How Warren Buffett Invests in Quality Companies

Warren Buffett is the most successful investor of all time. Over his career he changed from Investing in bargains to investing in high-quality businesses. Here's what he looks for.

"It's far better to buy a wonderful company at a fair price, than a fair company at a wonderful price.” - Warren Buffett

I’ve compiled a list of five things that Warren Buffett looks for when he decides whether a company is meeting his criteria for a high-quality compounder or not. These points are derived from his annual shareholder letters, interviews, and other publications of him.

1. Consistent and Predictable Earnings

Warren Buffett wants to own companies that have a consistent financial history. He is not interested when the company’s financials are obscure and non-transparent.

There is no way to find out what a company is worth if you can’t predict the future earnings power of the company.

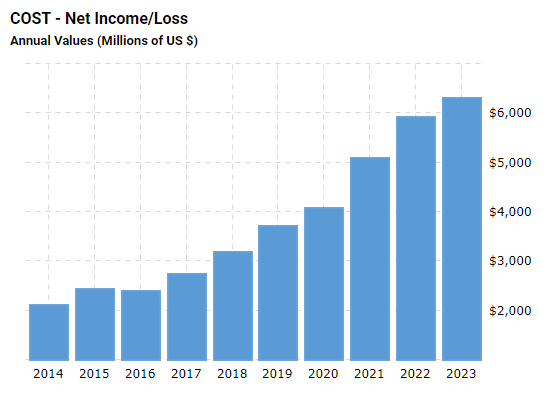

Costco is one of Buffett’s and Munger’s all-time favorite companies. If we look at their financial history, we get a pretty good idea as to why.

2. Sustainable Competitive Advantage

If you want to see financials like the ones above, you need a company that is not only growing but improving margins at the same time. The only way to do that consistently is by having something that sets you apart from the competition.

Either in the eyes of the consumer. For example, by being perceived as the superior brand. Or by having a macroeconomic advantage such as cost leadership or access to technology no one else has.

Historically, a strong brand seemed to be among the most substantial advantages you can have. It comes with tremendous pricing power. However, it is also the hardest to achieve.

Apple is a Lollapalooza of competitive advantages. It’s considered the strongest brand name in the world and simultaneously manages to be a world leader in tech innovation. Once again, it’s not surprising that Buffett’s biggest-ever purchase was this exact company.

3. Capital Allocation Skill

When you look for companies that you hold as long as possible, you need to have confidence in the management and the CEO of the company.

One of the most important factors of good management is the ability to allocate capital. He looks for managers who are skilled at deploying the company's capital wisely, whether through reinvesting in the business, making acquisitions, or returning value to shareholders through dividends or share buybacks.

The best way to allocate capital depends on the individual company. There is no general right way to do it. Buffett does not strongly favor any specific capital allocation method. In the end, capital should be allocated to the long-term benefit of its shareholders.

“The lack of skill that many CEOs have at capital allocation is no small matter: after ten years on the job, a CEO whose company annually retains earnings equal to 10% of net worth will have been responsible for the deployment of more than 60% of all the capital at work in the business.” - Warren Buffett

My Investing Platform is now Online for Paid Subscribers.

Features are:

Monthly Deep Dives/Valuations of Companies (In two days, a China and Alibaba Deep Dive)

Free Access to my Investing Courses

Access to my Portfolio

Direct E-Mail Access to me

4. Low Capital Intensity

Companies with low capital intensity tend to perform better financially. Not only because they often generate higher margins but also because they get into less trouble in economic downturns.

They have less need for debt financing, which makes them more resistant than companies that rely on refinancing through debt.

Sometimes, things are very easy in investing. A company without debt has a hard time going bankrupt, even if they try very hard.

The other big advantage is their ability to reinvest. Take See’s Candies, for example. See’s Candies is the company that turned Buffett into a quality investor.

In 1972, Buffett acquired See’s for $25 million. Back then, See’s had capital expenditures of $8 million to run their operations. They made pre-tax profits of over $5 million. This resulted in a 60% return on invested capital when Berkshire took over.

According to Buffett, over the following decades, See’s invested a total of $32 million in capital expenditures over the years. With this $32 million, they generated over $1.3 billion in pre-tax earnings over that period.

5. Industry Dynamics

Buffett is known for his weakness to airlines. An industry that he himself often refers to as one of the worst industries of all. Still, he repeated his mistake of investing there again and again.

One of the few times the Oracle of Omaha doesn’t seem to learn from his mistakes. Even though he’s very vocal about the low quality of airlines publicly.

Besides the airline industry, there are other industries that are structurally unattractive places to invest in.

Their characteristics are:

a) Intense Competition

b) Low Margins

c) High Cyclicality

d) Many bankruptcies

If you want to read through all of Buffett’s published writings, you can find a PDF in my Investing Ressource section:

If you’re interested in my Investing Checklist System, you can check it out here:

https://danielmnkeproducts.com/

Now, have a great day and enjoy the evening. If it’s evening where you are ;)