5 Visuals that explain the Core Ideas of Investing

Today we will take a short look at 5 Visuals that summarize some of the most important learnings about Investing.

1. There will Always be something to Worry About

Today’s world is the fastest and most complex it has ever been. New information is reaching investors worldwide at record speed, and this is a welcomed trend for Wall Street.

Wall Street makes money through commissions. More trades equal more money. In contrast to the individual investor, they profit from high turnover.

Thus, macroeconomic noise is wanted. Fear and greed are the two most efficient emotions. Nothing works better as a call to action.

An increase in newsflow leads to an increase in trades.

As you can see in the chart below, the investor who ignores the noise and holds on to his investments not only has more spare time, he’s also the one genuinely benefiting from rising markets.

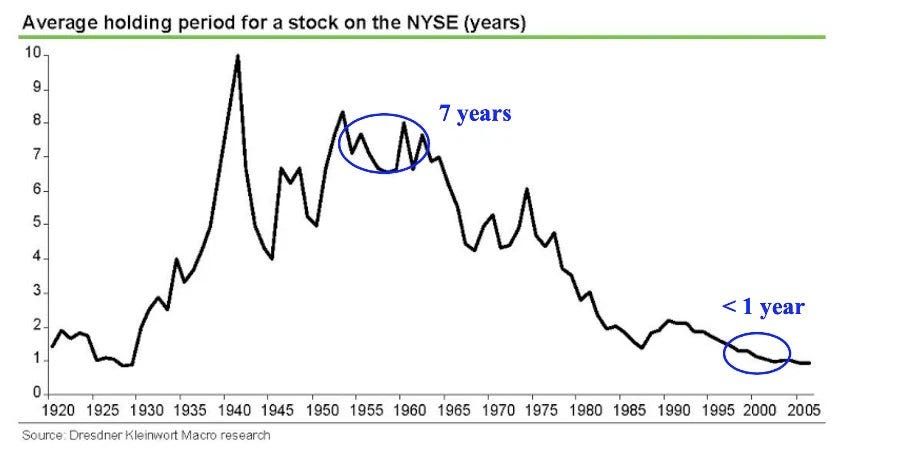

2. The Average Holding Period Decreases

Here’s another chart showing the result of the increased newsflow, lower fees, and commissions.

The average investor sells his position less than a year after making the investment. In the 1950s, this number was at almost eight years.

Simultaneously, the performance of the average investor went down. According to J.P. Morgan, the average investor annualized 2.8% over the last 20 years compared to 7.5% for the S&P 500.

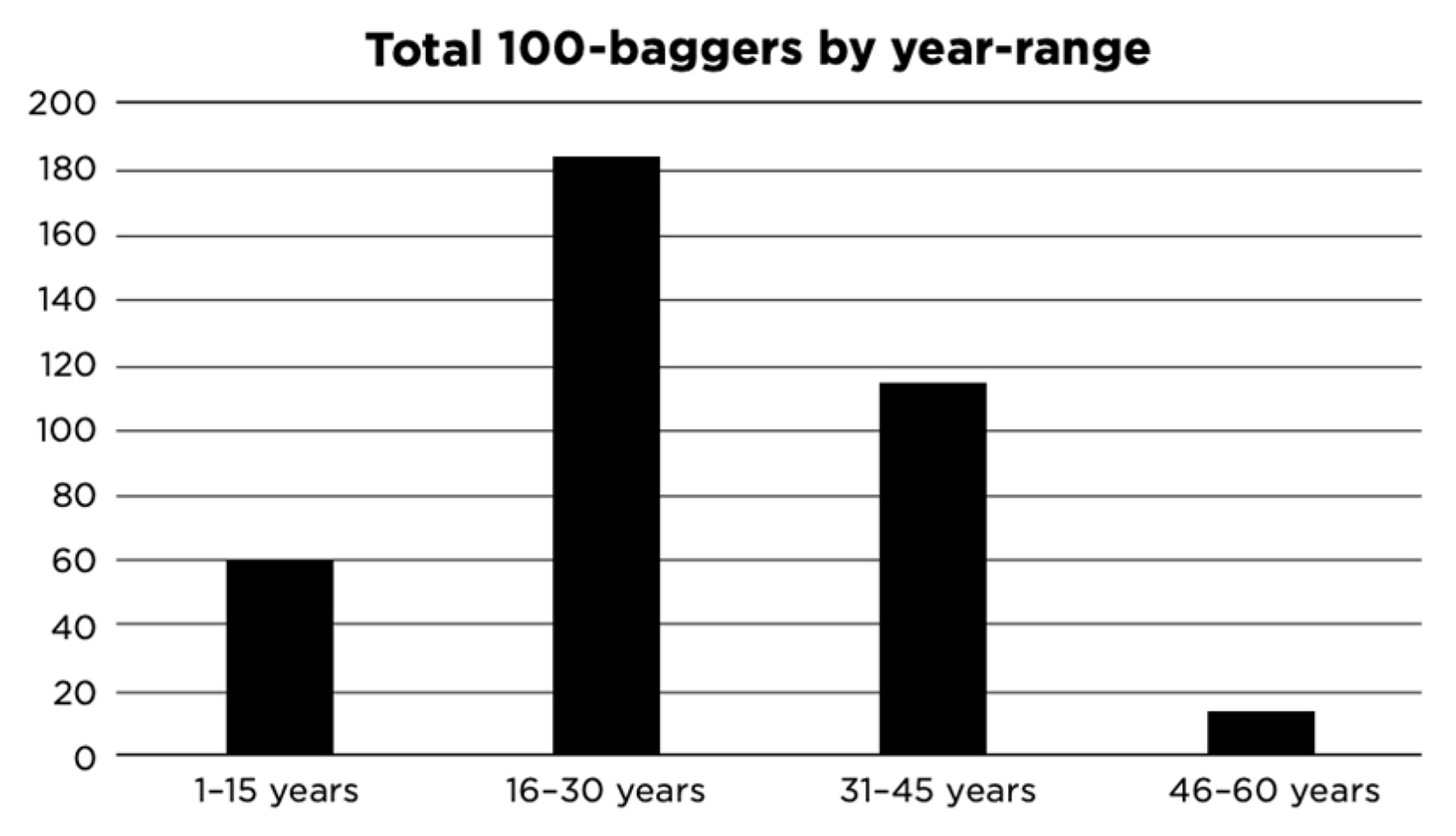

3. Large Gains take Time

This chart is from Chris Mayer’s book “100-Baggers: Stocks that Return 100 to 1 and How to Find Them.”

As you can see, the majority of 100-Baggers took between 16 to 45 years. These are companies like Berkshire Hathaway, Walmart, Starbucks, Gilead, or Electronic Arts.

With an average holding period of <1 year, you can imagine your chances of benefiting from such a 100-bagger.

4. Minimizing Losses (also) takes Time

You not only benefit from long holding periods because of your chance to find a big winner. You’re also minimizing your risk for losses. The longer your investing period, the less likely it is to lose money.

However, this, of course, also depends on your level of diversification. These numbers are based on holding the S&P 500 index. The more concentrated you are, the more risk you take, regardless of your holding period.

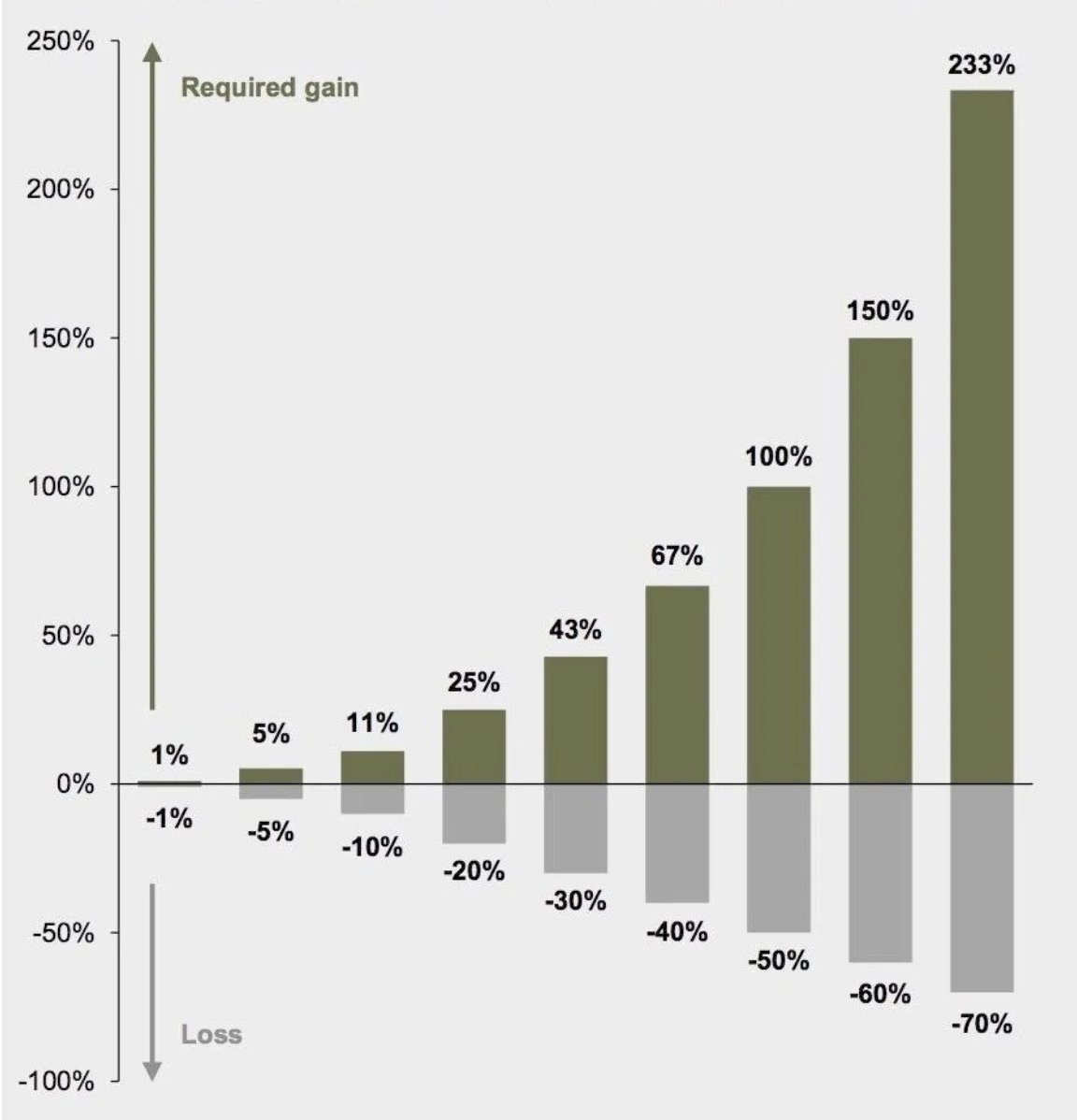

5. Keyword: Avoiding Losses

Avoiding losses should be the primary goal of every investor. The most recognizable quote on this topic, as so often, comes from Buffett:

“Rule Number 1: Never lose money! Rule Number 2: Never forget Rule Number 1.”

This seems a little ridiculous since it’s obvious that no one starts investing with the intention of losing money. However, this logic has a precise mathematical background.

This chart shows in a pretty impressive way the immense effect of losses. And these numbers seem a lot less intuitive than the premise of Buffett’s quote.

That’s it for today!

Since many of you asked, I’ll start writing such shorter articles more regularly.

However, this does not mean that I stop writing more detailed articles. They’ll also keep coming. This way, there will be more regular content coming here.

I hope you like that idea.

Have a great day!

If you enjoyed this article, please Like and Share it so more people can see it!

You can also Support my Work here and on Twitter by subscribing. Thanks a lot to everyone who chooses to do so!