Nike Stock Analysis - Who is Right? Bill Ackman or the Market?

I think I can keep the company introduction short today… we will talk about Nike, the biggest shoe retailer and one of the most valuable brands in the world (ranked #13 on the Forbes List).

Despite being one of American history's biggest entrepreneurial success stories, its stock has seen better times. It’s down 56% from its 2021 All-Time High and ~27% YTD. Decades of outperformance have (for now) come to an end, and at 78$, the stock hasn’t delivered any returns since 2018 (if you would’ve owned it without buying or selling).

But what happened to Nike? Is this the downfall of the sports giant, or is it an overreaction of the market, which is scared of short-term macroeconomic headwinds?

If you ask Bill Ackman, billionaire investor, founder, and chief executive officer of Pershing Square Capital Management, he would say the latter. Nike is now one of his largest holdings and represents +11% of his $12 billion portfolio:

This feels like a good time to discuss Nike and see whether Bill Ackman or the market will be proven right.

Let’s start by understanding why Nike, both the company and the stock, has been struggling lately.

The Nike Downfall

There are multiple reasons for Nike's recent problems. Some are more long-term and concern the company level, while others are short-term factors that primarily caused the latest stock sales.

Long-Term Strategy and DTC Focus

In 2017, Nike decided to focus more on its DTC business, Nike Direct. The idea was to cut costs, improve margins, and simplify the company’s operations. Part of the DTC strategy was to cut ties with retailers and thus drive more customers to Nike’s websites.

That strategy has proven effective, especially during the pandemic. Nike benefited from the online shopping boom and the tailwind of an increasing interest in sportswear.

In recent years, however, growth has slowed significantly. In part, this is due to the general decrease in consumer spending. However, Nike’s DTC strategy also has an effect here. A more price-sensitive consumer is more likely to pass on an expensive Nike shoe and instead look for cheaper models or discounts in a nearby retail store.

With Nike gone, other shoe and apparel brands have taken Nike’s spot in local retailers. The management might have underestimated the importance of retail stores, especially in weaker economic times.

Brand awareness is another factor. Sure, everybody knows Nike. However, retail stores are also effective and relatively cheap marketing machines. Retail stores market their best-selling products. Nike has been that product for almost every retailer in which it was sold. By leaving the stores, you also miss out on the store’s marketing for your brand.

Nike has admitted that mistake and has been increasing its wholesale presence again since last year. However, getting back in has not been as easy as they might have hoped. Previous customers who agreed to sell Nike again have ordered less than before due to a weak consumer environment and the strategy shift to become less dependent on a single brand. They are more diversified now, resulting in fewer Nike orders than before.

Macroeconomic Factors

Inflation and Consumers

I’ve mentioned the weak consumer several times now, and that’s one of Nike's main problems. Premium brands also demand premium prices, and Nike is no exception.

Rising raw material and labor costs due to global inflation have significantly increased production expenses. Materials such as rubber and synthetic fibers, critical for shoe production, have become more expensive.

To keep margins stable, Nike raised its prices. This has worked for years. But since the pandemic, Nike has to realize that when the middle class starts struggling with grocery prices, $200 sneakers might not sell as well anymore.

Geographies

I’ve heard that Nike mostly struggles because of its China business and the macro problems there. However, if we look at the numbers, that's not the case.

Last Fiscal year, China was the second-best performer with 4% revenue growth, while North America was the worst with a 1% revenue decline. Overall, Nike is struggling in all its geographies, which is unsurprising since most macroeconomic headwinds have been global phenomena (with some local exceptions, like the war in Ukraine).

Problems on the Business Level

Competition

The combination of high prices and the “retreat” from wholesale has created new and strengthened old competition. In recent years, multiple brands have emerged that are giving Nike a run for its money (pun intended).

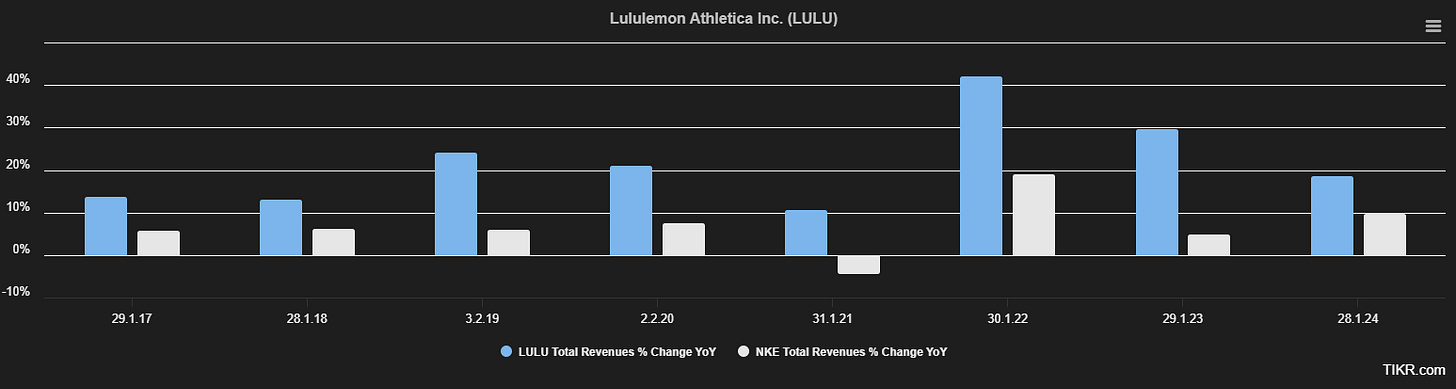

A look at Lululemon’s financials shows that the weak consumer is not the only one responsible for Nike’s performance. The competition keeps growing. Of course, growing from a smaller base is easier, but Lululemon is a company with nearly $10 billion in revenues. It’s not a small brand anymore.

Despite that, we actually see a larger difference in growth rates in recent years than in 2017 or 2018.

Lululemon is also a great example of a bigger change that I see in the apparel and show market: Trends work differently today.

Lululemon is not cheap at all. In fact, Nike products are often cheaper than Lululemon’s (Nike lost the price-sensitive consumers by raising prices and the less price-sensitive consumers to more specialized brands. More examples later).

Lululemon is a great example of how a modern brand can be created and grow quickly. The keyword is social media. I know… this is not an astonishing revelation. However, I mean a certain and newer use of social media.

Nike is by far the most followed sports brand in the world, but it has failed to create big and long-lasting trends for years. Trends in today’s world are far more short-lived than they used to be, and they rarely come from established brands anymore.

Back in the day, Nike could put out a certain shoe or clothing line and dominate trends or styles for years. Today, the world is a lot faster. A big following is not the way to get exposure anymore. It’s about temporary trends that spread quickly and far.

It’s the TikTok influence on the fashion world. Lululemon benefited from that and evolved from the niche yoga market to the broader sports market. Shein emerged like that, Crocs or Abercrombie&Fitch rebranded through social media campaigns, and many more will come up in the future.

Being a small (or struggling) company can even be an advantage in this scenario. As companies grow, they become less flexible and less likely to create the next big trend. Nike is experiencing this firsthand.

Other Competitors

While Lululemon is one of the bigger competitors in the apparel business, companies like Hoka (one of many) are putting pressure on Nike’s shoe business. Once again, they’re not cheaper than Nike, but they’re more explicitly targeting Nike's “bread and butter” customers, runners. They deliver what Nike failed to deliver in recent years: innovative shoes. With sales of ~$2 billion per year, they are significantly smaller, but Nike needs to take the competition seriously and draw the right conclusions.

The risk isn’t to get replaced by a single big company. The risk is losing market share in all of their product segments to many smaller but more specialized brands.

While all this sounds pretty negative, my perspective on Nike’s future is less dark. The flip side of the new trend mechanisms is that companies that are built on those quick hypes are often short-lived. Nike persists, but most of them don’t.

I also believe that Nike will create new trends in the future. Their innovation has been poor lately, and they know that, which is why they have made management changes and are working on a new innovation cycle.

Management (Decisions)

In October 2024, Nike appointed Elliott Hill as CEO, succeeding John Donahoe. I’m always cautious when it comes to judging the management of multi-billion dollar corporations. They have diversified operations that make it difficult to assess how good a single manager/CEO is.

In this case, however, everything seems like this is the right choice. Donahoe came off as a consultant, and it didn’t seem like he understood what Nike stood for. Hill brings over three decades of experience within the company. His career at Nike began in 1988 as an intern, and he has since held 19 different roles, culminating in his position as President of Consumer and Marketplace before his initial retirement in 2020.

His job now is “revitalizing key product lines,” which is business English for making better products again, strengthening relationships with retail partners, and reviving the Nike company culture that supposedly suffered under Donahoe.

Recent Financial Results

We’ve now talked about the problems Nike had. Let’s look at the financials and see how big the impact actually has been.

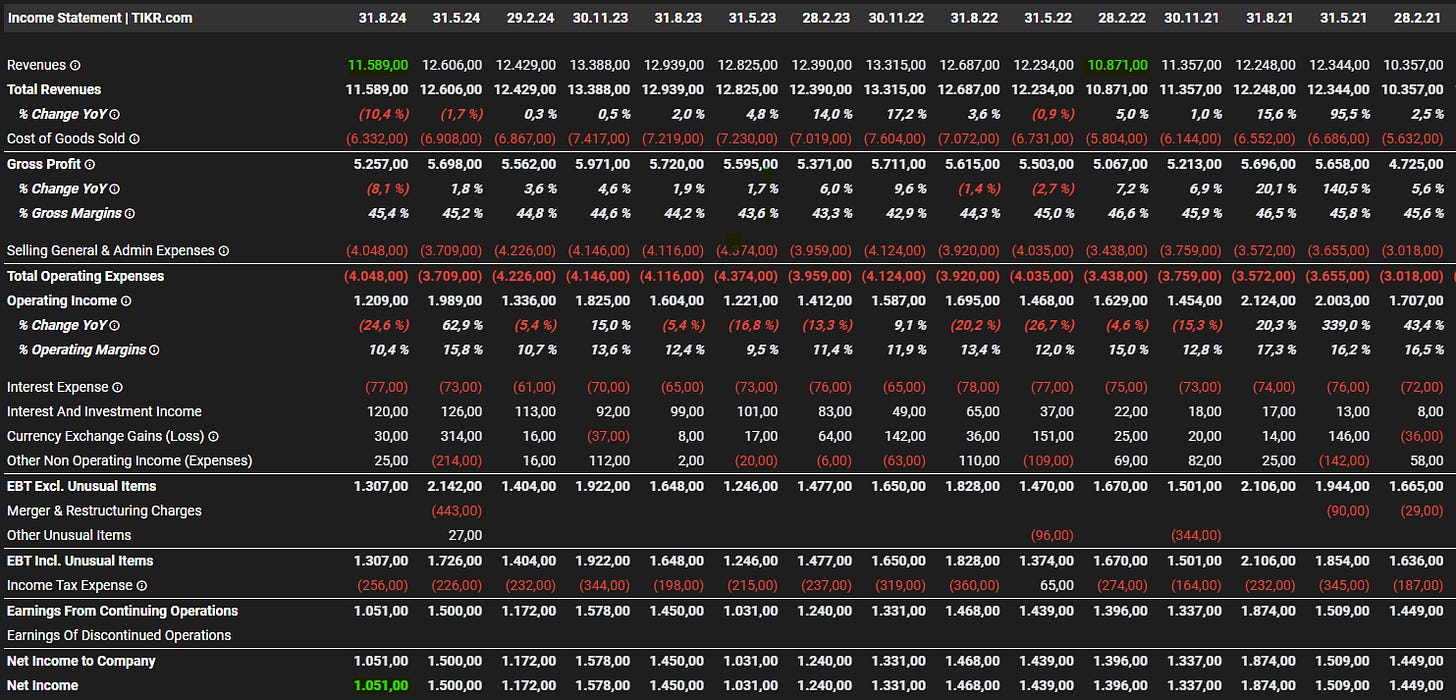

In the results for the first quarter of the 2025 financial year, we see weakness throughout all channels. Revenues overall are down 10%. Nike Direct, the DTC operation, saw a revenue decline of 13%, and wholesale also declined by 8%.

Nike’s profitability took an even bigger hit, with diluted EPS down 26% YoY. This has been the weakest quarter since the Q1 of the 2023 Fiscal year revenue-wise. Profitability-wise, even longer.

Perhaps even worse for the stock has been the announcement by CFO Matthew Friend during the earnings call to withdraw the full-year 2025 guidance due to the “transitional period” Nike is in and postponing the investor day presentation. Instead, Nike will release quarterly outlooks.

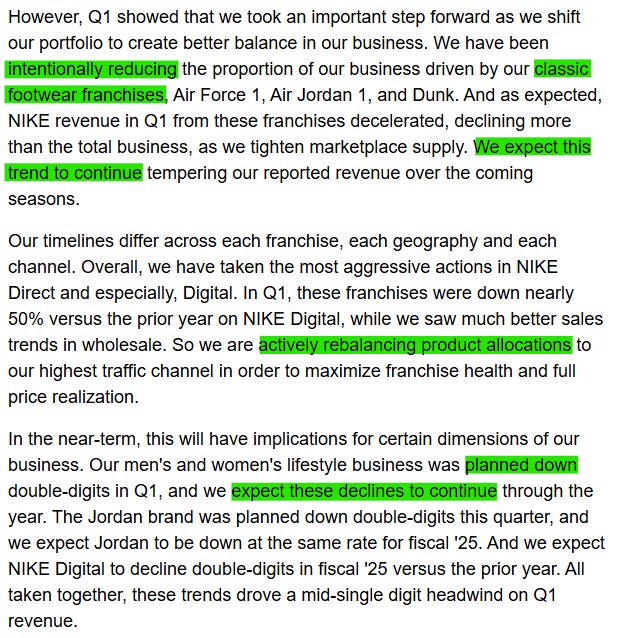

Generally, Nike already hinted at a continued weakness in almost every product and channel as part of the “plan” to refocus on innovative products instead of the classics and rebalance sales channels.

These excerpts give you an idea of the narrative in the earnings call. If this wouldn’t be one of the greatest brands in the world and a company that has proven for decades that they know how to do business, I would be highly skeptical of the “planned” decline.

However, it can make sense in this case since we already discussed that the measures they now take, more innovation and refocusing on retail, are necessary.

To put all of this into perspective, let’s take a look at the bigger picture and see if the last couple of quarters are such a disaster as they seem to be.

The Bigger Picture

If we look at the long-term chart for Nike’s revenues (similar picture for earnings), the current “decline” is almost invisible. We have seen slower growth since 2022, which was also caused by a normalization after the pandemic boom.

We need to answer whether we see a continuation of the trend of the last quarters (so further decline) or a recovery to the long-term growth trend. Answering this question is what makes or breaks Nike’s investment case.

In my opinion, Nike’s brand strength and the operational infrastructure they have built will be a moat that shields off the competitive pressure that is certainly there and getting stronger in the future. Add in the new measures taken by the new CEO; I agree with Bill Ackman that Nike can return to its long-term growth trend.

However, the second important component (besides the “value” or state of the business) of an investment case is still missing—the price you have to pay.

Valuation

As you know, I spent more time looking at small and micro-cap companies, so I haven’t really noticed the massive Nike selloff. I only came across it when I checked some of the superinvestor's newest buys and sales and saw Ackman’s position.

Looking at the stock chart, I thought Nike might be a huge bargain right now. After digging in, I think the picture is not as clear.

The company is currently trading at historic lows. However, historic lows for Nike mean a P/E and P/FCF of 21-22x, not necessarily bargain level.

I think the valuation is quite simple today. Nike trades at a pretty fair price right now, considering the uncertainty around their results but also the fact they’re still producing lots of cash ($6.6bn FCF last year and +$7bn this year).

However, using models like a DCF or reverse DCF makes little sense right now since the cash flow has been volatile in recent years (between $4bn and $7bn), and there will be even more volatility ahead of us.

Modelling from this base is nothing but a guessing game. I know, though, that many of you would like to see such a model. Thus, with the disclaimer in mind, I’ve used the rough average of $5bn FCF for the model below. It showcases pretty well where a Nike investment would generate its returns from:

Looking at this model and the three different scenarios, what would you think is the main driver of returns?

It’s the multiple. Here’s what this model would look like if I assign the same multiple in all three scenarios:

In the first model, you see a difference of $55 between the best and the worst case. In the second model, the difference is only $30.

I believe Nike will manage to recover in the long run after experiencing a tough 3-5 next quarters. Your returns will then come from the multiple the market gives to Nike. Will investors accept Nike as an American premium business again?

If so, Nike will become a double as soon as results recover and stabilize on a higher base.

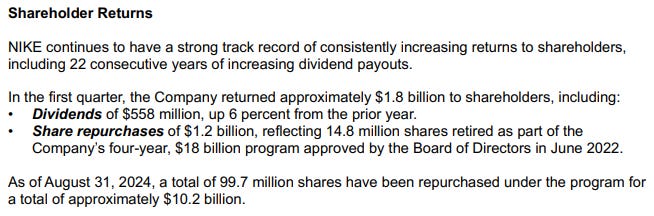

If not, even a business-level recovery will not deliver outstanding returns, as seen in the fast recovery scenario of the second model. However, Nike is also paying dividends and buying back shares. Both can make the time waiting for a recovery more lucrative.

Conclusion

I believe Nike deserves a premium valuation! It’s trading at a fair price right now, but if the business gets back on track, I wouldn’t be surprised to see Nike trading at $120-$130 relatively quickly after.

You have the risks of more competition, though, and this will be a bigger problem in the future than in Nike’s past. Let’s see how they execute in the quarters to come.

When looking through some superinvestors' portfolios, I had the idea of starting a series where I quickly analyze their portfolio’s biggest holdings. Would that be interesting to you? Let me know!

That’s it for today!

Daniel