Bruce Greenwald's 3-Round Process to Value Companies

Bruce Greenwald is teaching Valuation at the legendary Columbia University. He taught many very successful Investors of today. Let's take a look at his Class Notes!

Content:

Round 1: Asset Valuation

Step 1 - Tangibles

Step 2 - Reproduction Value

Round 2: Current Earnings

Step 1 - Estimating CE

Step 2 - Extrapolating

Round 3: Growth and Franchise Value

Value of Growth

This Episode is sponsored by Streamlined Finance!

Today, we will explore the Valuation Approach of the esteemed Columbia Professor Bruce Greenwald, taught in his renowned Valuation Class.

Fortunately for us, the Class Notes are publicly available. It’s one of the most insightful Investing Resources out there.

He describes the Valuation Approach he and many of the most successful Value Investors use. I broke it down into a 3-Round Process:

Round 1: Asset Valuation

Every Valuation should start with the most reliable information you have about a company!

That way, Round 1 ensures that you come up with a value that cannot be wrong because of misjudgments or bad forecasts.

Step 1:

The most reliable information you have are the tangible assets of a company. Tangible assets are the first part of your safety net. Even if the company is going to get liquidated, tangible assets will be there.

Because of that, the first number you come up with is called the Liquidation Value. You derive it by simply going down the balance sheet and summing up all tangible/recoverable assets.

→ There it is: Liquidation Value!

Step 2:

Now follows step two of the first Round.

You’ll make the assumption that the industry and company are viable. Meaning that you assume it will not go bankrupt and has to be liquidated.

In that case, you need to find out what the reproduction value of the assets is. Since the company stays in business, sooner or later, the assets have to be replaced. You want to know how much that would cost.

Let’s discuss how to do that for each category:

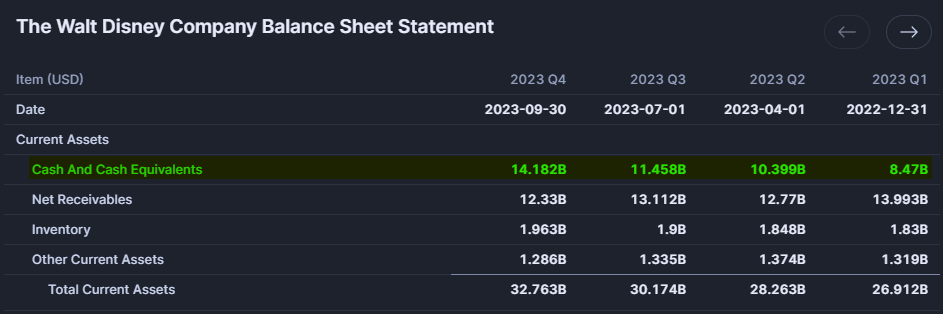

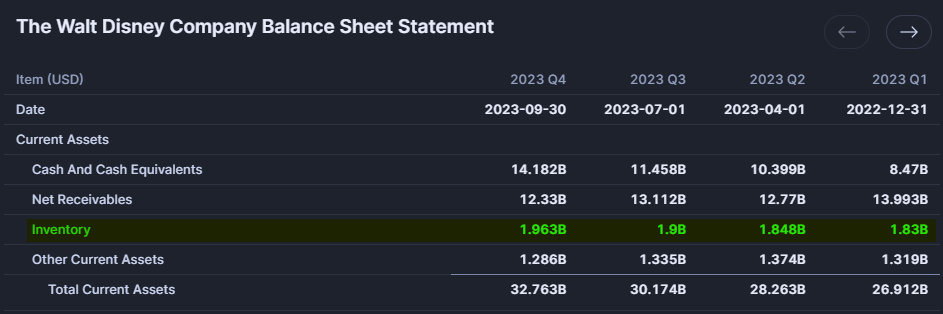

Cash and Short-Term Assets: Well, this is easy. Cash is cash, and short-term assets are, by definition, easy to liquidate, so you’ll count them for their real value.

Inventory: Due to international accounting standards, the reproduction value of the inventory will be very close to the book value, too. They are valued at the lower price of acquisition and production costs or net realizable value.

Property, Plant & Equipment (PP&E): In this case, the first thing you should do is look for information in the annual report. If the company has construction projects or regular repairment costs, they should give guidance on the costs.

If you can’t find anything, assume a little markup on the original costs. That should be conservative enough. If real estate prices are a big part of your thesis, for example, in a liquidation case, the best thing you can do is to send out an assessor. But that won’t be possible (or necessary) for individual investors.

I prefer Buffett’s idea of “if it’s too hard to value, let it be.”

Round 2: Current Earnings

After starting with the most reliable information you have, the natural thing is to continue with the second most reliable information.

Step 1:

Those are current earnings. You do not want to speculate at this point of your valuation. You just use the earnings that are reasonably forecastable. An average of the sustainable earnings the company can generate today.

What are sustainable earnings? Sustainable earnings are adjusted for one-time earnings or expenses that are not part of the regular business activities.

Step 2:

If you have those current earnings, you extrapolate them into the future. But, and that is important, you won’t assume any growth or change. You assume the current earnings will be the result forever.

Discounted back with an appropriate discount rate (10-Year US Treasury or a fixed rate of your choice, let’s say 10%), what is the value of those earnings today?

→ Now you have derived the Liquidation Value and the Value of Current Earnings.

Adding these up gives you the company's value without any speculative aspects!

This is important because you can later categorize the company's value into value with and without risk.

That way, you’ll have a far superior understanding of what value is truly there and what is subject to future risks.

Round 3: Growth and Franchise Value

The economic intuition is that wherever companies earn profits, new companies will enter the market and drive down prices and, eventually, profits. In economics, you assume that companies keep producing as long as marginal revenue equals marginal costs.

In reality, markets may not be as efficient, but the logic still applies. That intuition also means that growth and profitability can only last for so long.

Growth won't be worth anything if you have no competitive advantages (Franchise Value) since competition drives down profitability either way.

In fact, you often see growth at a competitive disadvantage in today's world, which has negative value. Your costs of growth (Investment required) are higher than the return on invested capital.

That’s why return on invested capital (ROIC) is such an important metric. You want to earn access capital for every $1 invested.

Assessing competitive advantages can be difficult, but an easy way is by comparing Return Metrics between companies.

Streamlined Finance offers a phenomenal tool that does just that.

The Compare Function:

You can compare all important metrics between multiple companies and see which company has the best industry position.

If you want a modern solution to keeping track of markets, finding and analyzing stocks, Streamlined Finance is the way to go.

In the long run, this is only possible with competitive advantages.

“The only case where growth has value is where the growth occurs behind the protection of an identifiable competitive advantage.” - Bruce Greenwald

There are many forms of competitive advantages, and I wrote about them many times. Here is an example:

I just released my January Deep Dive. If you’re interested in the Mechanics and Players of the Streaming Sector, it’s worth a read:

Here’s more Company Research:

My Current Portfolio:

Here’s my Investing Checklist (Free for all Paid Subscribers):

https://danielmnkeproducts.com/