Alibaba Earnings - The Good and the Bad?!

Today, we’ll look at the Alibaba’s earnings. There’s a lot to unpack, and whether you like what you see is up to you. Spoiler: I tend to like it. I’ll also give a short update on my Alibaba position in my portfolio.

But first, I’ve found two or three interesting companies I'm researching further. You’ll get a stock pitch on them soon! So stay tuned and subscribe to get access and not miss them!

Balance Sheet

Let’s start with Alibaba’s balance sheet. There’s not much to say since it speaks for itself, but I think emphasizing it once again makes sense, considering how ridiculous the margin of safety business-wise is.

Alibaba is sitting on $85.5 billion of cash with a market cap of $190 billion. They have another $85 billion in retained earnings and more than $150 billion in Equity(!). The balance sheet is insane!

Dividends and Buybacks

In the past, I was a bit cautious with Alibaba’s announcements or authorizations of buybacks since they rarely used their full capacity (despite having all the cash lying around). In Q1 2024, they finally delivered on that front.

In the first quarter, they bought back the equivalent of $4.8 billion. Over the fiscal year, a total of $12.5 billion. If they keep reducing the share count at this level, the buybacks should start impacting Alibaba’s stock price soon.

Additionally, they approved a two-part dividend consisting of a regular dividend of $1 per ADS and a one-time extraordinary dividend of $0.66 per ADS ($4 billion total). Initially, I wasn’t a big fan of their idea to start a dividend instead of investing their money to fuel their growth again, but as you’ll see, they finally started doing both.

Revenues and Earnings Q1

Here’s an overview of Q1 revenues. However, some things need more detail.

The best way to take a closer look is to analyze the business segments individually.

Chinese E-Comerce - Taobao & Tmall

The Taobao & Tmall business was relatively unspectacular, which is nothing bad. This business is Alibaba's cash-generating machine, and slow and stable growth is good. Other parts of the business should show more growth until they become cash-generating machines.

One of them is Alibaba’s cloud…

Cloud Intelligence Group

This quarter, we got a little more details than before. Profitability is up almost 50% due to the focus on high-quality revenues (meaning high-margin products) instead of low-margin products. Because of that (cutting low-margin products), revenues declined.

They say the core cloud products delivered double-digit YoY growth, and AI-related revenues grew triple-digit YoY. We don’t get more details. Following this logic, we should see higher growth numbers in the coming quarters.

Let’s wait and see if that’s the case.

International Digital Commerce

You may have wondered why the article is called “The Good and Bad.” Well, because we now get to the part of the business where you have to figure out if Alibaba’s path fits your investment thesis.

The International Digital Commerce segment grew its revenues significantly, with 46% YoY growth. However, this came at the cost of profitability. The segment was loss-making last year and is even more loss-making this year.

It’s the Amazon playbook. They have been loss-making for the longest part of their existence, but I never saw the problem with that. It was quite obvious that the business was profitable when one adjusted for the reinvestment in growth. Amazon’s risk was that its balance sheet wasn’t strong at the time.

Alibaba’s balance sheet is extremely strong. There is no doubt they can continue this strategy without hurting the overall company. In Alibaba’s case, the question is whether these businesses have the potential to become profitable.

Currently, I’m on the positive side of the argument and think they do. But we’ll have to wait and see how reinvestments and profitability develop over the next quarters (perhaps years… investing is a long-term game, after all).

Cainiao Smart Logistics Network

Unsurprisingly, Cainiao's story is similar since it correlates with the International Digital segment. It has high revenue growth of 30% YoY but is unprofitable.

Cainiao was one of the businesses that Alibaba planned to IPO separately. However, that plan has been put on hold for now. In the end, I’ll briefly comment on the planned IPOs.

Local Services Group

The growth of the Local Services was good, reaching 19% YoY, and earnings improved, although the services remain unprofitable for now and will most likely remain so for some time.

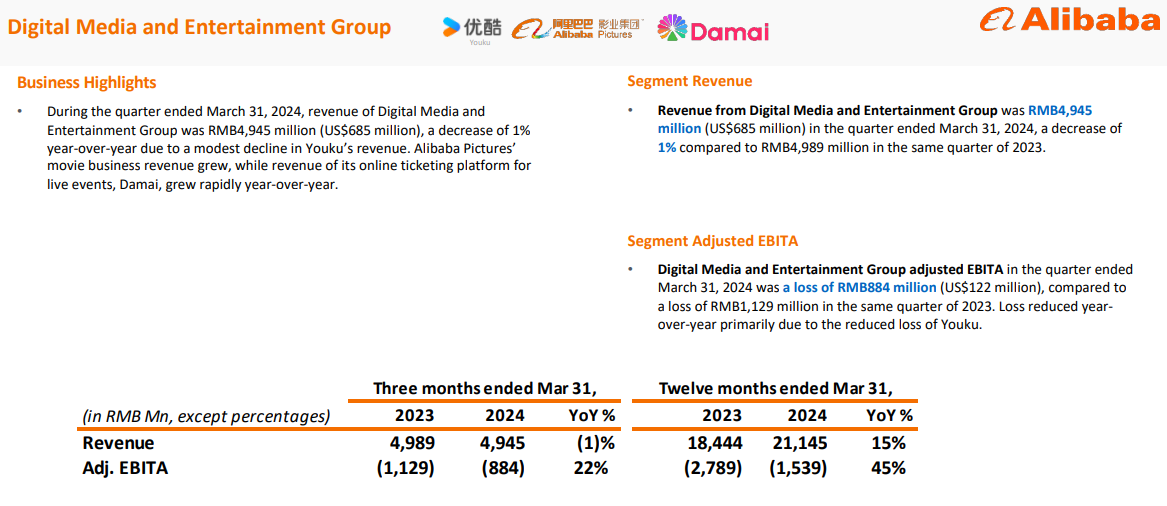

Digital Media and Entertainment

Revenue growth was 15% YoY for the fiscal year, and EBITA growth was 45%. If this segment can keep improving earnings at this rate, it could become profitable relatively soon.

All Others

Well, this segment is weird, as I said in my Deep Dive before. It’s difficult to say anything about it since the changes can’t be assigned to any of the services in detail. In general, we see that investments in this segment caused earnings to fall quite extensively.

I expect Alibaba to develop and communicate some plans for these companies in the long run. I don’t think putting them into a basket like this will be beneficial.

Planned IPOs

Alibaba planned on 6 IPOs for further value creation. With the current market sentiment, they want to wait before implementing this plan. I think that’s the right decision and combined with their “new strategy,” growth over profitability, this could become a profitable move when the market sentiment favors growth (and China in general) more again.

But I have no idea when this will happen.

Conclusion

Earnings-wise

I like the share buybacks and dividends combined with investing in growth for the business. This is what I want to see from a company with Alibaba’s market position and financial strength.

I still struggle with the development of the Cloud business. In my deep dive, I explained why growth is so much slower than one would expect in this industry. This quarter, we got a little more detail than before, but I still think Alibaba’s management would make a smart move by giving more detailed numbers.

It could be a main driver, even a catalyst, if that business unit starts growing again. Or, at least, we know what the struggles are in detail.

Nevertheless, overall, I like the way they’re going.

Portfolio-wise

Now, a quick thought on my Alibaba position in the portfolio. Alibaba is by far the largest company I own in my portfolio. I wouldn’t own it if I didn’t see the potential for a double or more relatively quickly. For that to happen, we would need a change in the sentiment around China. That’s without question.

I’m pretty sure it will happen. But when? I don’t know. In my Deep Dive, I said that making money in Alibaba is relatively good and possible if you trade it in the range of $70 to $90. Buy close to $70 and sell around $90. This strategy has worked well in the last few years.

Maybe some of you did it. As you know (I would’ve sent you notifications on the trades), I didn’t since the trading costs would be too high considering my capital base.

Because of that, despite my low buy-in price, Alibaba is becoming expensive due to opportunity costs. Because of that, I’m considering trimming my position if we reach $90-$100 and I have better opportunities on the table (see latest stock pitches)—not selling all of it, but making it a smaller position.

Anyway, I just wanted to let you know my thoughts on it. If I change the position, I’ll let you know anyway.

Have a good day!

Cheers!

Latest Stock Pitches:

My Portfolio: