An Homage to Daniel Kahneman - 10 Lessons of Psychology by the GOAT 🐐

“Thinking, Fast and Slow” was the first book I read on human decision-making. I’ve since read dozens of books on the topic, but I would still say that it is the best I’ve ever read.

Instead of mourning his passing, let’s celebrate what he accomplished and all the great wisdom he left behind for everyone to study!

Here are 10 Lessons of Kahneman (and his often-forgotten colleague Amos Tversky, who left this earth way too early 28 years ago):

Today’s Episode is sponsored by Shortform!

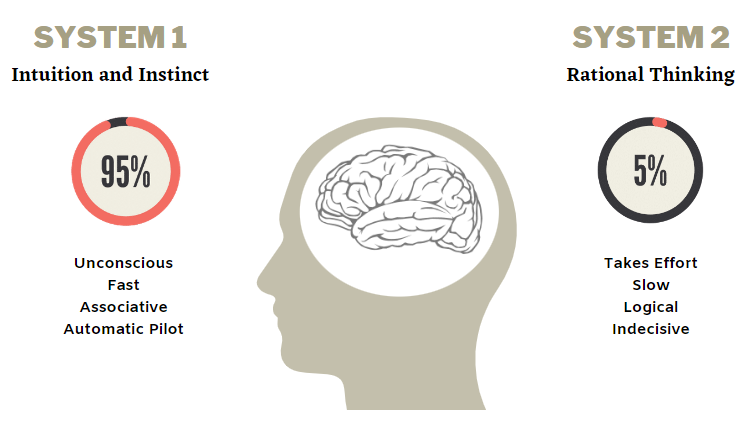

1. System 1 and System 2

We have to start with the classic. System 1 and System 2 are the terms he popularized to describe the two different ways we think. System 1 is fast and intuitive. We don’t realize it, but it works all the time in the background of our minds.

System 2 is responsible for slow, calculated, and deliberate thinking. It activates when a quick automatic response cannot fix the problem at hand. A typical example is a math task.

Almost all biases and heuristics we will discuss today originate when we are in “System 1 thinking.”

2. Cognitive Ease

Cognitive ease is the main reason all the following biases work so well.

It is a desirable state of mind associated with good feelings.

Most of the decisions our fast-thinking System makes are designed to keep us in a state of cognitive ease with as little cognitive dissonance as possible.

3. What You See Is All There Is

When making a decision, you can only consider what you know.

In most cases, the range of all possibilities is much greater than the range of possibilities we can think of. Paradoxically, the less information we have (the smaller our circle of knowledge), the more confident we are in our decisions.

A great way to widen your Circle of Knowledge is today’s Sponsor Shortform!

Since reading is one of my favorite things to do and part of my job, I’ve tried many services to help me find the best books. As a long-term customer, I can say Shortform is the No.1!

Among their Unique Features are:

1. Additional Insights beyond the scope of the book

2. Quizzes and Exercises to deepen the lessons learned

3. Crosslinks to related Books and Topics

These features improve the understanding of the topics and add context—two of the most effective ways to maximize the success of studying.

Using my Link, you get a free trial and a 20% discount:

My Recommendation: Use the Free Trial and read the Summary of “Thinking, Fast and Slow”. Very well made!

4. Overconfidence

However, on second thought, being overconfident when having less information rather than more is not so paradoxical after all. That’s exactly what cognitive ease is causing. Working with as little information as possible to form conclusions and eliminate the state of doubt and uncertainty.

5. Confirmation Bias

Another bias feeding our desire for certainty and confidence in our decisions is the confirmation bias. It describes how we filter information in a way that fits our existing beliefs.

There are many ways to read the same news, and we interpret it to fit our narrative, mostly unintentionally (System 1).

6. Priming

External factors can also influence how we perceive something. Because System 1 always works even without us noticing it, it is also influenced by things that we do not actively perceive.

Studies have shown the impact of music playing in a store's background. Customers who bought wine in a store that played French music bought more French wine than customers who visited the same store when it played Italian music (they bought more Italian wine).

The same technique is used in terms of the speed of music. If you want customers to spend more time at your store to potentially buy more products, play slower music. We adapt our walking speed accordingly.

7. Prospect Theory

When making a list of Daniel Kahneman's greatest lessons, Prospect Theory cannot be left out! It’s the theory that won him the Nobel Memorial Prize in Economic Sciences.

The Prospect Theory has three main takeaways:

There’s a preference for a safe win over a gamble with the same expected value.

In contrast, we prefer a gamble with a potential higher loss (but the same expected value) over a certain loss.

Losses hurt more than equal gains make us happy.

8. Commitment Bias

Commitment is associated with positive characteristics such as consistency and intelligence. Thus, we avoid breaking commitments.

The more public a commitment is, meaning, the more people know about it, the more committed we are to it. You can make this work for and against you depending on how you use this knowledge.

9. Recency Bias

The tendency to overweight recent events and neglect long-term trends or probabilities. This bias also has a big impact on the cyclicality of markets.

When things are great, we think they will get only better.

When things are bad, we think they will get only worse.

10. Endowment Effect

The endowment effect is also partially rooted within the prospect theory. It describes our tendency to value items higher when we own them. It’s linked to the prospect theory via the loss aversion aspect. We do not want to give something up that is already ours, so we value our belongings more.

Another aspect is the justification of our decisions. After spending money on something, we justify that decision by increasing the product's worth. Of course, this happens unconsciously.

Now, I wish everyone who celebrates Happy Eastern! To everyone not celebrating, I’m sure you still enjoy the short vacation ;)

Want More?

Become a Premium Member and access Exclusive Research & My Personal and only Portfolio (with Live Updates):

My Portfolio:

My Research: