Alibaba Earnings Update and Thoughts on Chinese Investments

Alibaba stock has decreased significantly (~27%) since its rally in October. To minimize the opportunity costs of holding Alibaba, I have previously mentioned trading the stock in the $70-$100 range. I’ve owned Alibaba for quite a while now, and, to me, this seems like a profitable approach (although you also have to keep transactional costs in mind).

If you know me, you know I usually do not trade stocks. I make exceptions in positions I hold for the long term to take advantage of price movements. I would not trade positions that I do not consider long-term holdings. There are two main reasons for that:

Just because certain price ranges could be observed in the past doesn’t mean they will continue to exist going forward. If it’s a long-term position for me anyway, doubling down when it gets cheaper makes sense either way. If you trade a random stock, you might get trapped in a bad investment.

You’ve analyzed and observed long-term positions much more rigorously than other stocks and understand price movements better.

There’s truth in the saying that you only know a stock when you own it. Thus, when I see similar patterns (price ranges) in stocks I have owned for many months or years, I, here and there, try to take advantage of them.

I mention this again because I see even more difficult times for Chinese stocks after the US election, not because of the policies that Trump might introduce—I don’t know what will happen, and I don’t think anyone does—but because a sentiment change towards China will become even more difficult now.

But now, let’s get to the Q2 2025 Earnings (Alibaba is a bit ahead of us 😉):

Earnings Overview

Alibaba Group Holding delivered mixed results, missing on the top line but outperforming significantly on the bottom line:

$33.7 billion in revenue, up 5% (Miss by $500 million or 1.5%).

$2.59 in GAAP diluted EPS, up 63% (Beat Estimates by $1 or 62%).

$2.15 in adjusted diluted EPS, down 4% (Beat Estimates by $0.10 or 5%).

$4.4 billion in operating cash flow, down 36%.

$1.95 billion in free cash flow, down 70%.

The cash flows have been lower due to Alibaba's investments in the quarter, but we will get to that.

Segment Overview

Looking at the segment results, we can see a picture similar to the last quarters. The market saw it in a similar light and didn’t react decisively in any direction. However, since JD, a close competitor of Alibaba, had reported disappointing results a day before, BABA's stock was also punished by the bad overall sentiment.

Without further ado, let’s dive into the details of the most important segments and see whether these numbers are a positive or negative sign.

Chinese E-Comerce - Taobao & Tmall

At first glance, revenue growth of only 1% doesn’t look good for Alibaba’s most profitable and important business. However, considering the current macro environment and the reason for the slow revenue growth, I think it looks worse than it is.

It’s not that fewer people order from Taobao or Tmall. Alibaba reported double-digit order growth year-over-year. However, this is not shown in the revenue numbers since the average order value decreased.

While this doesn’t help Alibaba right now, it will when the Chinese consumer strengthens again, and the average order value increases again. Then, we will see the growth caused by the higher order growth reflected in revenues.

The same goes for the 5% decline in EBITA margin. It doesn’t look too good without context, but considering market conditions and, more importantly, Alibaba's investments in the business, I’m okay with that result.

Cloud Intelligence Group

The cloud business is the positive surprise in the earnings in my book. Top line growth of 7% despite the strategy shift in recent quarters to cut out low-margin products (non-public cloud products), which have been the largest part of revenues, and an 89(!)% EBITA increase.

It looks like the new strategy is working pretty well. What’s even better is that we can finally see a long-term strategy and direction for the cloud business after many quarters of uncertainty and obvious differences of opinion, even within the company, as evident by the management changes.

The reason for the still relatively low overall EBITA margin for the cloud business of 9% is the investments made into cloud infrastructure and, of course, AI products. In Alibaba’s case, however, the AI investments definitely make sense:

International Digital Commerce Group

From good news to mixed news. Alibaba's AIDC businesses have been growing rapidly in recent quarters, and they still do, with 29% revenue growth. However, profitability is further away, with EBITA margins dropping again.

I’m fully aware that growth comes at a cost. However, I think it would be wise to keep an eye on the losses in this segment. Alibaba’s investment thesis is its fundamental strength and the huge cash flows it still produces. The times where growth is the main thesis are long over.

In a situation of relative weakness, I would like BABA to focus primarily on the fundamental soundness of its operations rather than growth at all costs.

This is not yet concerning, but I wouldn’t want to see EBITA margins slide further going forward.

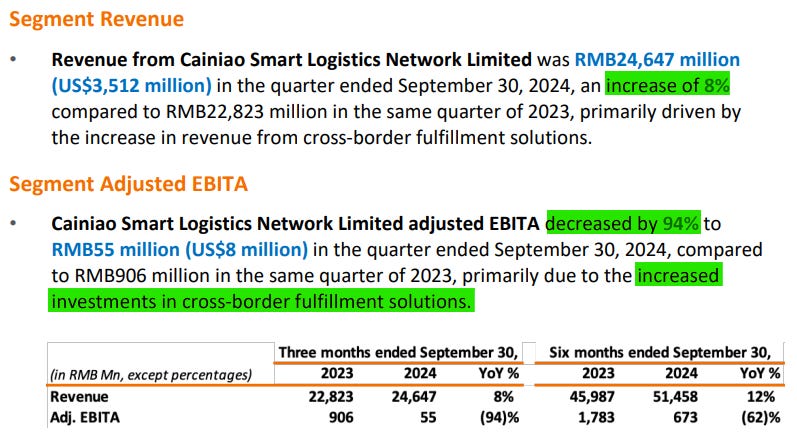

Cainiao Smart Logistics Network

Cainiao had a similar fate, with EBITA down to almost breakeven due to increased investments in cross-border fulfillment solutions.

Local Services Group

The Local Services Group had a good quarter, with 14% revenue growth and 85% EBITA growth. The improved margins are due to improved operating efficiency and scale, which means that we should expect further improvements going forward and might see profitability soon.

Digital Media and Entertainment

Not much has changed in this segment. Revenues are mostly flat, and EBITA improved slightly by 11%.

All Others

Now, to my favorite! Okay, irony off. The still weird “All Others” segment delivered an “okayish” quarter, growing top line by 9% and decreasing EBITA by 10%.

Not much to say here and not much info anyway.

Share Buybacks

In this quarter, Alibaba bought back shares worth $4.1 billion, which is less than in the preceding quarters and results in a 2.1% net reduction of shares. The management explained this slowdown by taking a strategic approach to buying back shares when they’re at the bottom.

Considering the rally in October, they probably reduced buybacks at that time. Kind of like the strategy I described at the beginning 😉. Considering the remaining $22 billion in the share repurchase program, I think we’ll see increased buybacks at the current prices.

Conclusion:

As mentioned, it was a mixed quarter. Some businesses were still experiencing macro headwinds, and others, namely the cloud, surprised on the upside.

Going forward, I think it will remain tough for Alibaba and Chinese stocks as a whole for quite some time. I do not see near-term catalysts here. The October euphoria burst quickly after the new stimulus wasn’t as expansive as the market wished.

To be honest, I think the CCP couldn’t have done much more. The market expected too much, as it wanted to see a huge rally fueled by huge stimulus packages.

If we see regular stimulus that supports the underlying economy, the overall picture should eventually get better. With macro headwinds gone, we could finally see if the investments and underlying improvements of companies like Alibaba pay off.

Alarum will report earnings tomorrow. I know some of you, including me, are interested in how they will look. I’ll also cover them here.

That’s it for today!

Best

Daniel