How to analyze the three Financial Statements

Since many of you guys asked me on Twitter, here's my latest Thread also published here.

Every Investor MUST know how to analyze companies. A huge part of that is analyzing the 3 financial statements. Here’s how to analyze and interpret the…

- Balance Sheet

- Income Statement

- Cash Flow Statement

1. Balance Sheet

The balance sheet tells you about the net worth and health of a company. What assets does the company own (Assets) and Where did the money for those assets come from (Liabilities)

1.1 What to look for?

1) Cash & Equivalents Position

2) Relation of Debt and Equity

3) Retained Earnings Position

1.2 What You want to see (Rule of Thumb):

1) Cash-to-Current Liabilities Ratio > 1

2) Debt-to-Equity Ratio < 2

3) Retained Earnings-to-Total Assets > 40%

2. Income Statement (Profit & Loss Statement)

The income statement tells you about a company’s revenues and expenses. It makes sense to compare two or three consecutive P&Ls to look for trends.

2.1 What to look for?

1) Uptrends in Revenue and Earnings

2) Profit Margins

3) EPS Growth

2.2 What you want to see (Rule of Thumb):

1) Uptrends in Revenues and Earnings >15%

2) Profit Margins >20%

3) EPS Growth >15%

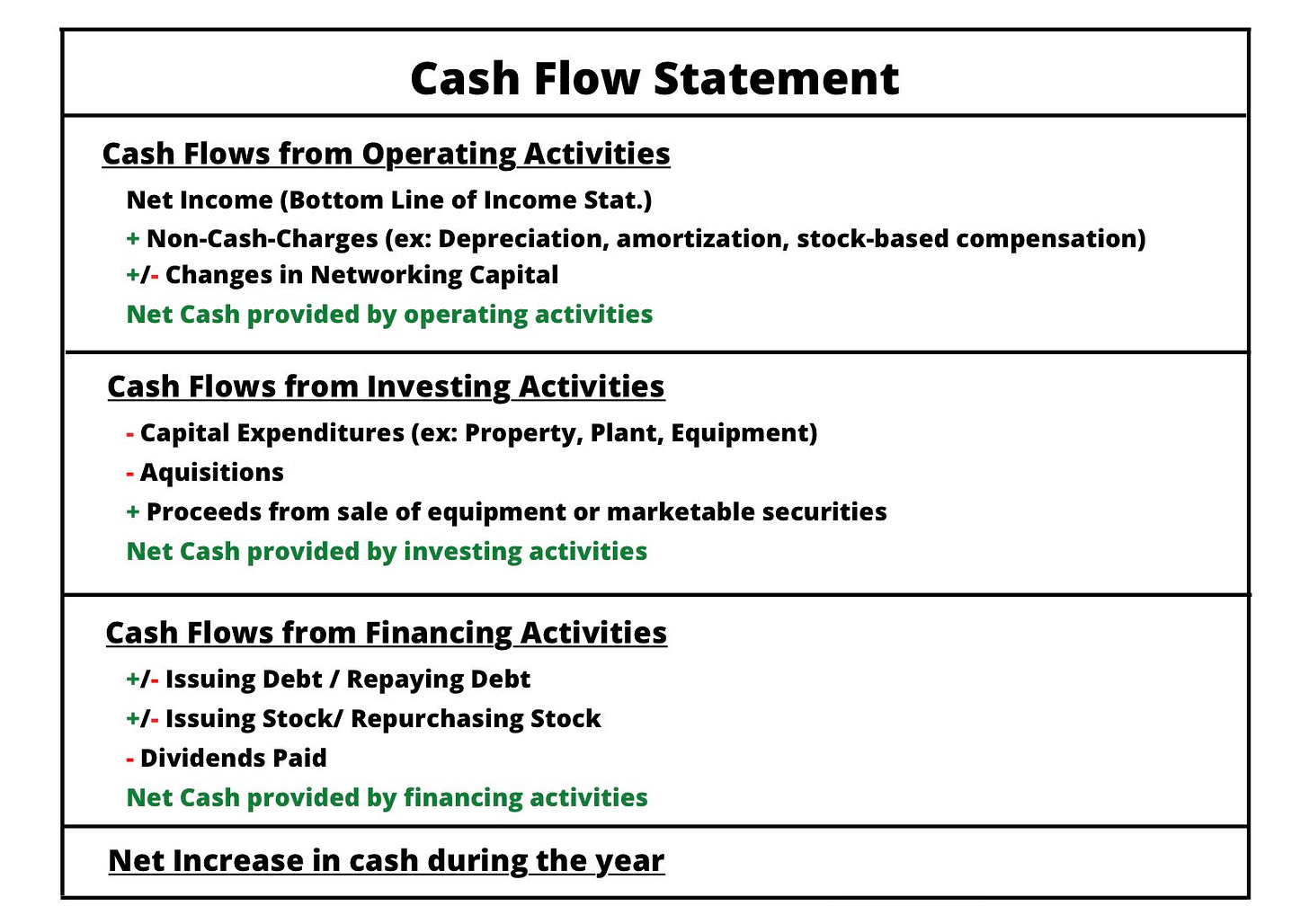

3. Cash Flow Statement

The cash flow statement shows how cash moves in the business. It’s where you see if the company is generating or burning cash.

3.1 What to look for?

1) Net increase/decrease in cash

2) Operating Cash Flow relative to Capex

3) Is Debt issued or repaid?

3.2 What you want to see (Rule of Thumb)?

1) Net increase in cash

2) Operating Cash Flow > Capex

3) Debt get’s repaid regularly

That’s it for today. Thanks for taking the time!