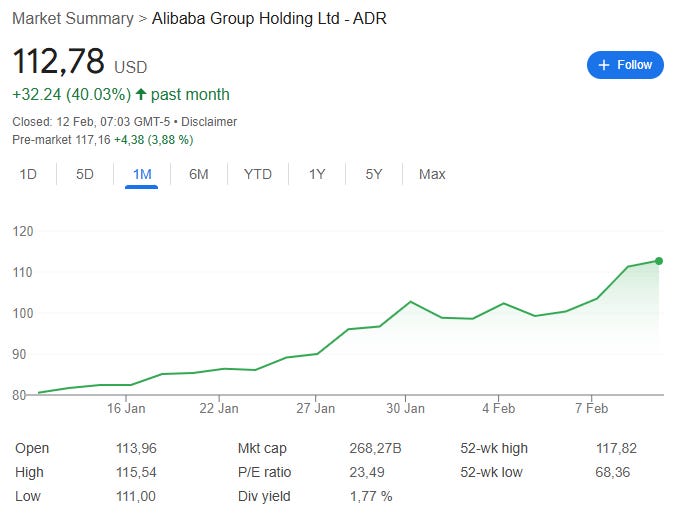

Alibaba’s stock has climbed 40% over the last four weeks, hitting the same level as in October last year at $113. And it’s up another 4% in pre-market trading, thanks to the Apple news (more on that below).

I’ve been asked a few times recently whether it makes sense to sell now or at least trim the position—especially with the earnings release coming up next week (Thursday, 20th).

As you know, I’ve traded part of my Alibaba position in the $70–$100 range whenever volatility was high. I did the same last October.

But will I do so this time? Honestly, I don’t know yet. Let’s look at the facts and then decide!

Why Did Alibaba Stock Rise?

Earnings aren’t out yet, so the stock hasn’t moved based on fundamentals. So why the rally? Answer: The recent AI Developments and … Speculation.

Last October, the Chinese government announced a stimulus program to boost the economy. Alibaba, along with the rest of the Chinese tech sector, shot up.

The Problem: It had little to do with Alibaba itself, making the rally dependent on the Chinese government. Once the market decided the stimulus announced wasn’t enough, Alibaba’s stock dropped right back down.

What’s Different This Time

This time, the speculation is based on company-based reasons (at least mostly). DeepSeek has revived the Chinese tech universe, and the markets have realized that China is a significant player in AI as well.

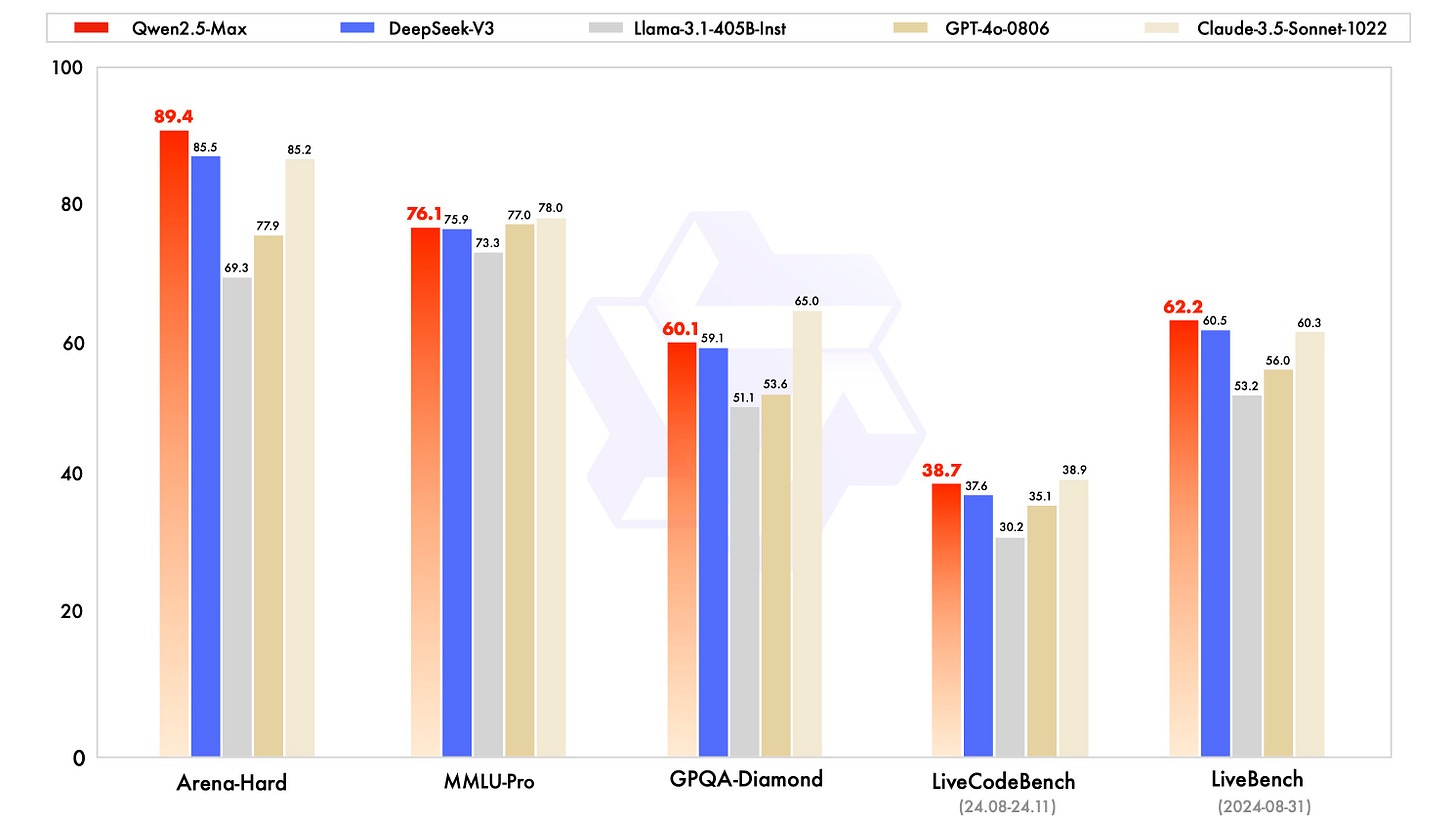

Shortly after, Alibaba released its new Qwen 2.5 Max model, which beat both DeepSeek and ChatGPT in most categories.

Alibaba’s Cloud and AI segment has already gained momentum in the last two quarters. With these new developments, hopes are high that Alibaba can gain even more momentum going forward.

On Sunday or Tuesday, I’ll give a detailed rundown on what the Update in March will look like. There’s been a lot of work in the background.

If you’re new and don’t know what I’m talking about, here’s a quick summary:

Then came yesterday’s news: Apple and Alibaba are reportedly partnering on AI features for iPhones in China. Last year, Apple worked with Baidu but wasn’t satisfied with the results. Choosing Alibaba over all competitors, including DeepSeek, strengthens its market-leading AI and Cloud position in China.

In short: This rally is different because it is company-related.

That said, next week’s earnings won’t reflect the impact of this latest news. Previous earnings reports didn’t do much for the stock, and if I had to guess, I’d say there’s a slightly higher chance of a drop than a rise post-earnings.

But it all depends on how management presents their outlook. If the numbers come in weak but they convince investors that recent developments will drive long-term growth, the stock could hold up.

If the numbers are good anyway, the direction of the stock should be clear. I’m just a skeptic by nature, so I prefer to have little anticipation before earnings.

Valuation: Still Ridiculously Cheap

Even after this rally, Alibaba is still significantly undervalued.

Normalized free cash flow (FCF) is over $20 billion per year, even with over $10 billion spent on stock buybacks (as we saw in 2023 and 2024).

Factor in the dividend, and Alibaba would have had $21 billion in FCF. That puts EV/FCF at 11.8x. If you also account for the massive $16 billion (!) in buybacks in 2024, that drops to 6.7x—equivalent to a 15% FCF yield.

But I don’t need to tell you that—you already know all this.

Decision: Sell or Hold?

Even after a 40% rally, Alibaba’s long-term potential is still massive. But obviously, the risk/reward shifts after such a big move.

If you’re sitting on a large Alibaba position and have other stocks that look attractive, it might make sense to trim, maybe even before earnings.

Even if there’s a 50/50 chance of a 10% increase or decrease, the risk/reward looked much better at $80.

Personally, I’m not selling or trading. My cash position is still over 30%, and I have no immediate alternative that’s better than holding Alibaba long term.

Also, I’ve never traded going into earnings or anything. I sold when prices reached +$95, which has been only once or twice and bought back at $80 or below. Calling this trading might be a bit too much.

I’ve waited long for Alibaba to gain some momentum, so I’m enjoying the ride while it lasts. 😉

What’s Next?

Tomorrow: Flow Traders reports earnings, which should be interesting given the recent uptick in volatility. I’ll keep you posted.

Sunday or Tuesday (not sure yet): Q&A about the Upcoming Update in March. I’ll give you a detailed rundown of how it will look! (Any questions? Let me know!)

Thursday 20th: Alibaba Earnings Update

Till then—cheers!

Daniel