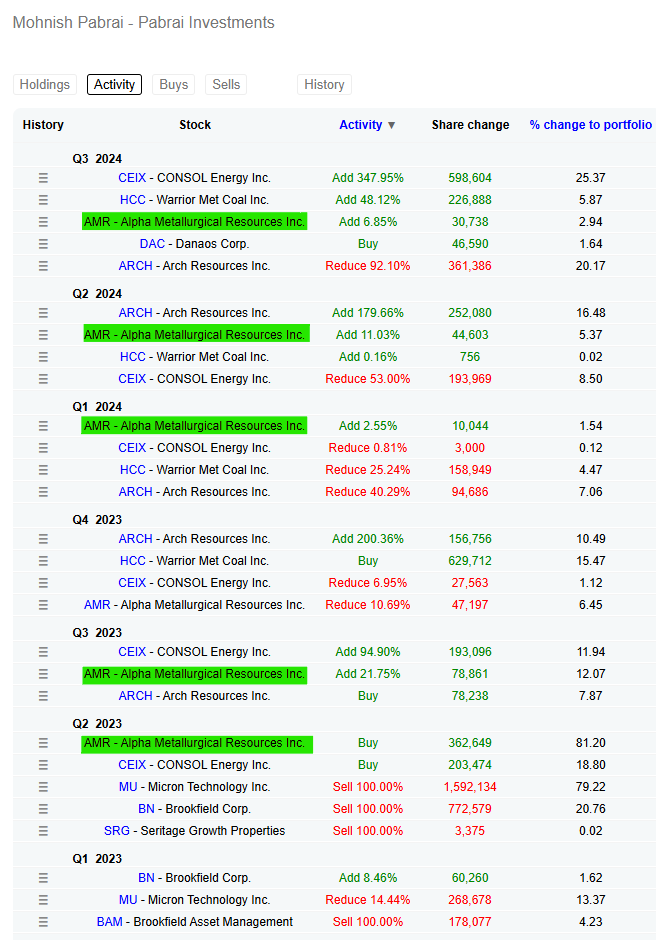

Mohnish Pabrai bets 45% on This Stock!

Mohnish Pabrai bets 45% of his US-Portfolio on the stock we discuss today. He even adds to this bet by other investments in the sector!

Mohnish Pabrai is one of the best-known value investors. He is famous for his “cloning” strategy. This is what he said about finding today’s stock:

“I have no original ideas. I’ve seen a filing by David Einhorn. And his largest position was a coal producer. And I just wanted to answer: Why is David Einhorn so hard and heavy on stupid coal??”

So, let’s keep the cycle going and see if we should clone Mohnish’s investment.

Mohnish accumulated a significant position of over $110,000,000 in today’s stock, which is +45% of his entire US portfolio. Two other positions from the same sector add to this bet.

Combined, they make up ~97% of his US portfolio. If one of the best investors bets this big and(!) the stocks haven’t moved yet, we should take a look.

Learning about this industry was interesting since I hadn’t encountered it before. However, I’m clearly no expert yet. I’ve come across so much more information that I’ll have to do a second part since I couldn’t fit everything here (and I still have some open questions I must answer).

Today’s article will help you understand the market and the investment opportunity. I’ll use Alpha Metallurgical Resources to show the possible upside of metallurgical coal stocks. In my second article, I’ll dig deeper into competitive dynamics, costs, and prices. I’ll also share a detailed valuation/financial model with you.

Alpha Metallurgical Resources is the largest US coal mining company specializing in metallurgical coal. I know… coal sounds ugly, but give it a shot! This company is not in a dying industry—quite the opposite.

Alpha Metallurgical Resources, headquartered in Bristol, Tennessee, operates 21 active mines and nine coal preparation and load-out facilities across Virginia and West Virginia. These operations are strategically located in the Central Appalachian region. AMR also owns 65% of the Dominion Terminal Associates (DTA), an export terminal in Norfolk, Virginia.

Here’s a quick Overview of what makes AMR attractive:

Healthy Balance Sheet → Low (Fundamental) Risk

$485m in Cash vs. 3.6m in Long-Term Debt

Well-run Company → Intelligent Management

Shareholder friendly → Bought back 30% of shares in the last 2 years

Skin in the Game → 11.27% of Shares held by Insiders

Macroeconomic Headwinds → Very Cheap

Possible Bottom in the Cycle

Regulations created Oligopoly

Option-Like Upside Potential

Let’s start with a short industry breakdown.

There are two types of coal: Thermal and Metallurgical. Thermal coal is used for electricity generation. Metallurgical (“met”) coal is used for steel production. It is higher in carbon and lower in moisture and is also referred to as coking coal.

The Process of Making Steel:

When making steel, the met coal is heated above 1000 degrees Celsius in a coking oven. The result is coke, which is then given into a blast furnace together with iron ore. Hot air and PCI are introduced and increase the temperature to over 2000 degrees Celsius.

This produces carbon monoxide, which, combined with the high temperature, converts the iron ore into a liquid. The liquid is then cleaned of impurities, and alloys are added. Voila—you have created iron.

Thermal vs. Met Coal:

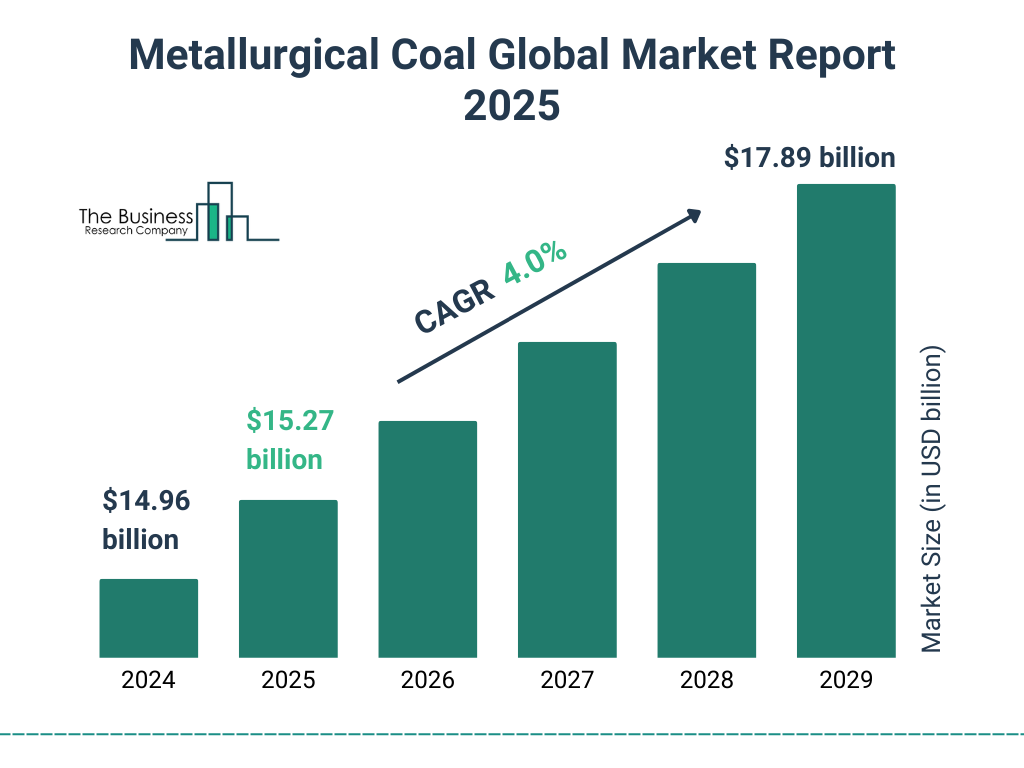

The difference between met coal and thermal coal is important because it explains why AMR is not operating in a dying industry. Coal used for electricity is slowly decreasing and will face increasing long-term troubles (except for high-quality CV thermal coal, perhaps). However, coal used for steel production is a growing industry and will remain so for the foreseeable future.

Experts expect the met coal market to grow between 2% and 4% annually in the next five years, depending on the forecasts.

China is by far the largest consumer of met coal. Its weak economic situation, especially in the property sector, has been a major factor in the decline of prices in recent years. India is second on the list of consumers, and its demand is rising much faster than Chinese demand.

While the left chart makes it seem like India is still of little relevance, that’s not the case. In fact, for AMR, it is highly relevant since India is importing met coal at the same levels as China (both about 20% of total imports; 2022 numbers) and has accounted for ~37% of AMR’s export sales over the past five years. AMR doesn’t sell any of its coal to China. AMR is still dependent on the Chinese economy, though, due to China’s influence on met coal prices.

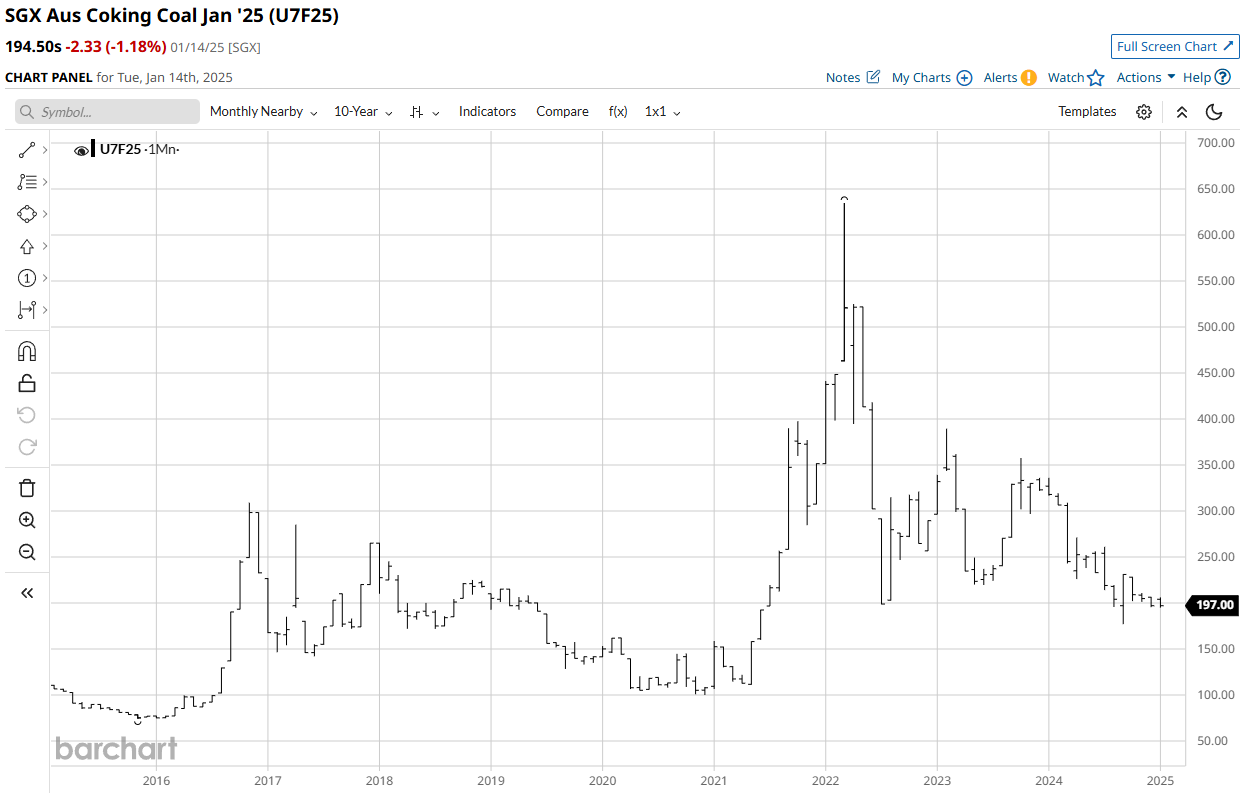

However, the weakening Chinese economy is not the only reason for the severe decline in coal prices. Part of the story is that prices in 2022 have been far above historical averages.

There are three main reasons for the outlier in 2022. The biggest has been the Russia-Ukraine war, which caused massive supply chain issues and general shifts in global trade dynamics. A longer-term trend has been the regulation regarding ESG, which (indirectly) caused many mines to close, thus creating a supply problem when demand shot up both after the pandemic and at the beginning of the war.

While the problems weren’t completely solved, demand flattened due to the Chinese economy and countries adjusting to the new circumstances. China’s lower demand for steel, and, hence, met coal, hurt the market in two ways. First, Chinese imports of met coal went down, and second, China dumped its overproduction onto the market. This caused prices to come down significantly. Accordingly, the profits of met coal companies like AMR also declined.

If you look at AMR’s revenue and net income chart, you can see the resemblance of the met coal price chart. It’s relatively easy to see that investment success with AMR is primarily dependent on the met coal price.

Thus, we need to find out where in the cycle met coal currently is, where prices could go, what that would mean for AMR’s profits, and whether AMR (and we as potential investors) can wait that long. One of the biggest risks with cyclical companies is that the downcycle lasts longer than expected and that companies do not survive it. (From an investor perspective, you also have potential opportunity costs as a risk.)

Where in the Cycle are we?

As always with cyclicals, many factors influence a cycle's duration. So, there is no exact, fixed duration for these cycles. However, we can try to estimate where we are by looking at historical patterns.

Looking at historical prices can be a bit confusing at first since there are different grades of quality for coal and thus different prices. The market standard is the price index for “premium low volatility hard coking coal.” In the chart above, we look at “Australian low vol PCI.” We can see lows in 2014-2015 and then again in 2020. A visual analysis might suggest that we are in the middle of a cycle right now.

If that were the case, the investing opportunity would involve some risks. Yes, AMR is very cheap (see below), but we wouldn’t know how low coal prices will go or how big the impact on AMR’s financials will be. If, however, we are close to the bottom, then we have a company that is extremely cheap, financially perfectly healthy, and ready to benefit from all the price increases in the next upcycle. And I think there are signs that could show we are at such a bottom.