Is GAP on the Verge of a Turnaround? A Stock Analysis of The Gap

Today, we will look at another retailer (after recently reviewing Nike). One of my readers recommended today’s stock. I’ll happily research your ideas when I have the time. So keep them coming!

These posts will sometimes be briefer than my usual ones just because the businesses are typically well-known (which is totally fine!). So, instead of explaining the business and industry in detail, I will give a shorter introduction and then follow with my opinion on the current investment case.

My next Stock pitch (scheduled for next Friday for now) will be more extensive and deal with the company I added just yesterday to my portfolio (Paid Subscribers got a notification).

After many small-cap investments, this is my first large-cap investment in a while. In 2025, there will be a greater mix of small and large-cap investments.

Don’t miss it and become a Founding Member!

Learn more about what changes in 2025 and secure the lowest price ever:

Content

Introducing The Gap

The Gap Stock

Past Performance and Current Valuation

Recent Results and Turnaround Story

Income Statement

Balance Sheet

Cash Flow Statement

Competition

Lululemon

H&M

Abercrombie and Fitch

Brand Breakdown

Athleta

Old Navy

Gap Global

Banana Republic

Geographic Breakdown

Investment Case

Introducing The Gap

GAP is a leading American clothing and accessories retailer founded in 1969 in San Francisco. It operates four brands: GAP, Old Navy, Banana Republic, and Athleta. Here’s an overview of what the brands stand for:

We will look at each brand's recent results individually, but first, let’s take a look at GAP’s stock development.

GAP Stock

GAP stock has been extremely volatile since… well, ever.

If we look at the 10-year returns, GAP has delivered a negative return of around 40%. If we take a 5-year period, GAP is up ~40%, and in the past twelve months, GAP is up 31%. And even in those 12 months, GAP has traded from a low of $18.6 to a high of $30.6. As I said, the stock is volatile.

The stock looks cheap on a fundamental basis. The forward P/E stands at 11x, just like the EV/EBIT. Compared to its competitors, GAP is one of the cheapest companies in the industry. However, AEO (American Eagle) and ANF (Abercrombie and Fitch) are equally cheap, especially in the second comparison. This could suggest that “cheap” is the wrong word and that these multiples are fair for apparel companies in the current environment.

Sure, Nike and Lululemon are trading at higher multiples, but the businesses are superior in many ways. Nike currently struggles on a fundamental level but has the strongest brand of all companies. Lululemon has arguably the second-strongest brand and, as we will see in a minute, still grows decently (outside of the US).

Nevertheless, what makes GAP seem attractive is the turnaround that happened since Richard Dickson joined as the new CEO. If this turnaround is real and improves GAP in the long run, it might deserve higher multiples going forward. Combined with earnings growth, that could be a good opportunity.

Let’s check out the turnaround story:

Recent Results and Turnaround Story

GAP’s business performance has not been great over the last decade. Revenues and net income are lower than they were 10 years ago. Even in recent years, revenues kept declining. However, profitability has increased significantly in 2024.

Income Statement Turnaround:

All four brands have returned to growth (more on that later) after delivering lousy results in 2022 and 2023. The declining revenues hide the fact that operating margins have improved significantly since Dickson took over, leading to remarkable growth rates for operating and net income.

Balance Sheet Turnaround:

When I research a company, the first thing I check is its balance sheet. I’d only invest in companies with a weak balance sheet on rare occasions (special situation investments). GAP’s balance sheet can be considered healthy. Since Dickson came in, the company has focused on growing its cash position (64% growth YoY), which I like, especially in a weak market environment.

In absolute terms, the cash position increased by over $600m and now exceeds long-term debt. Merchandise management has also improved significantly. Ending inventory in Q3 decreased by 2% year over year and was consistently lower throughout 2024 than in 2023, which has been the main driver for the improved merchandise margins (90bps increase year over year). In Q4 of 2023, the first full quarter with Dickson on board, ending inventory decreased by 16% year over year.

There’s a clear path to cutting opex and focusing more on profitability, which is a welcome change for investors.

Cash Flow Turnaround:

Cash flows also recovered from the 2022 levels. However, that has already been the case in 2023. Year-to-date net cash from operating activities was $870 million. Year-to-date free cash flow was $540 million.

I may remind you that these strong 2024 numbers are generated in a very challenging industry environment. The apparel industry shrank by 1.5% last quarter due to weak consumers, inflation, and weather events like hurricanes and storms. (GAP disclosed that the weather extremes cost them approximately 1% of net sales growth.) I don’t know yet if the fires impacted the business and, if so, how much.

We recently talked about Nike and their problems. If the industry's biggest and most powerful brand struggles this much, these results are even more promising. Now, you might say the problems at Nike are unique to the company and that it is primarily a shoe retailer that only generates 14.5% of its revenues from apparel. And you’d be right. However, Gap’s more direct competitors also felt the pressure.

Competition

Lululemon:

LULU has been the industry's growth stock in recent years. However, after a challenging year in 2024, the stock more than halved from the beginning of the year to August. As so often, the market overreacted and realized its mistake later that year. In response, the stock rallied 65%. While still below all-time highs, it recovered quite well.

But how do the fundamentals look?

At first glance, LULU grew at decent rates. In Q1 2024, revenues increased by 10%, in Q2 by 7%, and in Q3 by 9%. However, on closer inspection, you will see that LULU also struggled with lower demand. Over 74% of revenues are generated in the US and Canada, and growth in this region is much lower than overall sales growth would suggest, averaging only 2% from Q1 to Q3 of 2024.

So, overall growth was primarily fueled by the 40% average growth in China and 26% average growth in the rest of the world. These are strong growth rates; however, if the US business fails to regain growth in the long term, overall revenue growth is likely to decelerate considerably.

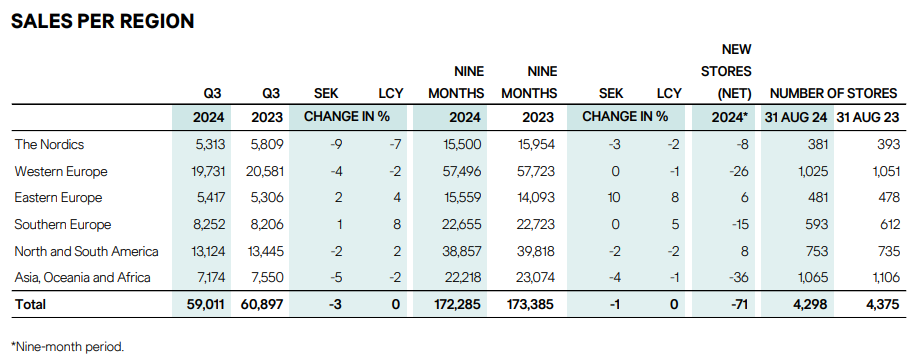

H&M:

H&M is clearly encountering problems in this challenging environment. While it delivered a good second quarter, its overall performance in 2024 was rather weak. It lost market share across all geographies except East Europe.

The operating margin decreased 1.9% year over year in Q3 due to increasing SG&A expenses and forex headwinds. The total number of stores decreased from 4,375 to 4,298.

Abercrombie and Fitch:

Abercrombie and Fitch is one of the few companies in the industry that can report good numbers across the board. Its top and bottom lines grew, and its operating margins are attractive at around 15%.

As is often the case when a company outperforms over a couple of quarters, the market expects this outperformance to last forever. Despite posting earnings in line with expectations, the stock tanked (-18%) after the latest earnings release two weeks ago. The guidance wasn’t the problem either, as it was also raised.

To summarize, while most companies in the industry struggle, companies like Abercrombie and the Gap can consistently gain market share and improve their financials quarter over quarter.

Let’s examine Gap's individual brands to determine where their growth comes from and whether it is likely to continue.

Brand Breakdown

The table below shows the comparable sales by brand. To get a better idea of real sales growth, the comparable sales (or like-for-like sales) adjust for sales from new stores opened and stores closed.

Athleta:

Let’s start with Athleta since we see the most significant turnaround here. Just a year ago, comparable sales declined in every quarter and totaled 12% in the fiscal year. In 2024, the picture changed and Q1 and Q3 showed 5% growth each. In the second quarter, comparable sales declined by 4% because of a previously planned and communicated discounting campaign to reset the brand image.

Judging by the numbers, the rebranding works. However, I lack “on-side insight.” That makes it difficult for me to judge the brand on a quality or popularity level. According to the company, the brand is attracting high-value customers and is building a community (the numbers support this). On TikTok, it became one of the fastest-growing sportswear brands since its launch in February.

Athleta currently generates ~7.5% of GAP’s sales ($290m of $3.8b).

Old Navy Global:

Like Athleta, Old Navy was a problem child for GAP in 2022 and the first half of 2023. Since then, the business has changed its focus and regained strength, growing comparable sales each quarter. In Q3, growth was slowed due to weather-related headwinds, which resulted in store closures. Gap closed 180 stores, of which 90 were Old Navy stores.

This is what the management said about the business changes:

Old Navy is GAP’s most important brand by revenue, generating ~78.5% of GAP’s sales ($2.2b of $3.8b).

Gap Global:

Gap Global has been the most stable brand in the past, and it continues to be so, with 3% comparable growth in every quarter of 2024. Still, this is a great development since being GAP’s most stable brand means it also decreased in the years prior, just a little less than the other brands…

There is not much news about Gap's business. Management's message is basically, "Business as usual.”

Gap Global currently generates ~23.6% of GAP’s sales ($899m of $3.8b).

Banana Republic:

Banana Republic was the second-worst performer in 2023. While the numbers improved, there’s still no visible growth. Gap is still in the process of giving the brand a new image.

To achieve that, the focus is shifted toward social media and influencer marketing. Additionally, stores will be repositioned to new locations that better fit the target audience.

The next quarters will show whether this strategy can fuel growth. Judging by the track record of the other brands, I wouldn’t be surprised by improvements. However, it is hard to say how fast they will come.

Banana Republic currently generates ~12.3% of GAP’s sales ($469m of $3.8b).

Geographies

I’ve mentioned that Lululemon's growth numbers were “rescued” from global demand and sales because the US results were weak. Gap must rely on its regained strength in the US since it cannot offset weak US results with international strength.

You can decide whether this concentration in the US market is positive or negative. Currently, the US market is relatively weak, but that can change within a year or two. I don’t have a strong opinion on the geographic concentration, but I believe the US market will grow in the long run, so I wouldn’t see it as a risk. Success will be more dependent on good execution at the company level.

In a couple of weeks, this Research Platform will get a huge Update! Be a part of it and become a Founding Member! Read about all the Updates here:

Investment Case

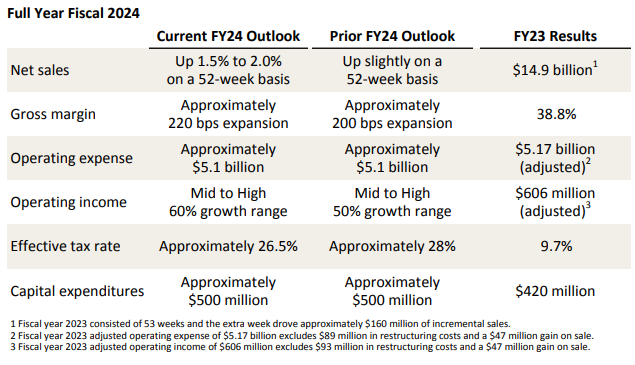

Due to the strong third-quarter performance, Gap raised its guidance for the Full year of 2024.

Now, if we do the calculations and assume net sales grow 1.75% (the average of guidance), this gives us $15.16 billion. Staying conservative on operating income, assuming 60% growth, gives us $970 million, taxed at 26.5%, leaving us with ~$713 million in net income.

This would suggest a forward P/E of 13, slightly higher than the current estimated forward P/E of 11-12, which is normal since this is a rough calculation, and we only estimated 60% operating income growth instead of the guided “mid to high 60% growth range.”

Summarized, you get a 2.4% dividend yield and can buy a profitable business returning to growth for a P/E of 11-13x. However, while the next quarters could bring positive surprises, such as higher-than-expected margin expansion, longer-term growth will likely stay in the low to mid-single digits.

If we add a 2.4% yield to 3% growth and expect no multiple expansion, you’ll get a return of 5.4%, which is not that appealing.

If we assume that multiples expand to 15, the 5.4% return increases to 25% (assuming a current multiple of 12). So, with multiple expansions, you could get a short-term return of +30%.

While this is absolutely possible, I wouldn’t want to bet on Gap right now. The return is only attractive under the assumption of multiple expansion, and a single bad quarter or a slowdown in the growth trend, which can always happen in retail, would wipe out all good returns.

To me, Gap is fairly valued (for mid to high single-digit returns), considering the uncertainty about the longer-term outlook and the sustainability of the turnaround trend.

That’s it for now! I look forward to the next pitch!

Have a great day!

Daniel