Dino Polska up 14% after Earnings - Analyzing the Q3 Report

Dino Polska released its Q3 earnings on Thursday after the market closed, and the stock jumped over 14% in reaction.

I must admit, looking at the numbers, the big jump surprised me a bit at first. However, it is about perspective.

Overview:

167 new stores (Q1-Q3 2024)

10.6% YoY Revenue Growth; 13.5% YoY from Q1-Q3 2023 to Q1-Q3 2024

3.7% YoY EBITDA Growth

EBITDA Margins of 8.9%; Down YoY by 0.5% but 1.5% higher than in Q1 2024

Like-for-Like Sales Growth 4.9% (expectedly lower than last year, but outperforming competition by far)

Massive Debt Reduction (Net debt / EBITDA ratio of 0.25x compared to 0.41 Q3 2023)

Okay, let’s go into the details of the numbers and make some comparisons with competitors since I believe that the comparison with competitors is what primarily caused the significant stock increase.

Like-for-Like Sales Growth:

LFL growth is one of the key metrics for retail stores like Dino. If you want to learn more about it, it’s best if you read out my initial stock analysis of Dino:

At first glance, Dino’s Q3 LFL growth looks weak compared to the historical numbers, especially in the last two years. However, the inflation and, even more importantly, the food inflation numbers provide important context.

Inflation came down significantly in 2024, and thus, the tailwind (although not good in general) for LFL sales was also stopped. Comparing the 4.9% to last year’s numbers doesn’t make any sense. What is important is that LFL sales growth outperformed food inflation by over two percentage points.

The results look even better when we compare them to Dino’s main competitors, in this case, Biedronka. They have reported the second quarter of negative LFL sales growth after another.

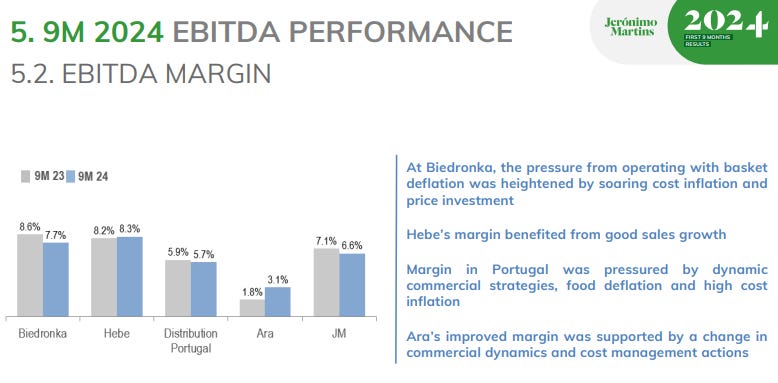

EBITDA Growth and Margins:

The year's second quarter was likely to be the worst due to price wars in the Polish market (especially with Biedronka and Lidl), food basket deflation, and rising labor costs. It seems that has been the case, and the remaining year, and especially 2025, will see a recovery.

EBITDA margins have recovered significantly already and, as you can see, outperformed Biedronka by more than 1%.

Balance Sheet and Debt Reduction:

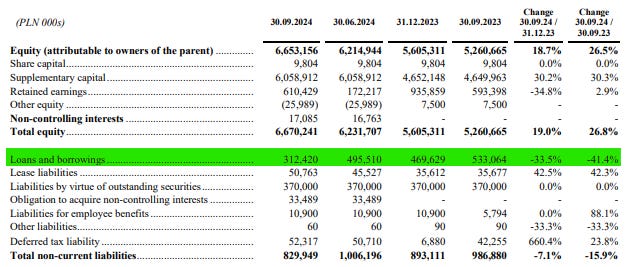

Dino has reduced its (long-term) debt position by 41% YoY and now has a Net Debt / EBITDA ratio of 0.25x.

For comparison, we can again take Biedronka or, better said, its parent company, Jeronimo Martins, which not only did not decrease but actually increased its borrowings and net debt in 2024.

Cash Flows and Investments:

Net cash flow from operating activities was up 27.8% YoY and 15.8% YoY between Q1 and Q3.

In good old Dino Polska style, most of the operating cash flow is immediately reinvested into the business, primarily in building new stores. Net cash flow from investing activities is up 60.3% year over year and totaled PLN 433.1 million in Q3 2024.

Over the nine months of 2024, Dino reinvested over PLN 1,168 million back into the business (~70% of total operating CF).

Conclusion:

The market punished Dino Polska in 2024 a lot more than it deserved. The stock went down around 10% after the challenging Q2 results and another 10% after competitors reported weak numbers and revised forecasts.

Dino was basically punished twice for the same thing. After those price decreases, Dino was definitely oversold, and I believe that’s why these numbers were enough for a 14% price increase.

Overall, it’s getting clear that the worst times are over, and, most importantly, Dino remains on its growth trajectory and is gaining market share from its competitors.

I’m happy with the results; they fit into Dino Polska's narrative of being a long-term compounder and show the management's great execution and long-term plan.

That’s it for today! Have a great Sunday!

Daniel