Macro Update (November 01, 2022)

Semi-Weekly Macro Update No.1

Welcome to the first Semi-Weekly Macro Update on my Substack, in fact, the first post on this Substack in general.

In the future, these Semi-Weekly Macro Updates will be solely about new developments and news in the markets and economies.

However, since this is the first one, I will not only look at the last two weeks but try to paint a broader picture that makes it easier for you (and me) to understand what’s happening at the moment.

But let’s take one more step back and talk a little about why I want to write these Macro Updates and what I hope to achieve with this.

As you might know, if you came here through my Twitter, I would describe myself as a Value Investor, although there’s still lots of room for interpretation about what that actually means.

If you’re familiar with value investing, you might also know that most value investors do not invest based on macroeconomics, and neither do I.

Yet, you’ll find very few, if any, investors who do not know or understand what is happening in the markets.

Howard Marks, founder of Oaktree and one of the investors who had the greatest impact on me, is paying quite a lot of attention to economics and markets. For him, it’s about market cycles and where we stand in those cycles.

It’s a topic worth discussing. Maybe we’ll talk about this more in-depth in another post.

But I digress…

The point is that knowing what is going on in the world and what drives markets and prices is not only interesting but also helpful to one’s investment decisions, even if you don’t make investment decisions based on macroeconomics.

The best way to let volatile markets not influence your mind and decision-making is to know why they’re volatile in the first place. And more often than not, it’s not about your company/investment itself but about the overall situation in the market.

The goal isn’t to become a macro expert. If that’s your goal, this is probably the wrong Substack, but to gain an overview and understand the topics that currently influence the markets and are on the mind of investors.

With that being said, let’s get straight in :

Inflation and Interest Rates:

As I said, because this is the first edition of the Macro Updates, I’ll focus on the broader picture a little more this time. And a little actually means a lot.

Inflation and interest rates have been the topics in the markets over the past few months. We’ve seen historically high inflation all over Europe, America, and many Asian countries.

To tame inflation, central banks worldwide are raising interest rates. After decades of falling interest rates, recent rate hikes are ending an era of zero-interest politics. At least for now.

And while the absolute level of interest rates doesn’t seem too scary compared to historic levels, two factors put them into perspective.

First, the rate of change. The speed at which the FED hikes rates is historical. A comparable rate hike was only seen in the early 1980s when former FED chairman Paul Volcker killed inflation by raising rates at an incredible speed starting from August 1979.

The graph above doesn’t show the current spike in 2022, which still seems small in comparison. However, you can already see how steep the curve is rising.

Historically, most rate hikes were executed in steps of 25 bps. In the last months, we saw rate hikes of 50 and even 75 bps. Some central banks even raised rates by 100 bps.

But apart from the rate of change, there’s another big difference between higher rates today and higher rates in the past. The key word is debt.

Total debt exploded in the last two decades and especially in recent years. Raising rates with this in mind differs from raising rates in the 1970s, 1980s, and even the 1990s.

Because of this, it’s unlikely that higher rates will be a long-term thing. Interest on debt is already the same size as the US military budget, which is about 45% of the whole US Discretionary spending.

However, no one knows what “a long-term thing” means in this context. The FED is pretty clear that they won’t stop hiking rates, let alone cutting rates before they know beyond a doubt that inflation has been defeated and comes down to the long-term goal of 2%.

For the next meeting in November, the market expects a target rate of 375 -400 bps, which is an expected increase of 75 bps.

A year from now, the target rate is expected to be even higher, somewhere between 425 - 500 bps.

With interest rates at these levels, stocks, especially growth stocks, will have a hard time rebounding.

A recession wouldn’t exactly help, either. And avoiding one seems almost impossible at this point. Europe has an even worse outlook than the US, considering the huge problems regarding energy. But the signs point to a recession in the US as well.

Just this week, the 10-Year Treasury Yield - 3-Month Treasury Yield inverted, meaning that the 3-Month Treasury Yield exceeded the 10-Year Treasury Yield. Historically a clear sign of an upcoming recession.

The seemingly unavoidable recession is why many experts criticize the FED for continuing the rate hikes. Arguing that the FED focuses on lagging indicators while leading indicators already show that the economy is breaking, lowering inflation sooner or later.

Part of the reason the FED is still holding onto its course is the still strong labor market. But there are first signs that this strength won’t hold much longer. The obvious one is the upcoming recession. Another one of these signs is the big-tech earnings we’ve seen this week.

Big-Tech Earnings

Meta, Alphabet, Amazon, Microsoft, and Apple released their earnings this week. Meta’s stock was crushed and lost almost a quarter of the market cap after reporting another revenue decline, rising costs, and a 46% decline in operating income. Meta has now lost nearly 70% of its market cap since the beginning of this year. According to Bloomberg, Mark Zuckerberg lost over $100 billion of personal net worth.

Alphabet, Amazon, and Microsoft also lost significantly after their earnings report. Apple was able to avoid losses and even gained 7% the next day.

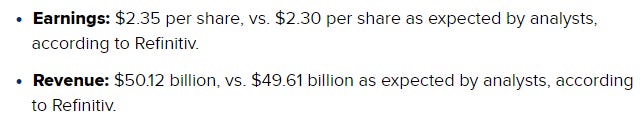

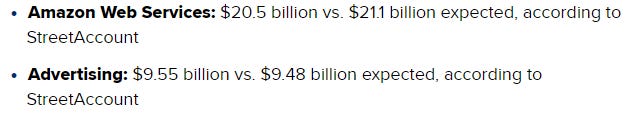

Apple Earnings:

Alphabet Earnings:

Microsoft Earnings:

Amazon Earnings:

But besides the stock movements, these earnings have another interesting aspect. An aspect regarding the previously discussed labor market. All of these companies have hired many new employees since the end of 2019.

Meta went from 45,000 employees to 83,000. Alphabet from 119,000 to almost 190,000. Microsoft from 140,000 to 220,000 and Amazon from 800,000 to 1,500,000.

Suppose they stop hiring or even lay off employees, which Amazon, Apple, Alphabet, and Microsoft have already announced, the labor market will inevitably cool off, which is exactly what the FED wants to see.

China

Chinese equities continue writing new lows. Just this year, the Hang Seng index lost over 40%, and last Friday, it closed at levels last seen in 2009.

The current selloff is fueled by news about the recent 20th National Congress of the CCP, where Xi Jinping was elected for a third term as leader of the communist party. Additionally, the new leadership is packed with Xi Jinping loyalists.

However, while this news caused another sharp selloff of Chinese equities, Xi’s third term came hardly surprising. Uncertainty seems to still be the primary driver of weaker Chinese equities.

And uncertainty is likely to stay for a while. It remains open whether the CCP will further restrain Chinese companies, especially big tech, and the Taiwan situation remains tense as well.

China’s take on Taiwan isn’t new, either. Still, the Russia-Ukraine war changed people’s perception of the situation, and the possibility of another war seems not only higher than a year ago but also more intimidating.

The China-Taiwan situation might be the hardest pill to swallow for investors, especially because both the time horizon and a possible solution to this problem seem entirely unknown.

Sticking to the zero-covid policy is another negative for investors in China. Generally, I believe the investment thesis for many Chinese companies has changed. That said, whenever anything is deemed “uninvestable,” there have been tremendous opportunities historically.

But this topic deserves an article of its own. If you’re interested in one, let me know.

The US-Dollar

Since the beginning of the rate hikes, the USD has shown significant strength over all other major currencies. It is at a 20-year high. Yet, in the current market situation, maybe saying that all other currencies are weaker than the dollar is more appropriate than saying the dollar is strong.

The British pound hit a 27-year low, the yen is at its lowest since 1998, and the euro is below parity, something that no one would’ve believed possible at the beginning of 2022.

And while a strong dollar sounds good at first sight, at least for the US, this is not necessarily the case. Internationally operating companies, like the tech companies mentioned above, face declining revenues because of the exchange rates. A strong dollar also causes worse returns for US investors.

Gold is a perfect example of that. Even though we see high inflation, gold couldn’t benefit from those circumstances. At least not if you’re an American investor. Since the start of 2022, gold has had a performance of -9.39% in USD. The performance of gold in euros was 3%.

Emerging countries are more vulnerable to a strong dollar anyways. That’s primarily due to their debt, mainly denominated in US dollars and thus rising. But rising prices for food, medicine, and other necessities are also a huge problem.

We will see how the currency markets will behave in the future. The currencies could rebound from current lows when other central banks catch up with the FED’s aggressive rate hikes.

UK and the Bank of England

Last but not least, here’s a short explanation of what happened in England in the last couple of weeks.

It all started with the so-called “mini-budget” by former British Prime Minister Liz Truss and former British Finance Minister Kwasi Kwarteng, which included plans to cut taxes dramatically and pay for it by issuing new debt.

In times of high inflation and central banks who switched from quantitative easing to quantitative tightening, this was a surprise that made government yields surge while the pound fell to record lows.

The rising government yields then started a vicious cycle. Pension funds that held leveraged long-duration government bonds suddenly got margin called. To increase liquidity, pension funds had to liquidate positions, mostly government bonds, for which they didn’t find enough buyers, which caused prices to plummet even further.

Eventually, the Bank of England stepped in and released a 65 billion pound package to buy government bonds from the pension funds. While this helped calm the situation short term, only a couple of days later, rates were rising again, and it became clear that the “mini-budget” wasn’t going to survive political and economic pressures.

On October 14th, British Finance Minister Kwasi Kwarteng stepped down after only 38 days. Liz Truss followed only a week later. New Prime Minister Rishi Sunak now has to restore faith in the British financial system and calm the situation.

In the next couple of weeks, we will see how this will turn out and if such a situation can happen in other countries besides the UK.

Alright, I think this is enough information for today. If you’re still with me, thanks a lot for taking the time.

I’m just starting writing Newsletters, so if you have any feedback, please let me know. If you liked what you read, I would highly appreciate your help by sharing this article and supporting my work by subscribing.

Thanks a lot, and until next time, have a great day!