China's Biggest Stimulus since the Pandemic boosts Stocks significantly

In an attempt to stabilize markets and “revive” its economy, China has unveiled a substantial stimulus package to curb deflationary pressures and support its struggling stock market.

This stimulus package feels overdue and comes at a crucial time. China has been on track to miss its 5% GDP growth target for 2024, driven by a deflated property market, which makes up around a quarter to even a third of China’s GDP, reduced consumer spending, and broader economic uncertainties.

China’s CSI 300 index was at a five-year low earlier this month, and its large-cap tech companies, which played a significant part in the country's growth in the last decade, have lost more than half of their market value since the peak in 2021.

Investors desperately awaited a confidence boost, and judging by the stock market’s reaction, this stimulus package has provided one. China’s Benchmark Index CSI 300 is up 7% since the announcement. The same goes for stocks like Alibaba ( BABA 0.00%↑ ).

Let’s briefly discuss the measures the Chinese government and Central Bank took and their influence on Chinese stocks.

Key Elements of the Stimulus

Liquidity Injection: The People’s Bank of China (PBOC) announced it would inject 800 billion yuan ($113 billion) into the financial system. This liquidity support aims to stabilize the country’s stock markets by allowing brokerages and funds to access central bank money to buy equities. In effect, the central bank is backing the financial markets significantly, ensuring that liquidity is not a constraint for market participants.

According to Morgan Stanley estimates, the combined total equals about 3% of domestic market capitalization. The Central Bank also suggested adding a further 500 billion yuan is possible if deemed necessary.

Interest Rate Cuts: In addition to the liquidity boost, the PBOC has lowered key interest rates, including reducing the seven-day reverse repurchase rate to 1.5% from 1.7%. This marks an attempt to make borrowing cheaper, encouraging both investment and consumer spending. The rate cuts extend to mortgage rates, with significant reductions expected to benefit homebuyers across China. Reports suggest that up to $5.3 trillion in mortgages will now carry lower borrowing costs, aiming to revive the sluggish housing market.

Lowering Reserve Requirements: Another vital aspect of the stimulus is the reduction in the Reserve Requirement Ratio (RRR) by 0.5 percentage points. The cut, which unleashes approximately 1 trillion yuan into the economy, is expected to ease lending constraints on commercial banks and provide businesses with more room to invest.

It has also been said that if liquidity remains low in the following months, another RRR reduction of 0.25-0.5 percentage points could initiated.

Stock Market Stabilization Fund: To address stock market volatility directly, regulators have indicated they are considering establishing a market stabilization fund, which has been discussed for over a year now.

Such a fund would protect against sudden selloffs by buying stocks with Government money in strategic industries to prevent downward spirals. This move would aim to restore investor confidence after years of market turbulence. This initiative complements the liquidity support aimed at bolstering the markets.

It also assures investors that China will not sabotage its stock market again. That’s a good sign since investors have been unsure of this for years. The announcement itself could be enough to end the downward spiraling of stock prices.

Support for the Real Estate Sector: China’s real estate sector has long been one of the critical drivers of its economy, but the current crisis—fueled by falling property prices and a lack of buyer confidence—has been a drag on economic growth. As part of the stimulus, the government has cut the minimum down payment ratio for second-home buyers from 25% to 15%, making it easier for potential buyers to enter the market. This is an attempt to revive home sales, which have slumped to their lowest levels since 2014.

Initial Market Reaction

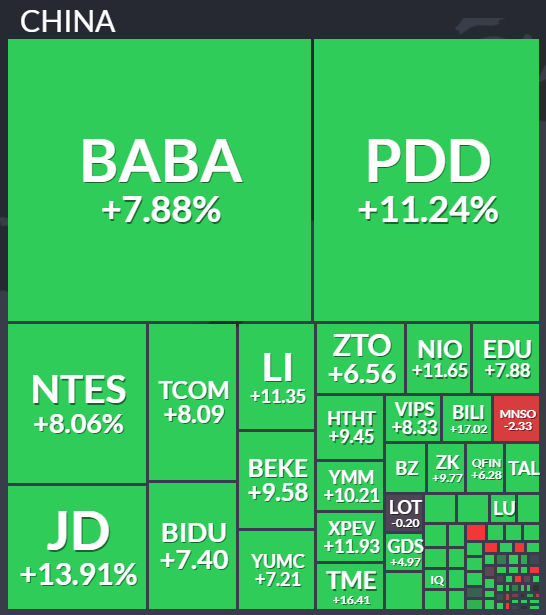

The stimulus measures triggered a positive market reaction both domestically and across Asia. China’s benchmark CSI 300 Index surged over 4% yesterday, and the rally kept going. The index is now up 7%, erasing earlier losses for the year. Hong Kong shares also soared, with key benchmarks gaining over 5%.

On an individual stock basis, big tech companies like Alibaba and Tencent both gained about 8%. Large caps generally benefitted more than small caps, which makes sense since the current reaction is mainly based on improved sentiment and not yet on the practical impact of the measures taken.

Broader Economic Implications

While the stimulus package has sparked short-term optimism in financial markets, analysts remain divided on whether these measures will have a lasting impact. The steps taken by the PBOC are viewed as necessary, but they may not be sufficient to fully revive China’s long-term economic prospects.

Structural issues, such as low consumer demand and the ongoing property crisis, are not quick to fix and will thus be a drag for some time going forward. While monetary easing is critical, it needs to be matched by stronger fiscal policies, particularly aimed at stimulating consumer spending.

What’s Next?

The success of China’s latest stimulus package will largely depend on how well it is coordinated with other fiscal measures, as well as its ability to boost consumer confidence and demand. If these monetary interventions are not followed by further fiscal policy action, analysts fear that the economy may struggle to maintain its momentum beyond the short-term stock market gains.

In conclusion, while China's stimulus measures are a clear signal of the government’s commitment to stabilizing the economy and financial markets, their long-term efficacy remains uncertain. More comprehensive reforms and additional stimulus might be needed to steer China back toward sustainable growth.

Nevertheless, with the Chinese government and the Central Bank taking action now, this should be a big and desperately needed confidence boost for investors to get back into Chinese markets. Institutional money, especially, now has arguments to return to China. Prior, it was very hard to do since investing their client’s money in a hostile Chinese environment was close to impossible, despite attractive prices.

Quick Announcement:

I’ve recently been a guest on The Millennial Investing Podcast. In the episode, Shawn O’Malley and I discuss S&P Global, one of the highest-quality companies out there.

Unfortunately, we had some trouble with the audio recordings; some parts needed to be re-recorded, and you’ll hear it sounds a bit off. The problems were on my side. It was my first ever podcast, so I’m sure this will improve in the future.

I still think the content is worth listening to if you’re interested in the company. You can check it out on Spotify or Apple Podcasts:

Have a great day, and see you in the next article!

Daniel