🃏 Evolution Gaming - A Deep Dive and Investment Thesis

Evolution has been the subject of much discussion lately. There’s a heated debate about whether the company’s phenomenal run of recent years is about to end or whether this is one of the best opportunities in the market right now.

As investors, we need to form our own opinion on these questions. I’ll try to give you all of the information you need to do that today.

We will discuss the iGaming industry, analyze Evolution’s Business and Moat, assess the Risks, and, in the end, I’ll give you my Valuation and Investment Decision.

Starting in March, you can get even more extensive Deep Dives every Week + Many Additional Features. Learn more about them here:

Become a Member now at the best price ever: $16/Month instead of $100/Month

Content

Introduction to Evolution

The iGaming Industry

Evolution Products

Market Size and Outlook

Online (+ Offline) Gambling

Regulation: Overview and Discussion

Regulation by Region

Legalization or Ban

Evolution Financials

Income Statement

Georgia Strike, Cyber Attacks, Expansion

Balance Sheet

Capital Allocation

Cash Flow Statement

Competition and Competitive Advantages

The Investment Case/Decision

Valuation

🃏 Introduction to Evolution 🃏

Evolution is a Swedish creator and provider of Live Casino Games. EVO was founded in 2006 and is headquartered in Stockholm. It’s the undisputed market leader with a 60% market share and has grown tremendously over recent years, which fueled the stock price.

However, 2024 was not a great year for the company and even worse for the stock. Growth slowed down compared to recent years; strikes in one of EVO’s most important studios raised concerns about the work environment and impacted operations, and cyber attacks in Asia caused zero growth in the region QoQ.

But how big are these problems in the long term, and is the price now cheap enough to compensate for that? After all, great opportunities are created by temporary headwinds.

Overview of Evolution’s Numbers:

Market Cap: $15.95 Billion

Enterprise Value: $15.2 Billion

Shares Outstanding: 206,56 MM

NTM P/E: 12,72x

EV/FCF: 12.3x → FCF Yield: +8%

Today’s goal is to provide you with the information you need to assess the investment case of Evolution. Therefore, we’ll analyze the industry itself as well as the company.

Let’s start with the industry and slowly go into EVO’s position in that market.

🎰 The iGaming Industry 🎰

In a world where everything is moving online, it shouldn’t come as a surprise that one of the oldest forms of entertainment—gambling—has made its way into the digital world. What once required a walk into a brick-and-mortar casino is now available 24/7 online.

To prevent misunderstandings going forward, let’s quickly clarify the terms “iGaming” and “Online Gambling”.

Online Gambling: Narrower term that includes “traditional” forms of gambling like: online slots, roulette, blackjack, as well as sports betting. Online Gambling is a subset of iGaming that (mostly) excludes skill-based games.

iGaming: Broader term that includes all forms of Online Gambling but adds all other forms of online betting or wagering money. Think of Fantasy Football, esports betting, or video games with gambling aspects (CS:GO, FIFA, Overwatch, etc.)

In addition to the traditional games, live dealer games are growing in popularity. These games feature actual human dealers running games in real time using streaming technology. This is what EVO specializes in.

The games are a more immersive, interactive experience, combining the convenience of online play with the authenticity of a physical casino. However, the real specialty and innovation in the space that EVO brought are large-scale game shows. These games can host tens of thousands of people at the same time.

Here’s an example of EVO’s most famous game and the most popular game show in the world - Crazy Times:

Crazy Time is based on a large spinning wheel divided into numbers (1, 2, 5, 10) and four bonus segments. Players bet on which number or bonus round the wheel will land on. If it lands on a bonus round, players enter that round, which offers the chance for larger multipliers.

The bonus rounds are:

Coin Flip: A virtual coin is flipped with a multiplier on each side.

Cash Hunt: Players pick a symbol that reveals a multiplier.

Pachinko: A ball is dropped into a board with pegs, landing in a pocket with a multiplier.

Crazy Time: A bonus wheel with high multipliers is spun for a chance at big payouts.

Who Buys Evolutions Products (Games)?

While EVO interacts directly with the players, they are only indirectly its customers. EVO sells its games to so-called Operators.

These Operators are the actual casinos that players are logged into. There are three types of Operators:

Brick-and-Mortar Casino: Classic brick-and-mortar casinos have realized that gambling has entered the digital world, so they are also expanding into this space. Evolution has just agreed to build a new studio in Pennsylvania in a deal with the US casino giant Caesars.

Online Casino: Online casinos are native to the digital space. Some of the biggest online casinos include Bet365 (England), 888 Holdings (Gibraltar), Flutter (Ireland), and MGM (USA). These casinos build EVO's main customer base. EVO sells its games to them and takes commissions on their winnings.

Game Aggregator: Game aggregators are platforms that compile a variety of games from different game developers and provide them to online casinos or gaming operators in a single, unified solution. Examples include: Relax Gaming, SoftSwiss, and EveryMatrix.

The commission EVO earns is calculated as a percentage of the operators’ winnings generated via the company’s casino offering. On average, it’s between 10-12%.

Advantages of being B2B (EVO) instead of B2C (Operators)

Online gambling is not an easy business to be in. Regulations can be demanding, and players must trust the sites immensely to place their funds on the websites.

The fact that EVO sells its games to operators (B2B) instead of dealing directly with the players (B2C) makes their life a lot easier. There are three main difficulties for B2C operators:

Identification: Casinos must ensure that their customers are of legal age. Thus, they need processes to verify IDs. This is not necessarily easy, and it’s risky. If there’s a way to trick the system and casinos have underaged people play, it can end the business.

Payment Processing: Casinos must be trustworthy, and the payment process must be flawless to guarantee that there will be no problems placing bets or withdrawing funds.

Marketing: The online casino space is incredibly competitive. To secure customers, casinos pay huge amounts in marketing expenses. If you’re a sports enthusiast like me, I’d bet a good amount of money that you’ve seen gambling site sponsors before.

EVO doesn’t care which casinos come out on top; they sell their games to whatever casino can successfully solve the challenges above. That also means that EVO doesn’t share any risks or costs involved in solving those problems.

Market Size and Growth Outlook

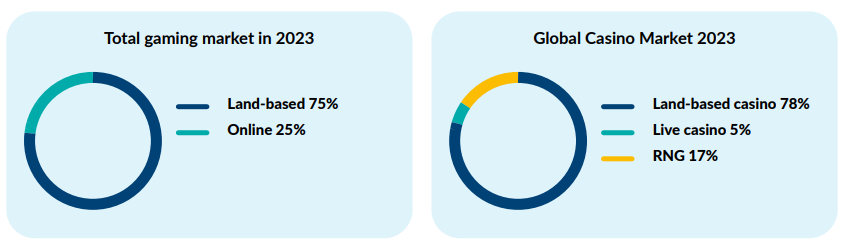

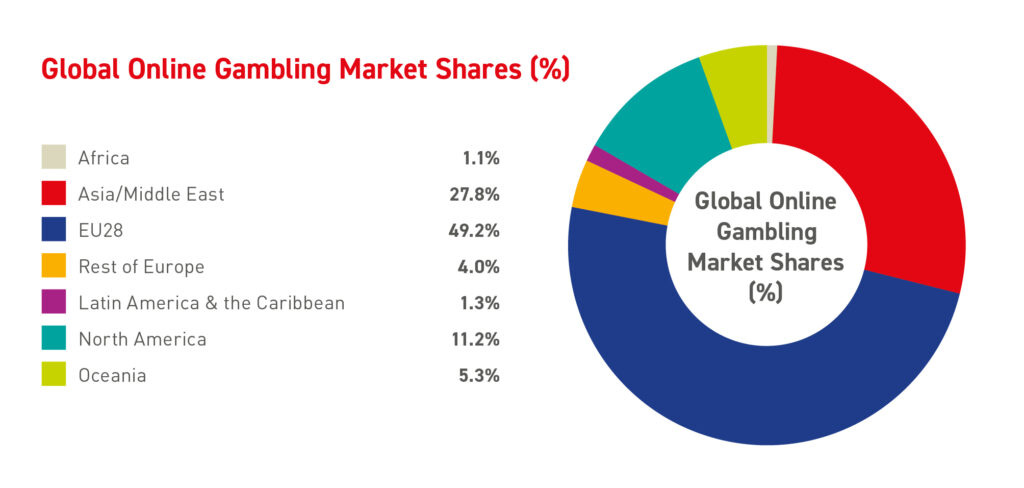

In 2023, Global Online Gambling revenues stood at €107.6 Billion (Source: H2GC). Most Research houses expect a CAGR of 7% to 12% until 2030. The significant differences in the growth estimates arise from varying assumptions on regulations, technological advancements, and the growth outlook of the many different segments. EVO operates in the Live Casino and RNG segments. Live Casino revenue grew at a rate of 23.9% annually from 2019 to 2023, and RNG revenue grew by 20.8%.

Europe is the biggest market by region (UK, Germany, and France at the top), with Asia catching up quickly in recent years. The US is also growing faster due to more legalization. Legalization is a keyword here. The black market for Online Gambling is huge. All the numbers mentioned only account for legal online gambling.

Adding Land-Based Casinos

Intuitively, I would’ve thought Online Gambling would have long surpassed land-based gaming by revenues. Or at least grow to a similar size. This couldn’t be further from the truth.

According to estimates from H2GC, land-based casinos still represented 75% of the total gaming market in 2023. Based on their estimates of a total gambling market (offline + online) of ~€490 billion, that leaves over €380 billion up for grabs for Online Gambling to take.

Of course, land-based gambling will not disappear, but comparing the growth rates suggests that Online Gambling will take significant market share, especially with live casinos delivering basically all the advantages of land-based casinos with a lot more convenience. Since the land-based casinos are piling into the space themselves, they’re not competitors anyway. They’re potential clients.

Regulation: Risks and Chances

One of the major concerns surrounding EVO is the regulatory environment. Here’s an overview of the current regulations by region.

Overview of Regulation by Region

The following overview of regulations is organized by the revenues EVO generates in each region, starting with the most important region and proceeding to the least important.

#1 Asia: (Revenue Market Share in 2024: 39%)

Asia is mostly unregulated and hosts one of the largest black markets in the world. However, the Philippines recently became the first country in Asia to legalize Online Gambling, and WinZir, a Philippine Online Gambling platform using EVO’s games, is the first licensed one.

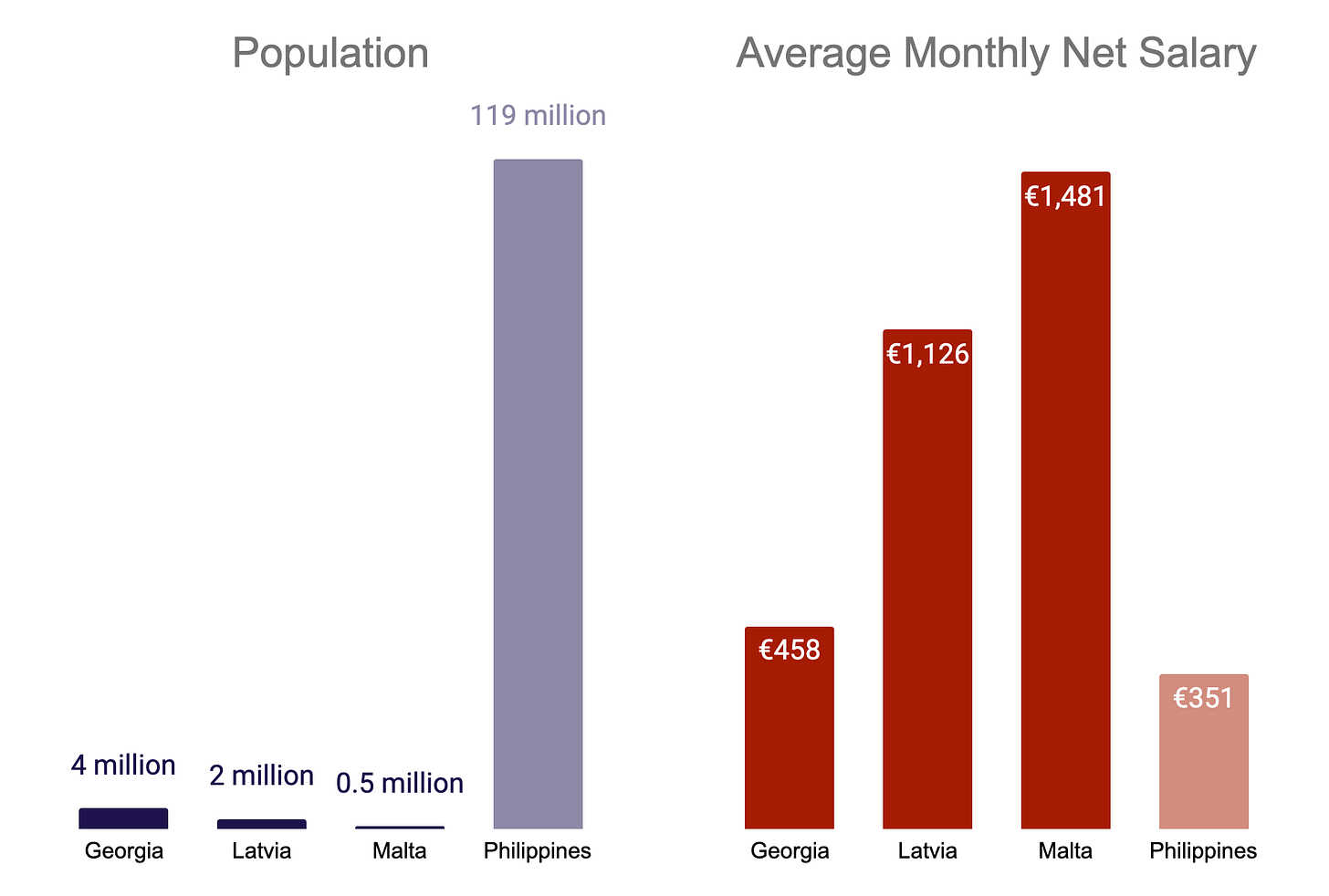

EVO will also build a studio in the Philippines. Building one was part of the agreement to get a license, but beyond that, I expect the country to be a great place to expand. Labor is cheap compared to other countries with studios, and English efficiency is the highest in Asia (next to Singapore). Besides that, there is a huge population for the business to expand.

#2 Europe: (Revenue Market Share in 2024: 38%)

The European Union (EU) does not have a unified Online Gambling regulation; each member state establishes its own laws.

UK: The Gambling Act 2005 is the main regulation in the UK, defining gambling terms and setting license requirements.

Special Development for EVO: The UK Gambling Commission has launched a review of Evolution’s operating license in the UK after finding EVO games provided to unlicensed casinos.

EVO took the games down and fully cooperated with regulators. Further details are still unknown. For perspective, the UK accounts for 3% of EVO revenues.

Germany: The Interstate Treaty on Gambling 2021 regulates online gambling, regulating online casinos and poker rooms under strict conditions and harmonizing regulation across all states.

The regulation includes a ban on certain games, Deposit Limits, an Advertising Ban, and Mandatory ID checks.

It’s especially tough on operators and one of the negative examples of regulation.

France: The French Online Gaming Regulatory Authority (ARJEL) oversees the market and regulates online gambling. France is the most heavily regulated country in Europe, and its tough regulations have created the biggest black market in the continent. (Maybe that sounds paradoxical to you, but we’ll get to that.)

#3 North America: (Revenue Market Share in 2024: 12.5%)

United States: Online Gambling laws are determined at the state level, leading to a fragmented landscape. Sports betting is widely legalized, while online casinos are only legalized in a few states.

These are the US states where Online Gambling is legalized, and EVO holds all possible licenses: Connecticut (1 Studio), Michigan (1 Studio), New Jersey (2 Studios), Oklahoma, Pennsylvania (1 Studio), and West Virginia.

EVO is also expanding in the US, building out its headcount, offering new games, and partnering with local casinos.

Canada: Similar approach, with provinces like Ontario regulating Online Gambling while others have less formalized frameworks

EVO operates 2 Studios in British Columbia.

#4 LatAm: (Revenue Market Share in 2024: 7%)

Once again, many different laws depending on the country. An important market for EVO’s future will be Brazil. Brazil recently changed local laws around Obline Gambling regulation, and EVO will build a studio in Brazil in 2025. Columbia will also be part of an expansion:

“We have a very exciting year ahead in Latin America, where the Brazil market introduced local regulation starting in January 2025, our upcoming local studio will be important to supply the demand in the country. We are also expanding table capacity in Colombia for the Spanish speaking regions in Latin America market as well as for markets outside the region.”

CEO - Martin Carlesund

#5 Other: (Revenue Market Share in 2024: 3.5%)

The Overall Trend: Legalization or Ban?

First of all, let’s discuss terms again since the difference between legal and illegal gambling is not as obvious at first. Sure, one is legal, and one is not… but what are the implications of that on a state and consumer level?

In short, legal gambling is licensed, and illegal gambling is not licensed. There’s not necessarily anything inherently criminal about black market operators besides gambling without a license (at first), which is why consumers often don’t even know if they gamble on legal or illegal sites.

Ismael Vali, CEO of the intelligence platform Yield Sec, recently held an interesting talk on the iGB@ICE and discussed the implications and consequences of regulation on gambling markets.

His main thesis: Current Regulation benefits Black Market Gambling

The reasoning is simple: Demand is high, and the barriers to start playing are low. This leaves two options on the table:

Option 1: Legalize Gambling → Generating Tax Revenues, New Jobs, Responsible and Safe Use

Option 2: Criminalize/Bad Regulations → Eliminate the Licensed Players → Drive Demand to Black Market Sites → No Tax Income, No Jobs, Scams, Crime build on top of Gambling Organizations

Because of this, he advocates regulation that leaves room for operators and strongly advises against banning online gambling or putting regulation in place that is a de facto ban.

Globally, this seems to be understood. There’s a trend towards more legalization.

Financials: Risks and Chances

There’s no better thing than going through a company’s financial statements and asking the right questions when you want to understand a company. So that’s what we’re going to do.

Income Statement

As mentioned, EVO earns money through commissions paid by the operators for using EVO’s games/streams. There are fixed and variable fees.

For live casino, the most basic agreements normally include access to, and streaming from generic tables, while more complex agreements can include dedicated tables and environments, VIP services, native-speaking dealers and other customisations to produce a live casino experience that is unique for the end user and helps the operator to stand out from the crowd.

Fixed fees are for the dedicated tables that are branded for the specific operator. Variable fees are revenue splits between EVO and the operator. They’re paid monthly and vary depending on the games EVO provides, the number of tables, and the active hours. On average, they are between 10-12%, although they can vary widely.

EVO’s long-term development looks like the dream of every investor.

Revenue Growth: 3Y CAGR of 25% and 5Y CAGR of 41%

Net Income Growth: 3Y CAGR of 27% and 5Y CAGR of 53%

FCF Growth: 3Y CAGR of 30% and 5Y CAGR of 51%

However, growth has slowed in recent quarters. Several factors contributed to this. We will discuss each in detail. Before we get to that, you might ask why I say growth has slowed when total revenues grew 31.5%.

That’s because we focus on Net revenues and ignore the “Other operating revenues.” These include reductions in earn-out liabilities from an acquisition in 2022. Since they’re non-cash income, they’re also adjusted for in EVO Adj. EBITDA numbers and FCF. It’s “artificial growth” with no substance for EVO’s business performance.

Reasons for Slowing Growth

1. Currency Headwinds and Tax Rate

Over the entire year, EVO had faced currency headwinds that decreased revenues by 3-4% depending on the quarter. In Q4, revenue growth on a constant currency basis was 16% instead of 12%. There's not much you can do about that. In some years, it’s a headwind; in others, it’s a tailwind.

EVO also experienced an increased tax rate due to the US expansion and Pillar 2 legislation in Sweden. In 2023 and prior, EVO’s effective tax rate amounted to 6-7%. Pillar 2 requires EVO to pay an additional tax when their effective tax rate is lower than the minimum tax rate of 15% in Sweden.

2. Strike in Georgia

Georgia has become EVO’s most important studio in recent years. I’ve read estimates that about 45%-55% of EVO’s profits were generated in that studio. In mid-July of 2024, however, about 500 workers left their jobs and started protesting for higher wages and better working conditions.

It’s difficult to assess the situation if you’re not on the ground. Strikers report a toxic work environment and poor workplace conditions. On the other hand, EVO showcases pictures of attractive studios with gyms and various amenities. However, they did admit to mistakes regarding hygiene issues and inappropriate behavior by some middle managers in certain studios.

Those things should be quick to fix, though, especially since EVO’s management seems to take these problems seriously. The bigger problem was wages. From what I know, the wages EVO pays in Georgia (14,000-25,000 GEL, according to Glassdoor) seem competitive and not below what is expected for this job.

However this turns out, I wouldn’t consider this a long-term problem, and I expect EVO to 1) improve on their operations and work environment and 2) diversify operations better (which could be done through the Philippine studio, for example)

3. Cyber Attacks in Asia

Over the last three years, Asia has been Evolution's main driver of organic growth. Then, in Q2, growth slowed drastically, reaching only 3.1%, down over 7% YoY. However, management explained the slowdown with cyclical market behavior, which seemed realistic since the quarter before showed lots of growth at 15.9%. However, growth rates for Q3 halved again and went to 1.5%.

The CEO then addressed issues with Cyberattacks:

“Cyber criminals use advanced technology to intercept our video feed, manipulate it and redistribute it without authorization which leads to loss of revenue. These kinds of thefts will always be a problem for a leading and multi-site product but we have during the last [quarter] have seen a more advanced and significantly increased activity. We have deployed several measures to counteract these cyberattacks but it has negatively impacted the third quarter.”

— CEO Carlesund

“Simply put, someone else is selling our product.”

— CFO Kaplan

The problem has not been solved yet. In Q4, growth rates were flat. If this issue is not resolved, it will have a longer-term impact on EVO’s business, so it’s worth monitoring any developments there.

4. Unregulated Markets

EVO still generates 60% of its revenues in unregulated (grey and black) markets, which has multiple implications. 1) there’s the risk of legal action against EVO. 2) margins are likely higher in unregulated markets. So, if the market gets legalized, margins could come under some pressure.

It also offers potential upsides, though: Cyber attacks like the ones in Asia are less likely in regulated markets. Thus, regulating markets increases stability for EVO’s business (important for investors as well). As one of the most credible game providers, they also tend to be among the first to get licensed as soon as markets become legal.

Revenues by Game Type

Looking at revenues by game type, we can see that Live Casino is clearly the dominant part of revenues. The RNG segment became a part of EVO after acquiring NetEnt in 2020 in a $2.1 Billion deal. After slow to no growth in the first years, the RNG segment grew 6.7% YoY, and management is positive that growth will continue going forward.

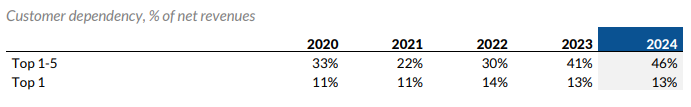

Revenues by Customer

EVO has a very concentrated customer base. 46% of its earnings come from the five biggest customers and 13% from the biggest one alone. On the one hand, this is a risk. If one of them, for whatever reason, goes out of business or leaves EVO, it will have a severe impact.

However, it also shows us that EVO seems to be inevitable in the Live Gaming space. EVO raises commission fees annually, has profit margins in the mid-50s to low-60s, and customers still stay.

Margins

We can make this quick since we already discussed the impact EVO experienced on margins in 2024. Overall, EVO’s margins are still looking great. As soon as the problems in Georiga and Asia are solved and the US expansion benefits from EVO’s typical scale, I think there’s a chance for improvement again. Even if not, holding this level of margins would be great for a company of EVO’s size.

Keep in mind that the margins in the chart include Other operating income (reduced earn-out liabilities). Thus, adjusted margins are a bit lower:

Balance Sheet

The balance sheet ticks all the boxes: €800M in cash on a €15 billion market cap, no long-term debt, and no indications of any red flags. So, the question is:

What is EVO doing with its cash?

Capital Allocation:

EVO traditionally has a dividend policy that requires it to distribute 50% of net profit annually. Accordingly, EVO announced a €2.80/share Dividend, which resembles a dividend yield of 3.8%.

However, they also bought back shares when the stock price had become attractive in recent years. The chart below beautifully shows how they repurchase stock whenever prices decline.

To respond to the 35% stock decline in the last LTM, EVO announced a €500M buyback program. Based on the current market cap, this could buy back 3.3% of outstanding shares.

In my opinion, when the stock price is at 3-year lows despite a still strong fundamental business, more buybacks would be a better option than keeping the dividend policy going. However, it doesn’t sound like more buybacks are planned in 2025, even if the stock goes down further.

“The board intends to repurchase shares for up to EUR 500 million during 2025, in line with our capital allocation framework.”

- CEO Martin Carlesund

The phrase “during 2025" gives me the impression that they’re closing the door on further buybacks later in the year.

Competition and Competitive Advantages

When considering Evolution’s margins and customer concentration, one question should arise: Is there no competition?

Rather than providing another lengthy block of text and extending this article, the website LiveCasinos offers excellent summaries and overviews of all the companies in the industry.

Short Overview:

EVO’s main competitors include Playtech, VIVO Gaming, and Pragmatic Play. Only Playtech and Pragmatic focus as much on the Live Segment and Game Shows as EVO does.

Playtech's revenue level is similar to EVO's, reaching $1.8 billion last year. However, their margins are significantly lower. The lower margins stem from a wider product mix, including lower-margin products, less targeted markets, and, most importantly, less scale.

They have an estimated 15% market share in live casinos, compared to EVO’s 60%. This is partly because they operate almost exclusively (~90%) in regulated markets.

I want to focus on EVO’s competitive advantages since the numbers clearly show that these competitors are not a viable alternative to EVO’s customers. Otherwise, margins and customer retention wouldn’t be this good.

EVO’s moat is based on many factors, but they all boil down to one thing - Scale.

The advantages of scale include:

1. Distributing Costs 💰

EVO can invest significantly more in its games since the costs are amortized more quickly due to its large player base. Better games, on the other hand, bring more revenues, higher margins, and, ultimately, more profits.

The same goes for investments in infrastructure. Online gambling is a sensitive business. You can’t allow mistakes with customers’ funds at stake.

2. Regulatory Advanatages 👩🏽⚖️

As mentioned, when countries legalize online gambling, EVO will be one of the first players in that region. This will give them a headstart in customer acquisition, acquiring the best employees, and becoming the best-known and most trusted brand.

3. The Mathematics of running an iGaming Business 🧮

Considering the size of the land-based casino market, I used to wonder why these casinos do not create their own live streams.

Then I saw a simple calculation on Twitter, and it was the first time I really thought, “Ahh, that’s why this business works.”

Instead of rewriting a worse example, here it is:

Once again, the main differentiator is scale. A quick anecdote if the above doesn’t convince you. In Europe, the still biggest online gambling market in the world, there hasn’t been a single casino trying to get into the market of life streaming their games. No one knows their business better than they do; they clearly think it’s not worth it or not possible.