Is Disney Stock a Buy at 10-Year-Lows?

After my Disney and Streaming Deep Dive earlier this year, I thought it is time for an update to see how Disney handled the challenges mentioned. Is it a better buying opportunity now?

Disney is down 30% from its highs this year, and even worse, it’s currently at 10-year lows. At the beginning of the year, I wrote a Deep Dive on Disney and the Streaming Sector, so that’s where to look when you want an introduction and deeper insight into the Disney business.

Today, I’ll compare Disney’s progress since my last article and answer whether Disney is a buy at these prices and what returns can be expected.

Disney’s Recent Developments

Theatrical Releases/Box Offices

Last year, the box offices didn’t perform well. They generated only $4.9 billion, compared to an average of ~$7 billion/year in the last 5-6 years. Movie releases generally account for mid-single-digit percentages of Disney’s annual revenues.

In 2024, box office performance improved. Multiple movies exceeded expectations. Among the successes were “Inside Out 2,” which is the highest-grossing animated movie ever, having topped $1.5 billion at the global box office, and “Deadpool & Wolverine,” which didn’t cross the billion-dollar mark but became the best domestic opening for an R-rated film, generating more than $850 million in global ticket sales.

Other highly anticipated movies like Moana 2 and Mufasa will follow in November and December.

With Disney's creative segment regaining strength, brands can be better positioned and monetized again through Disney Parks and additional content on Disney+. Having said that, let’s discuss Disney+’s recent developments.

Direct to Consumer and Disney+

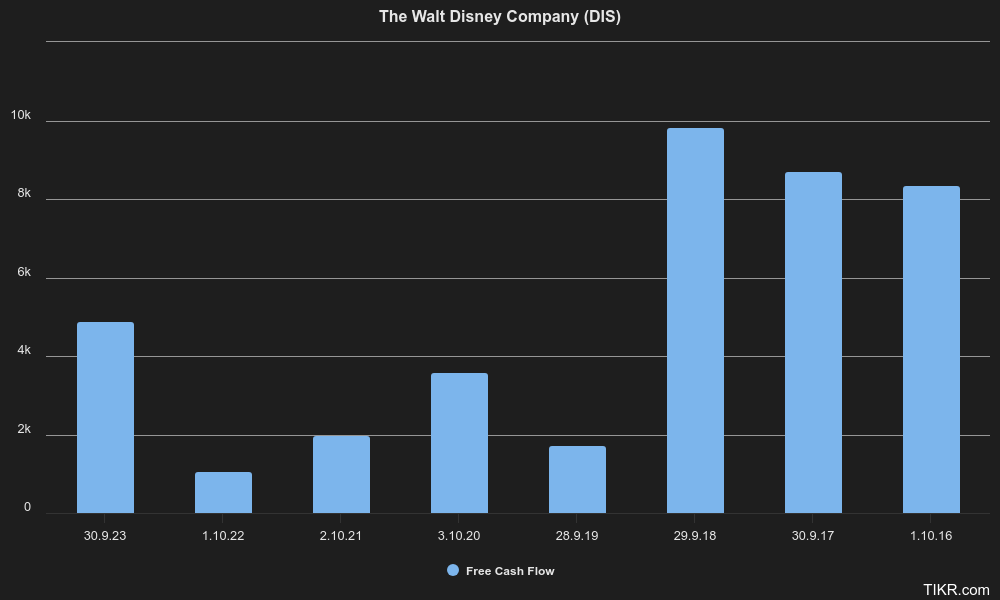

One of Disney’s biggest problems in recent years has been its Direct-to-consumer business, especially Disney+. While successfully gaining subscribers, it doubled Disney’s costs of goods sold and caused a decline from $9.8 billion in FCF in 2018 to an average of ~$2 billion from 2019 to 2022. In 2023, FCF recovered slightly to $4.9 billion. In 2024, Disney is on the right path again, expecting FCFs of $8 billion for the year.

These financial improvements are linked to Bob Iger’s return and, among other things, his changes in the DTC segment. His two main goals were to reduce costs and stop the content inflation that caused a decline in viewer numbers and worsened the reputation of flagship franchises like Marvel or Star Wars.

As a result, he wanted to achieve profitability in the DTC segment in Q4 of 2024. He cut Disney’s workforce by approximately 3%, canceled bad-performing shows, slimmed down the publishing schedule, increased prices for Disney+, and introduced an ad-supported tier. Just recently, he also initiated a crackdown on password sharing, but the impact of this measure will only be shown in the quarters ahead.

However, he already achieved his goal and reached profitability even earlier than anticipated. In Q3, the DTC segment reported a profit of $47 million. That’s far from having a material impact on profits, but it is much better than the huge losses seen before.

The goal now is to close the gap with Netflix, which is much more effective than Disney, judged by one of the key metrics in the streaming business: Average Revenue per User (ARPU).

Netflix’s global ARPU is slightly below $12. Its domestic ARPU, including the US and Canada, is a little over $17. The discrepancy comes from the different subscription prices depending on the country. International customers from Africa or India pay less per subscription than domestic or European users.

Disney+’s domestic ARPU in 2024 will be between $7 and $8. Assessing the global ARPU isn’t as easy as in Netflix’s case since Disney offers different services depending on the geography. The main service is Disney+ core, which is the same as the domestic Disney+ service. It’s active in almost all nations except India, Indonesia, and some other Southeast Asian countries. The ARPU is close to the domestic one at $6.80.

Hotstar is the streaming service active in the markets that Disney+ core doesn’t cover, and its ARPU is highly volatile. In recent quarters, it ranged from $0.70 to $1.30. Since Disney has a lot more subscribers in the Indian market than Netflix (36 million for Disney vs. 10-12 million for Netflix), Disney+’s global ARPU is more heavily impacted by the lower subscription prices than Netflix. While this might be a negative short-term, India will be an important market in the future, and Disney is much better positioned to capture it.

Also, there are opportunities to increase ARPU in countries with lower subscription prices by increasing the focus on advertising revenues.

Closing the ARPU Gap:

In my Deep Dive, I already raised the question of how Disney is supposed to reduce the gap between ARPUs. This will remain a longer-term challenge considering the measures already taken and the still significant difference.

Disney's bundling and upselling potential through its many brands and franchises is a good option and a differentiator from Netflix. These bundles offer consumers more value and allow Disney to cross-promote services.

Another strategy is to leverage strong franchises like Marvel, Star Wars, and Pixar further. These are major differentiators that, if used correctly, should improve pricing power and retention.

In addition to content, Bob Iger emphasized improving the technical side of Disney+, such as optimizing the user interface and content discovery through better and more personalized recommendation algorithms and an increased focus on streaming quality.

Disney’s Problems

Despite making good progress with the abovementioned difficulties, Disney still needs to solve some problems to regain its past success. Some of the remaining problems are temporary, so I consider them more of an “opportunity maker” for long-term investors in Disney. Others are existential threats to Disney’s business and part of the uncertainty surrounding the company.

Temporary Problems:

The Q3 results show a slowdown in the Experience Segment, especially in Disney Parks. While revenues grew by 2%, operating income declined by 3%. The revenue guidance for the next quarters has been “flattish.” However, Disney’s CFO repeatedly stated that he wouldn’t call this a recessionary slowdown and sees no “significant” change in consumer behavior.

I think Wall Street overinterpreted the slowdown due to the general recession fears that are still around. The Parks have been doing great since reopening in 2022 and will continue to do so in the long term.

Long-Term Problems:

Legacy Businesses: One of Disney’s biggest problems is the decline in cable and the consequential decline in revenues and cash flow this segment produces. Last year, Disney made $11.7 billion in revenues from the Linear Network Segment. These are “high-quality revenues” since they have good net margins and a sizeable impact on Disney’s cash flows.

In the Deep Dive, we discussed the structure of the Linear Network market and how ESPN dominated the space, generating up to 90 times(!) the revenue per subscriber as other networks. The latest numbers are $9.42 per subscriber for ESPN.

However, ESPN’s profitability will be under great pressure in the future, driven by the increasing number of people cutting the cord and the increasing cost of sports rights deals.

ESPN’s old NBA contract cost them $1.4 billion a year. The just-signed contract almost doubles the costs, standing at $2.6 billion. Bob Iger’s long-term plan for ESPN is to transition fully to ESPN+ and be part of the DTC segment.

While that seems like the best option, ESPN's prices will skyrocket, and whether consumers will be willing to pay those prices is questionable. The NBA deal alone would be the equivalent of over $3 per month for an ESPN subscription ($2.6 billion divided by 70 million users).

That might not sound like a lot, but imagine all the other sports and production costs ESPN has, the ever-increasing prices of sports rights, and possibly a further decline in users, which would result in higher costs for each paying subscriber. ESPN prices could be multiples of the $9.42 subscribers are “technically” paying now.

Disney will probably have to devise alternative models to monetize audiences in order to keep prices affordable and still profit from these contracts. As mentioned in the Deep Dive, it won’t help that the competition is highly profitable tech companies like Amazon, Apple, or Microsoft.

Disney is also still looking for a partner for ESPN. As discussed in the deep dive, this could be one of the big tech firms or the major US sports leagues. According to CFO Hugh Johnston, talks are still ongoing, but there’s nothing to be published. It doesn’t seem like there has been any progress on that front.

This transition is probably the biggest uncertainty left now that Disney+ is on the right path and no longer a drag on Disney’s financials.

Financials/Debt:

Talking about Disney’s financials… In the deep dive, we discussed how the recent acquisitions have increased Disney's debt burden. The biggest impact came from the $72 billion deal to acquire 21st Century Fox in 2019.

This deal resulted in a significant increase in long-term debt from 2018 to 2020, a decrease in retained earnings, and a dilution of shareholders through roughly 300 million newly issued shares.

While Disney has slowly started decreasing its long-term debt position in recent years, its balance sheet remains relatively weak. However, assuming that Disney can maintain at least $8 billion of FCF, there shouldn’t be any financial trouble arising.

Investment Case

Last time, I used $7 billion in free cash flow since this was management’s guidance. Since Disney reached $8 billion, and I consider this a realistic estimate for the lower bound of FCF in the future, I’ll use this as my input. Using a 5-year average, as I usually do, makes little sense in Disney’s case due to the low levels of FCF of the last years that are not representative of future results.

Using these inputs, Disney would need to grow its free cash flows by ~20% for the next five years and by 12% for the five years after that to achieve a 15% annualized return.

This seems like a stretch if you ask me. I’ve done some calculations on what Disney+ might add to FCF in the years to come, but I quickly realized that it’s a total guessing game. We can’t project any subscriber growth since Disney has struggled for quite some time now to break through the 160 million mark.

Estimating future ARPUs is equally difficult since Hotstar is a black box without visible trends and is important to the DTC's future. The ESPN transition is adding to the uncertainty and might be even more important since, if it fails, a significant share of FCF will be under threat.

I always like to look at the absolute numbers when performing DCFs or reverse DCFs. Percentages can easily fool us. Looking at this model, Disney would need to produce $16 billion of FCF in 2028. I don’t see any realistic scenario for how to do that, and the years after that seem even more unrealistic.

If 15% is unlikely, what return can we expect? Here’s a model using a 10% discount rate. Now, Disney would “only” need 9% FCF growth in the first five years, followed by five years of 5% growth. This is a lot more realistic if you ask me.

Looking at the absolute numbers, this would “only” take a double in FCF over a 10-year period. Considering that Disney has already seen FCFs of ~$10 billion and Disney+ is not burning cash anymore, this seems very possible.

So Disney is currently priced for a 10% return. As always, take these models with a grain of salt and question all the inputs and their likelihood. However, the reversed DCF is already solving many of the problems of a normal DCF, so I think they still give us a good idea of what Disney needs to deliver for double-digit returns.

Since I aim for annual returns of around 15%, Disney is currently not a buy for me. If it should go into the 70s again, this might change. I like the company and the moat. And if I had to bet, I’d say that they will be better positioned in five years from now than most people think.

That’s it for today!

Daniel