Alibaba Update - $25b Buyback, but a long way to go...

Alibaba just released the Q4 2023 Earnings Results, and I’ve listened to the Earnings Call and looked at the numbers. I thought I’d give you a quick update on the business and my opinion.

In case you’re in a hurry, here’s a quick summary of my takeaways:

Another $25 billion for the buybacks, total share repurchase program until the end of 2027 is now at $35.3 billion. However, they only aim to buy back 3% of shares per year. Doesn’t make much sense to me…

Revenue increases slightly by 5%, while EBIT and Net Income are down by 36% and 77%, respectively. However, this is due to one-time factors as well as amortization and impairment. Still, Alibaba struggles with the current economic situation and loses market share to Pinduoduo in the Chinese e-commerce market.

Cloud growth remains low (3%), while profitability increased significantly (86% Adj. EBITA increase). The focus, however, should not lie on profitability optimization yet. Growth needs to return, and Alibaba’s management declared it is its main goal to get back to higher growth at the Cloud and Taobao and Tmall Group.

Growth outside of the core businesses was strong, reaching double-digit growth across the board and a very strong 44% in International Commerce.

Content:

Overview Financials

Segment Breakdown

Each Segment Individually

My Take/Opinion

Let’s go into more detail and look at each segment:

Overview Financials

The overall financials of the quarter once again emphasize that Alibaba is struggling fundamentally with the current market environment in China. This is important to note.

Alibaba is undervalued because of the sentiment around China. However, Alibaba is also struggling business-wise. Competition is gaining market share, especially in the lower-priced segment. Pinduoduo is an example of a competitor that was able to gain market share in that segment, and the stock benefited greatly from it.

You should not expect Alibaba to have a blowout quarter in the next one and a half years. I think the Cloud business, as well as the Taobao and Tmall Group, will continue to struggle as long as the Chinese economy and consumers struggle.

Nationally, Alibaba is not the low-cost provider that it might be known for outside of China. When consumers want to save money, they can also find cheaper alternatives.

Cash Flow and Balance Sheet

Cash flow from operations was down 26% compared to the same quarter of 2022, and Free cash flow decreased 31% due to one-time factors, including timing of income tax payments and working capital changes as well as increased capex, according to the management statement in the earnings call.

One of the positives remains the strong balance sheet and a cash position of almost $70 billion.

Looking at the Segment results, we can see that the fast growth outside of the core business was also fueled by large investments. The international Digital Commerce business continues to grow very fast and becomes a more important part of Alibaba.

Segment Breakdown

In the following, you’ll see the summaries of all segments in which I highlighted the key takeaways and left a comment when necessary:

Taobao and Tmall

The results do not look good, with very slow growth. However, I like seeing the growing trend in order volume. It is currently offset by a decrease in the average value of orders, but that will change eventually when the consumer and economy recover.

What I want to see is that the customers stay and still use Alibaba (Taobao and Tmall). If that changes, that would result in long-term problems. But increasing order volumes don’t make it seem like that.

Cloud Intelligence Group

Another slow quarter for Cloud, where it cannot even remotely deliver on its promises.

Increasing the profitability at these levels is also not enough to make up for the lack of growth.

I wrote extensively on the Cloud in my Alibaba Deep Dive, so revisit that if you want more insights into the problems of Alibaba’s Cloud and the overall Cloud market (in China and internationally).

International Digital Commerce Group

Big growth rates fueled by big investments. AliExpress had a fantastic year, delivering over 60% YoY growth. Trendyol and Lazada were also able to grow in the double digits and retain their positioning in international markets.

Due to the investments, adj. EBITA decreased, but seeing the growth rates, those investments are justifiable.

(More Information: Alibaba Deep Dive)

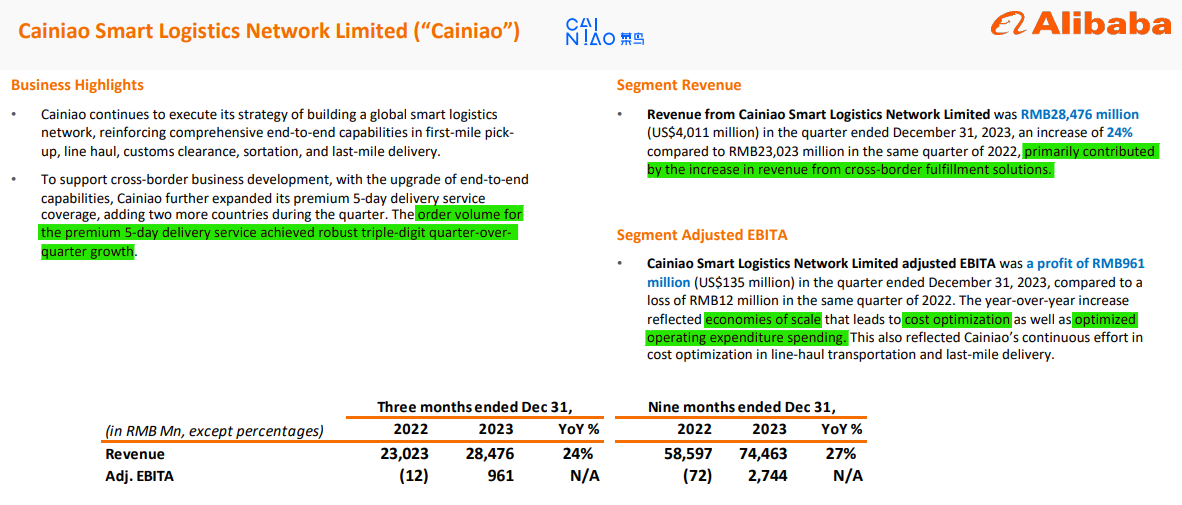

Cainiao Smart Logistics Network

(More Information: Alibaba Deep Dive)

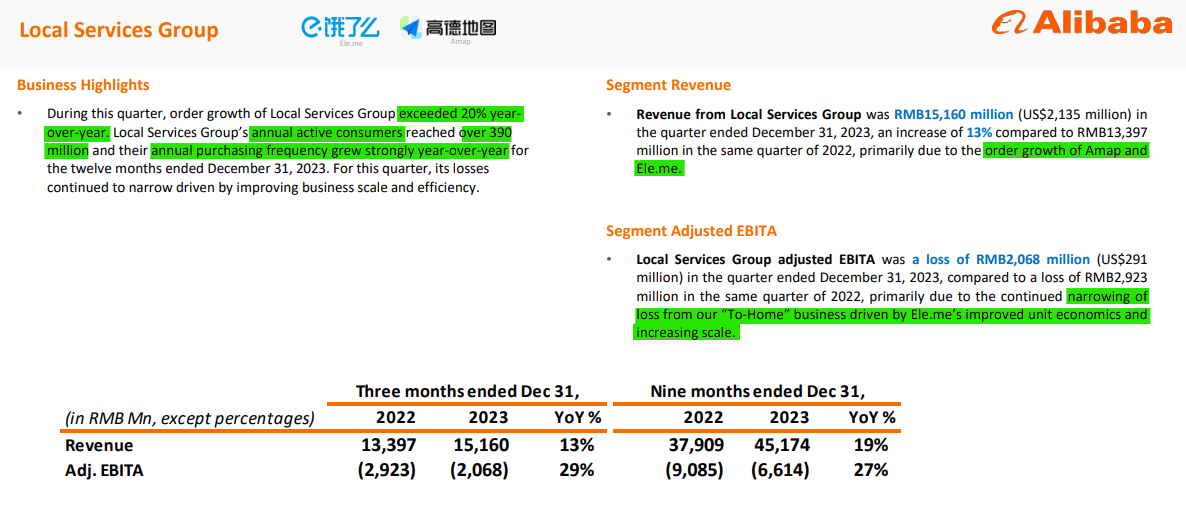

Local Services Group

(More Information: Alibaba Deep Dive)

Digital Media and Entertainment Group

This is still a very small part of Alibaba’s business, and it’s unlikely to become a vital part later on. However, accounting for over half of China’s total box office is impressive.

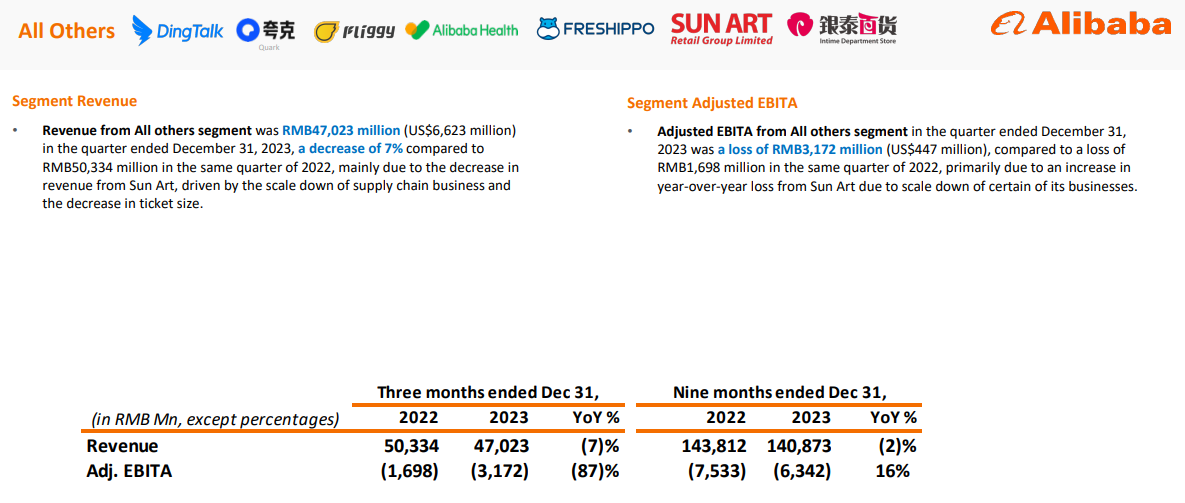

All others

The “All Others” segment is hard to analyze, given the amount of (unrelated) businesses that are combined in this group. If you want to learn a little more about each of the businesses, I’ve written a bit about them in the Deep Dive.

My Take/ Opinion on the Quarter

I didn’t expect much of this quarter, and thus, I’m not disappointed or surprised. The economic situation in China will continue to hurt Alibaba’s business in the coming months and perhaps years.

It’s important that they keep their market position and can thus grow faster again when the Chinese economy and consumer rebounds.

What I am disappointed by are some of the management’s decisions. While I agree with delaying the IPOs to wait for a more favorable sentiment and thus higher valuations, I don’t get why Alibaba won’t be more aggressive with the share buybacks.

In the earnings call, they clearly stated that they can invest the money attributed to the share repurchase program without any restrictions. Why then only aim for 3% per year? Alibaba has huge cash positions and is a bargain at this price.

To be fair, with the current $36b for share repurchases, which results in $12b per year, the share repurchase rate would be higher than 3%. So, management is already adjusting for a higher share price in the future. If we don’t see that, share buybacks will exceed 3%.

Still, a more aggressive buyback at these prices would boost the stock more than starting to pay a dividend…

I’d also appreciate a more detailed description of what is going on with the Cloud business. The environment doesn’t make it easy for Cloud right now, but it has been struggling for a long time, and the management would do itself a favor if it started communicating why instead of saying that they prioritize getting growth back.

The stock is trending down and giving up last week's gains. However, that’s a short-term movement and not that important to me. I’d rather get answers to the questions raised above, which are the same ones that I had already articulated in my Deep Dive.

If you want to know why I hold Alibaba and learn more about the business, you should read that!

That’s it for today; see you in the next few days with the next earnings updates of my portfolio companies and on Sunday with the next regular episode!